5 Ways Apple Pay Could Be a Winner for the Channel

Mobile Payment Plan

Apple seeks to modernize payment systems with Apple Pay, which claims to be safe, easy to use and secure. Resellers see the contactless system -- where an iPhone carrying credit or debit card information is simply tapped to a point-of-sale terminal -- as a game changer.

Apple Pay supports credit and debit cards from three major payment networks -- American Express, MasterCard and Visa. Apple said the technology will be available on iPhone 6 and iPhone 6 Plus starting in October. That's in addition to the 258 Apple Stores in the U.S. and some of the nation’s leading retailer. Apple Watch will work at over 220,000 merchant locations in the U.S. that have contactless payment enabled. It will soon be available to iPhone 5 models.

How can solution providers profit from the new technology? Here are five things to pitch to your clients when they’re considering Apple Pay.

Retail Focus

Apple Pay is expected to revolutionize retail. Though contactless payment systems have been around in the past -- think Google Wallet and the Isis application -- solution providers expect the strength of the Apple brand will get people more excited in the technology and its capabilities.

For retailers VARs look to target for their business, play up the sleekness and exciting capabilities of the technology.

Retailers are likely already interested in these offerings, too, according to distributor ScanSource.

Privacy Benefits For All

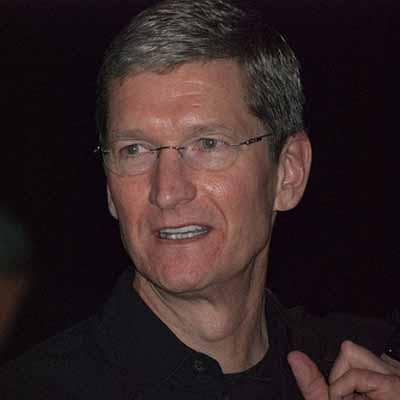

Apple promises to not harvest personal information and make money off data when implementing Apple Pay. In an interview on the Charlie Rose show, Apple CEO Tim Cook said this is an important point as more companies -- like competitor Google -- infringe on people’s rights to privacy.

In a long interview with the show's host this month, Cook said more consumers need to be aware of companies who look to profit off of them and their personal information.

’You are not our product,’ Cook said in his interview with Rose. ’… Everyone has to ask, ’How do companies make the money?’ Follow the money, and they’re mainly making money by collecting gobs of personal data. I think you have a right to be worried and you should really understand what’s happening to that data. I think the companies should be very transparent about it.’

Cook said this point will be a ’key topic’ over the next year.

’We’ll reach higher and higher levels of urgency as more and more incidents happen,’ he said.

A More Secure Solution

Apple Pay also promises to provide a locked-down system that won’t leak your critical information and keep it vulnerable for hackers and other Internet villains. This is a key selling point for customers as news breaks of more security breaches at major retailers.

Apple Pay works by taking a user’s credit or debit card information and assigning an individual device account number, which is encrypted and stored. Apple said each transaction made with the system is authorized with a one-time unique number using that number and ’instead of using the security code from the back of your card, Apple Pay creates a dynamic security code to securely validate each transaction.’

This also eliminates the need to hand your card over to a complete stranger after completing a meal to pay in a restaurant. Jerry Zigmont, owner of MacWorks, an Apple consultant based in Madison, Conn., told CRN there are ’inherent flaws’ in that current payment system.

Perpetuate The Upgrade Cycle

Now is the time to capitalize on Apple Pay, according to ScanSource, which said Apple Pay's use of near field communication (NFC) capabilities, will make use of the technology more popular. Paul Constantine, president of ScanSource POS and Barcode, says you can coincide upgrades in the NFC space just in time with EMV chip technology, a growing global security standard named after its original developers Europay, Mastercard and Visa. Now’s the time, he said, considering retailers that don’t accept EMV cards or chip-and-PIN cards will have liability from credit card companies shifted onto them beginning in late 2015.

Simplicity And Sleekness For Clients

The Apple Pay system is expected to grow in popularity, and many solution providers have referred to the technology as an item with lots of potential opportunities attached. Apple tends to swoop in on a product already out there, and make it incredibly popular, according to Steven Kantorowitz, president of New York-based Apple partner CelPro Associates. Some VARs are waiting to see how this shapes up. But to ride the trending wave, ScanSource notes as a distributor, this is an exciting product to get on board with for point-of-sale opportunities.