IDC: Top 5 Tablet Vendors With The Highest Shipments In Q1 2016

As Apple Tablets Continue to Slip, Challengers Ramp Up

As a whole, the tablet market has had a far-from-stellar beginning to 2016 after struggling through much of 2015. Amazon's low-end tablet, though, is helping to make up for some of market leader Apple's iPad losses.

Market research firm IDC said Thursday that global tablet sales saw a steeper decline in the first quarter of 2016 than it had in the fourth quarter of last year -- or in 2015 overall:

-- Tablet shipments slipped 14.7 percent to 39.6 million, according to IDC.

-- That's compared with a 13.7 percent drop in the fourth quarter of 2015 and a 10.1 percent decline for 2015 overall.

However, detachable tablets -- aka 2-in-1 devices -- grew to an all-time high in the first quarter with 4.9 million units shipped, representing triple-digit growth from the same period a year earlier, according to IDC.

Here are the five vendors identified by IDC for having had the most tablet shipments in the first quarter of 2016.

What Partners See

Solution providers said the IDC report is consistent with the level of interest they're seeing from customers. Demand for tablets "is not overwhelming these days," said Steven Kantorowitz, president of CelPro Associates, a partner of Apple and Samsung that's based in New York. "We'd sold a lot of iPads with Apple, but now it seems like maybe it's saturated a little bit. Nothing is really grabbing [customers]."

Michael Oh, CTO of Cambridge, Mass.-based Apple partner TSP, echoed that sentiment, saying that "certainly we're looking at a point of market saturation, at least for our customers." Newer-to-market Apple tablets such as the iPad Pro have sparked plenty of "curiosity," he said, but "I wouldn't say there's been huge demand or a spike in sales in that new form factor."

The most interest in the iPad Pro versions has been coming from top-level executives and, more generally, from firms in construction and architecture, Oh said. "[But] it's the type of tool where I can see it creeping into that market," he said. "I certainly don't see architecture firms picking up 50 of these at a time."

5. Good Times for Huawei

Tablet sales for Huawei nearly doubled in the first quarter of 2016, driven partly by the introduction of the MateBook, Huawei's first detachable tablet. The company's tablet shipments reached 2.1 million in the first quarter compared with 1.1 million shipments a year earlier.

The MateBook, a Windows 10 tablet that came out in February and starts at $700, is less expensive than the Microsoft Surface Pro 4, which begins at $800. The MateBook is also thinner and lighter than the Surface Pro 4, with a screen that's slightly smaller (12 inches vs. 12.3 inches).

4. Not So Good Times for Lenovo

Lenovo, noted IDC, "continues to suffer from slowing demand" for Android slate tablets, which can't connect to a companion keyboard. "While Lenovo has introduced some detachables and increased its Windows 10 portfolio, there are still gaps in its lineup in terms of performance and price points," IDC wrote in its report. "IDC believes those gaps will soon be filled, allowing Lenovo to benefit from detachable growth."

Lenovo's tablet shipments in the first quarter fell to 2.2 million from 2.5 million a year earlier.

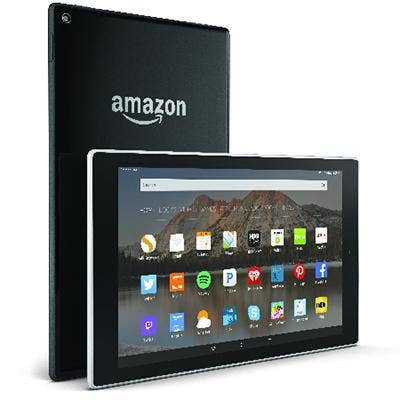

3. Amazon Catches 'Fire'

Amazon's ultra-low-cost tablet, the $50 Fire, has enabled the company to quickly gain ground in the global tablet market. Amazon's tablet shipments reached 2.2 million in the first quarter of 2016, up from 1.9 million in the fourth quarter of 2015, which had included holiday sales (IDC did not count any tablet sales from Amazon for the first quarter of 2015). "The success speaks to Amazon's prowess as a household brand and a distribution powerhouse," IDC wrote.

Amazon's growth in the tablet market knocked Asus out of the top five in the IDC rankings (Asus had ranked No. 4 in tablet sales for 2015 overall).

2. Samsung Stumbles

Tablet shipments for Samsung fell to 6 million in the first quarter, down from 8.3 million a year earlier. While the Galaxy Tab lineup has been a bright spot in the Android tablet space, IDC reported, Samsung's detachable TabPro S launch "has been somewhat tepid due to the high price point" (it starts at $900, compared with Microsoft's $800 Surface Pro 4).

"This is likely a short-term hiccup as Samsung is typically quick to offer various products and different price points," IDC wrote.

1. Apple Sees Another Big Drop

Apple easily remained No. 1 in tablet shipments in the first quarter, with 10.3 million units shipped. But that's compared with the 12.6 million tablets Apple sold in the first quarter of 2015. The declining popularity of nondetachable versions of the iPad among consumers continues to be a main factor. Compensating somewhat is Apple's recent effort to bring detachables into the iPad family. "The latest iPad Pro 9.7-inch and more enterprise-friendly storage options for the slightly older iPad Pro 12.9-inch are healthy additions to the iPad lineup," IDC wrote.