5 Reasons Why Uncle Sam Wants Apple Pay

Groundbreaking Partnership

Apple CEO Tim Cook has announced a partnership between the Cupertino, Calif.-based company's payment system, Apple Pay, and the U.S. government.

Apple Pay, launched in September, has been praised by Cook as highly successful in the past few months. The federal partnership will allow consumers to use the service at federal facilities and national parks. Cook said that the company also plans to support federal procurement cards issued to government employees.

Following are five security tools Apple Pay is equipped with, making it an attractive offering for the government to utilize.

5. Existing Success Of Apple Pay

According to Cook, since Apple Pay's release in the fall, the payment platform has seen tremendous success, which makes it a viable candidate for the government to consider as a payment method.

During Apple's earnings call for the first quarter ended Dec. 27, Cook said that roughly 750 banks and credit unions signed on with Apple Pay to bring it to their customers. He added that Apple Pay makes up more than $2 out of $3 on purchases using contactless payments across the three major U.S. card networks.

"More merchants are excited to bring Apple Pay to their customers, and adoption is strong," said Cook. "With all this momentum in the early day, we are more convinced than ever that 2015 will be the year of Apple Pay."

4. Supporting Apps

Apple offers a variety of supporting apps to enhance the security platforms surrounding Apple Pay, which would make the overall system more attractive to the government.

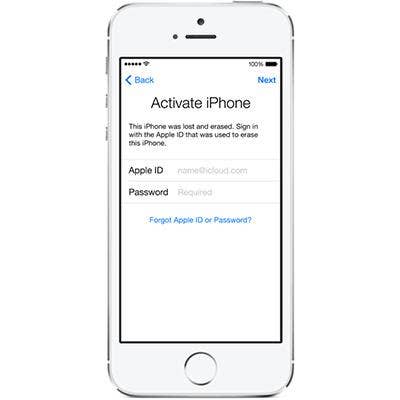

The most prominent of these apps is Find My iPhone, which allows consumers to access their device location if they are lost or stolen. The bonus quality of this app, however, is its ability to wipe consumer phones clean should they go missing as an added way to protect important data and information.

3. Device Compatibility

Apple Pay can be used across Apple's various devices, including the iPhone 6, iPhone 6 Plus, iPad Air 2 and iPad mini 3, facilitating contactless payments in stores. On the iPhone 6, users can utilize the Touch ID feature to use Apple Pay, creating an easy and secure method of payment.

The payment system also will become available on Apple Watch, once the new wearable is launched in April. To pay with Apple Watch, the user can double-click the button on the watch near the digital crown and hold the watch near the contactless reader, according to Apple.

2. Secure Element Payment Process

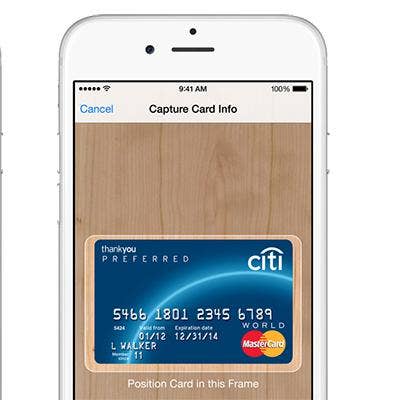

Apple Pay uses a feature called Secure Element, patented in 2011, to add an extra layer of security to the consumer pay process. Secure Element is a chip in the iPhone with an encrypted unique device account number, which helps eliminate the possibility of credit or debit card numbers being shared with merchants.

The payment process uses NFC technology, or near field communications. Users also can confirm payments using the device's fingerprint reader.

1 . EMV Utilization

Apple Pay uses EMV, which stands for EuroPay, MasterCard and Visa, a more secure communication payment process that the U.S. is slated to transition to in October. Other areas of the world, like Europe and Canada, already use this process, which allows payments through embedded chips as opposed to the strip on most credit and debit cards.

These embedded chips protect against the massive breaches that several U.S. retail chains, including Target and Home Depot, have seen over the past year.