IDC: Winners And Losers In The Q2 Tablet Market

Tablet Vendors Teetered In The Second Quarter

It came as no surprise when the global tablet market faced yet another quarter of decline, according to a second-quarter report released by market research firm IDC, Wednesday.

The market dove 7 percent year over year, with shipments totaling 44.7 million units, harried by an increased consumer preference for big-screened phones, or phablets, over tablets.

What was a surprise was the successes -- and failures -- of tablet vendors in the second quarter.

IDC Senior Research Analyst Jitesh Ubrani stressed that the tablet landscape was changing as vendors tapped into valuable markets. "There's a lot of negativity around the tablet market, but there are still areas of growth that some vendors are keeping an eye out for," he said.

Following are the top five tablet market vendors in the second quarter.

5. Winner: LG

LG Electronics took the fifth-place spot for tablet vendors in the second quarter with 1.6 million shipments, snagging 3.6 percent of the market share.

The South Korean company faced blowout growth, over 246 percent, from the same quarter last year, driven in part by the productivity focus of its tablets, as well as deals from the vendor that allow consumers who purchase a smartphone to also receive a discounted tablet, said Ubrani.

LG's latest tablet series, the LG G Pad devices, are three 7-inch, 8-inch and 10.1-inch Android-based devices featuring KnockCode security features that allow users to power on and unlock their devices securely, as well as a smart keyboard feature and Dual Window mode to view multiple apps at the same time.

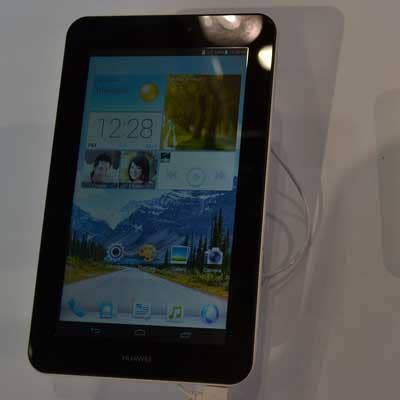

4. Winner: Huawei

Chinese tablet vendor Huawei also faced a massive spurt of growth in the second quarter, up 103.6 percent from the same quarter last year.

Huawei shipped 1.6 million tablets in the second quarter, gathering 3.7 percent market share and pushing it into fourth place as a top-selling tablet vendor.

While LG had a presence in the U.S. market, Huawei's tablets were primarily focused in the Asian market, according to Ubrani. "In markets like Asia, consumers tend to go for the tablet, as connected tablets are also used as phones, operating for a much better experience," he said.

Huawei's tablet line recently expanded to include its flagship Huawei MediaPad X2, which debuted at Mobile World Congress this past quarter.

3. Winner: Lenovo

Lenovo marked the third-place tablet vendor with the most shipments, selling 2.5 million tablets in the second quarter and taking 5.7 percent of the tablet market share.

The Chinese-based company faced moderate 6.8 percent growth over the same quarter last year, helped in part by the tablet vendor's consistent release of the devices over the past year.

Lenovo rolled out two sub-$200 tablets at Mobile World Congress in March: the Android A series-based 10.1-inch Lenovo Tab 2 A10, and 8-inch Lenovo Tab 2 A8. The company also revealed the $299 8-inch Yoga Tablet 2 with AnyPen at the Consumer Electronics Show in January.

2. Loser: Samsung

Samsung, while staying the second-best tablet vendor in terms of shipments in the second quarter, slipped 12 percent from the same quarter last year.

The South Korean company still took 17 percent market share with 7.6 million shipments in the second quarter, driven by the company's popular Tab 4 series and its recent focus on the mid-high tier tablets. More recently, the company released its Galaxy Tab S2, a 5.6mm-thin Android device with productivity and connectivity features, matching Apple's iPad Air 2 tablet.

However, stressed Ubrani, Samsung will need to make additional changes to its generational tablets to gain even more market share. "Apple and Samsung drive the market as a whole ... so these vendors are affected by market declines, and one big reason is that their tablets don't change that much from generation to generation," he said.

1. Loser: Apple

Despite leading the tablet market by a long run with 24.5 percent market share and 10.9 million shipments in the second quarter, Apple was unable to turn around its declining tablet sales.

The Cupertino, Calif.-based company's shipments of its iPad models fell 17.9 percent from the same quarter last year, in direct contrast to the wild success of its iPhone smartphone models.

However, said Ubrani, the popularity of the iPhone 6 and iPhone 6 Plus may be part of the problem. "People wanted Apple's larger smartphones, and now that they're available, consumers are shifting away from tablets," he said.

Apple may be able to make a comeback, however, as its new iPad Pro tablet is rumored to have more productivity features and will be bolstered by iOS 9's enterprise-targeted tools like QuickType and MultiTask.