The 10 Biggest Managed Services Stories Of 2013

Managed Services Ripe For Growth

With the market for managed services expected to double in the next five years to $256.05 billion, it was an area ripe for growth in 2013 and beyond. The past year brought acquisitions, a rise in software-as-a-service offerings, management platforms, cloud services and more to help MSPs adapt and thrive in a rapidly growing marketplace. Take a step back through the year with CRN to take a look at the 10 biggest managed services of the year.

10. MSPAlliance Unveils MSP Guidelines

To help bolster end-user clients' confidence in MSPs, the International Association of Cloud & Managed Service Providers, or MSPAlliance, a professional association with more than 20,000 members worldwide, introduced a set of guidelines in June for MSPs based on the group's own rules and the rules of the Unified Certification Standard for Cloud & Managed Service Providers (UCS). To become certified, MSPs would need to get audited to see if they meet standards of data protection, transparency, ethics, finance and public and private cloud.

The guidelines were designed to help protect the unregulated MSP market's reputation from bad apples that aren't living up to industry standards. The program appealed to MSPs looking to bolster customer confidence, remedy business problems or satisfy customer compliance issues, the MSPAlliance said.

9. FusionStorm Sells Managed Services Business To Synoptek

Information technology delivery company FusionStorm spun off its managed services division in August to Synoptek, forming Synoptek LLC. Terms of the deal were not disclosed. The spinoff combined the former FusionStorm managed services division with Synoptek's own managed services business, as well as its cloud. The reason for the split, FusionStorm said, was to allow the company to focus on its data center and systems integration business.

"The deal provides cash for us to invest in the things we do best, which is data center infrastructure and integration. At the same [time], we found a dedicated home for our managed services operation," Ed Korenman, vice president of marketing at FusionStorm, told CRN at the time.

Although FusionStorm had dreams of an IPO a year prior, the company said the spinoff had nothing to do with the IPO, which fell through this May, but instead was a move focused on growth going forward for the company.

8. Panorama9 Rolls Out MSP Program For Cloud-Based Management Platform

In a move tailored to the growing complications for managed service providers in an increasingly cloud-based world, Panorama9 rolled out a partner program to specifically address the needs of the MSP in regards to its management platform. The partner program, launched in March, helps MSPs move to a recurring revenue model by offering either volume discounts when the partner bills the customer or commission if sold directly.

"The MSP partner program is designed to make it easy for managed service providers to offer, bill and get paid for delivering our services to end customers. We want to make it easy for them to get paid on a recurring revenue basis," Panorama9 CEO Allan Thorvaldsen told CRN at the time.

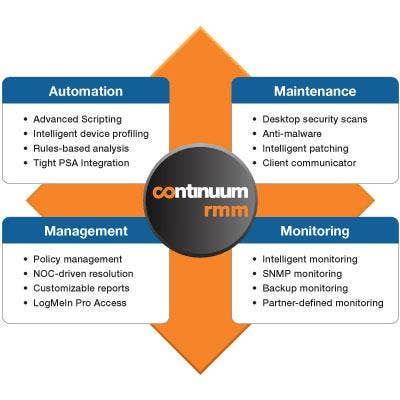

7. Continuum Rolls Out New Programs For MSPs

Boston-based Continuum had a dual rollout in January to enhance its support of customer needs and legacy infrastructure. Announced first, the BDR Revive Solution allows for a simple USB stick install of Continuum's backup and disaster recovery solutions. The significance of the solution, Continuum said, was that it could be installed on existing hardware, meaning hardware investments already made didn't have to be scrapped to install BDR software. The second, Tech Advantage program, lets MSPs access Continuum's Mumbai, India-based operations center team to resolve problems and cost-effectively work on projects around the clock.

6. Trend Micro, Tech Data Partner To Simplify Account Management

Trend Micro and Tech Data in January announced a partnership aimed at helping managed service providers simplify their accounts through a platform integration between the two companies. More specifically, the integration linked Tech Data's Solution Store with Trend Micro's Licensing Management Platform (LMP). The move is meant to help MSPs streamline accurate billing, especially for SaaS security products, instead of auditing the end user to determine their usage.

"On the partner side, it eliminates the administrative chores associated with this business function. As customers move towards the cloud model, there are a few days every month when people are just scrambling to gather data on usage in order to invoice the customers," Bharath Natarajan, director of product marketing at Tech Data, said of the announcement. "This has been a painful thorn in the sides of all the providers, and we believe that we have just removed that thorn."

5. SolarWinds Buys N-able

In order to expand its SMB service portfolio, SolarWinds made a $120 million cash acquisition of N-able, an Ontario-based RMM and service automation software company. N-able also brought security, backup, patch management, automation and reporting tools to the table for SolarWinds.

"We are not very successful in that part of the MSP market where relatively small companies are providing services to a bunch of small businesses around the world. N-able gives us the ability to do that," CEO Kevin Thompson told CRN at the time. "So this opens up a market we have not been serving directly in the past, a market that has not been included in our view of the addressable market because we haven't had a good way to get there in the past."

4. Arrow Enhances Cloud Services Platform With New MSP Tool

After announcing the release of its ArrowSphere cloud brokerage and aggregation platform to North America in June, Arrow said it was extending the offering in August to add xSP Central, a cloud service tool to help MSPs monitor licenses from a single platform. The tool helps MSPs predict and automate future cloud operation costs for their customers, as well as white label and build clouds more effectively, Arrow said at the time. Partners cheered the release, saying the ability to aggregate the cloud vendors into a single pane helped accelerate their entry into the cloud.

3. Kaseya Eyes Cloud, MDM With New Acquisitions

Kaseya clearly had its eyes set on cloud and mobile device management in July as it acquired cloud software and services vendor Zyrion as well as Rover Apps, a software maker that specializes in mobile device management for BYOD. Both companies were acquired for an undisclosed amount. With the acquisition of Zyrion, Kaseya said it planned to combine Zyrion's Traverse monitoring software with its own systems management software for both public and private clouds, which it upgraded to a SaaS offering in October. At the time, Kaseya said it also planned to integrate Rover Apps' Secure Container Suite for mobile devices with its systems management software, and in December, the company rolled out the Kaseya BYOD Suite, an enterprise-class platform for corporate mobile device management based on the technology it gained from its Rover Apps acquisition.

2. HP Launches Partner-Owned Contract Managed Print Program

As part of a much-anticipated move, Hewlett-Packard unveiled a managed print services program at its June Discover conference. The move by HP gave control of the customer contract to the partner for the first time. Solution providers cheered the HP Managed Print Specialist Resell Program, saying it would bring higher margins and better account advantages.

At the time, estimates predicted that 80 percent of partners already in the HP agent program would take advantage of the new program.

1. Dimension Data Moves IT Support Maintenance Into Cloud Services Era

To help more MSPs move into the cloud, Dimension Data announced a new managed services offering in January to help MSPs move break/fix support into the cloud. The offering, called Global Uptime, was extended to Dimension Data's 6,000 clients worldwide and gave them access to cloud-based IT asset tracking, with proactive uptime mobile monitoring. The move is part of the company's aggressive push toward cloud-based managed services, Dimension Data said at the time, and will help MSPs cut costs and consolidate operations under a single managed service.