Affinity Index: Unified Communications

Solution providers are doing more SMB unified communications business with Cisco Systems than any other vendor, but the networking powerhouse wasn't the top choice when it came to scoring vendors in the new Channel Affinity Index by the Institute for Partner Education & Development (IPED). IPED is the research arm of Everything Channel, which also owns ChannelWeb.

The following slides illustrate some results in the SMB unified communications category.

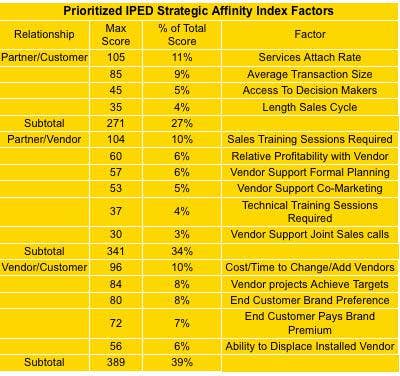

In the Channel Affinity Index, VARs scored vendors in 15 different factors, which the respondents also weighted according to importance. For SMB unified communications, services attach rate accounted for 11 percent of the total score, the highest for this product category. Other factors that were highly valued by solution providers included sales training sessions required, 10 percent; cost and time to change and add vendors, 10 percent; and average transaction size, 9 percent.

On the other hand, vendor support for joint sales calls, length of sales cycle and technical training sessions required were determined by solution providers to be the least valuable of the 15 possible criteria used to rank vendors.

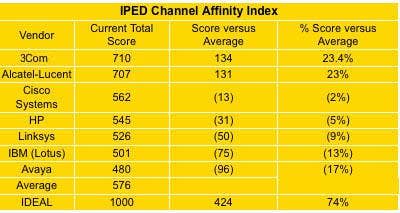

When adding the scores of the 15 factors, Cisco actually ranked third, despite having the greatest share of the channel's wallet in the first half of the year. 3Com emerged as the top vendor to solution providers in the Channel Affinity Index with a score of 710 out of 1,000. The vendor edged out Alcatel-Lucent, which had a 707 score. With an average score of 576 across all vendors, unified communications was one of the highest-scoring technology areas across all Affinity Index categories.

Glenn Conley, president and CEO of Metropark Communications, a St. Louis solution provider, said he agrees with the overall results. According to Conley, 3Com makes great equipment and is a solid vendor partner, but it lacks the brand recognition of Cisco, meaning that solution providers may like working with 3Com more, but Cisco can score more deals.

"They just don't sing a good song," he said of 3Com, adding that Cisco is everywhere and more recognizable to most end customers. Conley said many solution providers and end customers rely on Cisco because Cisco has a great deal of mindshare.

"They always want to root for a winner, and Cisco's a winner. Who's going to win the Super Bowl? That's Cisco. Who provides the best cheese on the nachos? That's 3Com. Once you really get granular, 3Com does a good job not only for the end customer, but for the dealers who can make money.

While Cisco ranked third overall in the Affinity Index, it excelled in sales proposals generated through the channel, illustrating that solution providers can make money with Cisco, but they may not have strong loyalty to its programs.

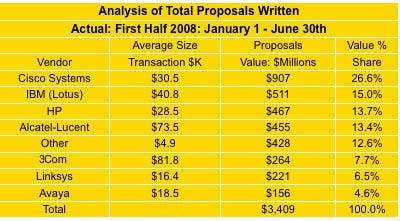

Cisco took the top spot for the dollar value share of all proposals written by solution providers in the first half of 2008, raking in an average transaction size of $30,500 with the total value of proposals reaching $907 million. That sizeable number of transactions in the first half of 2008 gave Cisco a 26.6 percent share of the value of all SMB unified communications proposals written. Cisco's closest competitor, IBM with its Lotus suite, only reached $511 million, or 15 percent dollar value share, despite having a higher average transaction size of $40,800. Rounding out the top five were HP, Alcatel-Lucent and 3Com, which offered the highest average transaction value with $81,800 per proposal.

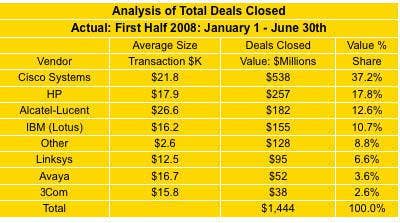

For Cisco, it was a similar story for deals closed in the first half of 2008. Cisco took a whopping 37.2 percent of the value of all SMB unified communications deals to close in the first half of the year, to the tune of $538 million with an average transaction size of $21,800. For deals closed, HP came in a distant second with 17.8 percent of the value of all deals closed, or $257 million.

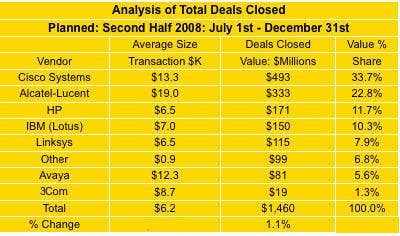

For the second half of the year, solution providers also expect Cisco to be the top dog, again beating out Alcatel-Lucent and HP. While VARs expect the total value of expected unified communications deals in the second half to only increase 1.1 percent compared to the first half, Cisco still managed to crank out a 33.7 percent share of all deals expected to close, with an average transaction size of $13,300 and a total proposal value of $493 million.