The 10 Biggest Cisco Stories Of 2008

When Luke Hosinski, president of Infra-Comm, took the $40 billion networking giant to court charging that Cisco had violated terms of its reseller agreement, few could have guessed at the widespread impact the verdict would have. In a true David vs. Goliath tale, Infra-Comm, a small solution provider, won its case and was awarded $6.4 million in damages by the jury (Cisco later agreed not to appeal and settled the lawsuit for $5.5 million). But the victory itself is not the end of the story: The judge in the case also ruled that several clauses in the partner contract were unconscionable, or extremely one-sided. The result? Cisco as well as other vendors across the industry will need to rethink the language of their partner contracts.

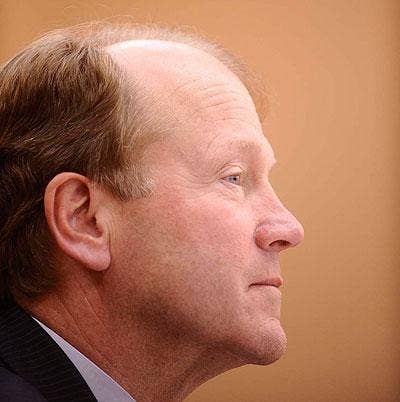

Cisco felt the impact of the current economic slump from the very beginning of 2008, as the company in January saw an unexpected dip in order growth. As customers grew more cautious throughout the year, so too did Cisco Chairman and CEO John Chambers. In November, Chambers predicted that sales for the vendor's second quarter, ending January 2009, will drop by as much as 10 percent year-over-year. He also revealed plans to cut $1 billion out of Cisco's fiscal 2009 budget, a move that led the company to cancel its 2009 Global Sales Meeting and to implement a mandatory shutdown in North America at the end of December.

Cisco's Data Center 3.0 initiative really took flight in 2008 with the launch of the Nexus family of data center switches, starting with the Nexus 7000 Series in January (pictured) and then the Nexus 5000 Series in April. Cisco said the new Nexus line would help solution providers nab their share of the $14 billion data center hardware and services opportunity expected to develop over the next five years. Cisco in April also launched a data center technology specialization for channel partners and added data center products to its popular Value Incentive Program.

Shortly after the launch, Jayshree Ullal, a 15-year Cisco veteran who had been leading the charge as senior vice president of data center, switching and services, left the company in a move that many saw as a signal of Cisco's push away from its networking roots toward the broader IT market. Reports that the company plans to launch a line of blade servers, which would mark a major strategy shift for Cisco, surfaced in December.

Whenever Cisco talked small business, one question always surfaced: How will you differentiate between your Cisco and Linksys small business offerings? In 2008, Cisco came out with a definitive answer: We won't. Instead, the vendor absorbed the Linksys partner program into its own and then disclosed that it will no longer bring new small business products to market under the Linksys name. Existing "Linksys by Cisco" small business products eventually will be rebranded, leaving the Linksys name for exclusive use on consumer products.

At the same time, the vendor launched a new Cisco Small Business Pro product lineup, part of a $100 million investment in its small business efforts. "Our channel will be a sustained competitive advantage for Cisco as we seek to grow our business in the 's' space," said Andrew Sage, Cisco's vice president of worldwide small business sales.

Global channel chief Keith Goodwin told attendees at this year's Cisco Partner Summit that he needs $20 billion in new channel business over the next several years in order to meet the vendor's growth goals. To get there, Goodwin is focusing on ways to help partners collaborate with Cisco and with each other.

The vendor opened Cisco Partner Exchange, a virtual environment where Cisco's 8,500 certified partners can create "booths" to share information about themselves and their skill sets, and launched its Cisco Global Resale Agent model, an initiative that establishes policies and provides tools so solution providers can work with Cisco partners in other geographies around the world.

Cisco in 2008 became the No. 1 enterprise telephony vendor, outpacing rivals such as Avaya and Nortel, according to quarterly reports from several research houses. It's a big milestone for Cisco since it only offers IP-based systems and had no legacy base of traditional telephony customers or channel partners to draw from when it entered the VoIP space 10 years ago.

Cisco celebrated the one-year anniversary of its WebEx acquisition in May, but solution providers are just now starting to see the real benefits of the deal as Cisco starts to build out channel programs around the hosted collaboration service. The September launch of WebEx Connect, a Software-as-a-Service platform that combines presence, instant messaging, video, collaboration tools and Web 2.0 applications into a portal, piqued the interest of many channel partners.

At the same time, Cisco is integrating WebEx-based tools into its channel program to help improve communications with partners and foster partner-to-partner collaboration. "While we've done over 130 acquisitions, WebEx has a very realistic possibility of being in the top five, maybe even in the top two, in terms of the long-term contribution to Cisco," Chambers said in March interview with ChannelWeb.

Cisco maintained its dominant switch market share, but its main competitors did work to make it a tougher fight. Hewlett-Packard's ProCurve division continues to outpace the growth rate of the networking market, Juniper finally launched its EX enterprise switch line (pictured) and Brocade snapped up Foundry. Cisco solution providers expressed concern that lower-cost edge switches from rivals such as ProCurve will tempt customers struggling with the economy.

Cisco in March took a major step forward in WAN edge performance with the launch of its Aggregation Services Router (ASR) family of midrange routers. The launch marked the culmination of a five-year, $250 million development effort. The ASR line was the first offering built on Cisco's QuantumFlow Processor, which promises a 40- to 160-times performance improvement vs. its predecessor, Cisco said. The company touts the router line for its unparalleled levels of resiliency and application availability.

What better way to ensure the long-term health of your network infrastructure business than to evangelize video? As John Chambers is fond of pointing out, all that video traffic -- everything from YouTube to high-definition videoconferencing -- dramatically increases network loads and keeps customers coming back for better, faster, more powerful networking gear.

Cisco rolled out personal TelePresence HD videoconferencing units (pictured) and also introduced the Cisco Media Experience Engine 3000, a new media-processing platform. It also inked a deal with the New York Yankees to outfit the team's new stadium with Cisco gear, including tons of integrated video capabilities.