IDC: Top 5 Tablet Vendors With The Highest Shipments In Q3

Tablet Takedown

With long replacement cycles and cutting-edge competition from the smartphone market, tablet shipments have steadily declined for several consecutive quarters. The third quarter of 2015 was no exception as tablet shipments slipped 12.6 percent vs. the same quarter last year, according to market research firm IDC.

IDC's report pointed to one glimmer of hope for the sluggish tablet market—a transition from slate tablets to detachable tablets. While detachable tablets have only accounted for a single-digit percentage of the overall tablet market, this share is expected to increase dramatically over the next 18 months, according to IDC.

Despite that trend, vendors are still facing challenges in the current tablet market. Following are the top five tablet vendors with the most shipments in the third quarter.

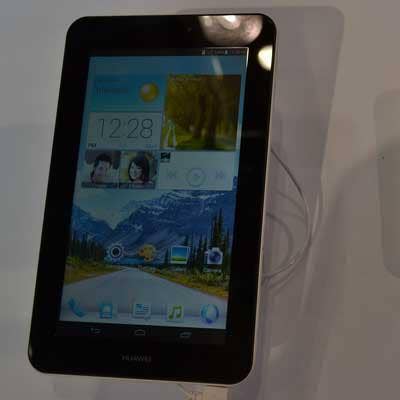

5. Huawei

Chinese manufacturer Huawei was the fifth most popular tablet vendor in the third quarter, taking 3.7 percent of the market's share.

Huawei shipped 1.8 million tablets in the third quarter, a whopping 147.9 percent improvement over the same quarter last year. The company's cellular-enabled tablets partially drove this wild growth, as more consumers in the tablet market are looking to their devices to make voice calls.

Huawei, which sells tablets including the Mediapad X2 and MediaPad Honor X1, also tapped into markets with low broadband penetration in the third quarter.

4. Asus

Taiwanese company Asus took 4 percent of the tablet market share, with 1.9 million shipments in the third quarter, due in part to the company's low price points on its tablets. However, the company faced a 43.4 percent decline in shipments compared with the same quarter last year.

Asus' declining shipments come as the company struggles with sales of its refreshed Transformer 2-in-1 detachable lineup. While Asus is known for its low price points on tablets, other vendors have started offering similar devices at low costs as well, tightening competition. Asus' tablets are in the low-end price range, as its 10.1-inch Transformer Book T100TAF starts at $199.99 at Best Buy.

3. Lenovo

Lenovo was the third tablet vendor with the most shipments in the third quarter, taking 6.3 percent of the market share, according to IDC.

The Chinese company sold 3.1 million units in the third quarter, a 0.9 percent growth vs. the same quarter last year. That number is relatively flat, but IDC senior research analyst Jitesh Ubrani stressed that even flat year-over-year growth is good in the sluggish tablet market.

"Lenovo's flat rate should be taken as a positive sign. … Lenovo is doing relatively well in the tablet market," Ubrani told CRN.

Lenovo's Android and Windows tablet portfolio includes less costly devices such as the Lenovo Tab 2, which starts at $129.99, up to the Lenovo ThinkPad 10, which is available for $654.99 through CDW.

2. Samsung

Samsung took 16.5 percent of the tablet market in the third quarter with 8 million shipments. The South Korean company's tablet shipments declined 17.1 percent in the third quarter vs. the same quarter a year ago.

According to IDC, Samsung's strengths in the quarter stemmed from its marketing push, helping it catch up in shipments to top vendor Apple. The company also has focused on detachable devices, recently releasing its Tab S2, a 9.7-inch device containing an optional keyboard.

Other tablets in Samsung's portfolio include the Galaxy Tab lineup, as well as its new massive 18-inch Galaxy View.

1. Apple

Apple took the top spot in the third-quarter tablet market with 20.3 percent share, according to IDC. The company sold 9.9 million iPads in the third quarter, a 19.7 percent dip compared with the same quarter last year.

Apple's iPad lineup, including the iPad Mini and iPad Air, have been struggling due to competition from the company's own large-screened smartphones, the iPhone 6 and iPhone 6 Plus.

Apple also has been targeting detachable devices, unveiling the new iPad Pro during its special event September. The device's screen is a whopping 12.9 inches, well beyond the iPad Air 2's 9.7 inches. The iPad Pro features a full-size software keyboard so users can type right on the screen, in addition to a $169 Smart Keyboard, a new enhanced keyboard accessory.