10 Networking Products The Midmarket Needs Right Now

Middle Ground

Midmarket customers are often left with either small business-oriented networking products stretched well beyond their means, or watered down versions of enterprise-class products that are prohibitively priced. For years, VARs have been asking: isn't there appropriate gear, software and services positioned for that midmarket sweetspot?

Here are 10 networking and infrastructure products meeting customers' needs in the middle, no excuses necessary.

Adtran NetVanta Unified Communications

Adtran spent years cultivating the SMB channel with its NetVanta routers and other key products, and in December 2009, entered the unified communications space with a new portfolio of hardware and UC software packages for Windows environments. Perhaps the most significant is the NetVanta Business Communications System, a package that ties together the NetVanta UC server (scaleable to more than 2,000 users) with Adtran's NetVanta 7000 Series IP-PBX. Couple that (and other Adtran UC products) with the ACES program -- through which VARs can develop specialized UC applications for customers -- and Adtran has a lot of midmarket bases covered.

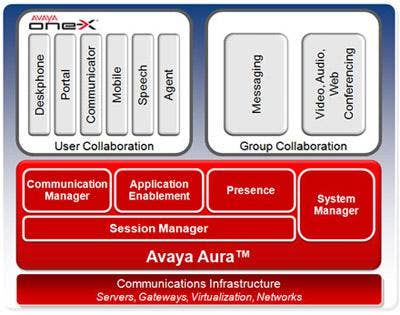

Avaya Aura for Midsize Enterprises

Avaya's virtualized unified communications platform, Aura, debuted a year ago. Designed to run on a single server and help enterprises migrate their legacy infrastructure to fully functional UC capabilities, it's been a hit. Last fall, Avaya released a version of Aura for midmarket customers that can support between 100 to 2,400 users in up to 250 remote locations, and pack Avaya features like Avaya Communication Manager, Voice Messaging, SIP Enablement Services, Application Enablement Services, Utility Services and Media Services into a single suite without asking those customers to invest heavily in hardware and power and cooling needed to maintain it. At $60 a user in the standard version, it's still a little rich for small business blood. But for midmarket customers deploying virtualized architecture for the first time, it's a winner.

Digium AA355 Switchvox PBX

The ranks of Digium devotees are modest, but steadfast, and there's a good reason: the open-source PBX company is on a roll with Switchvox, its "VoIP-in-a-box" product. The AA305 SMB version of Switchvox can support 10 to 400 users as an out-of-the-box turnkey IP-PBX, complete with softphone usage, a Web-based management dashboard called Switchboard, and plenty of subscription options that run the gamut from $11 to $28 annually per user. If there's a midmarket PBX solution with this much ease-of-use gaining more excited channel partners at a faster rate, we haven't heard of it.

D-LInk DAP-2590

D-Link's DiR-615 has carved out a nice niche in consumer/SOHO at a price point below $100, and in the midmarket, both its pricing and margins are similarly kind for channel partners. Among several midmarket-geared offerings is D-Link's DAP-2590 ($409.99), or the AirPremier N Dual Band PoE Access Points. All three dual band antennas on the DAP-2590 are detachable and can provide wireless coverage in 2.4 Ghz or 5 Ghz bands. The unit is enclosed in a plenum-rated metal chassis and offers 802.3af Power over Ethernet support, wireless signal rates of up to 300 Mbps, support for up to 8 VLANs, load balancing, Network Access Protection in Windows Server environments, and other features.

LifeSize Passport

To LifeSize, HD quality telepresence and affordability as a desktop solution aren't mutually exclusive ideas. The company, which was acquired by Logitech in 2009, had a hit last year with its 220 Series Telepresence portfolio, including a range of HD video systems for between $7,000 and $17,000. The lower end of the midmarket, though -- and the VARs that service it -- have caught on to Passport, a portable telepresence system offering HD videoconferencing with minimal hardware, with packages starting at $2,499. As Cisco, Polycom, and Cisco-acquired Tandberg push downmarket from their traditionally high-end video conferencing bases, they have a fierce competitor in LifeSize.

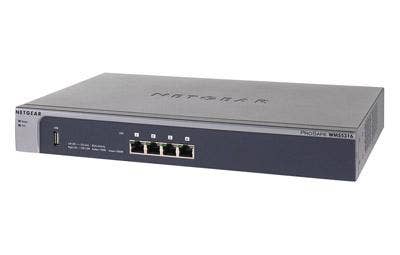

Netgear ProSafe 16-AP Wireless Management System WMS5316

VARs that service SMBs often complain about the lack of products specifically targeted to a segment that wants sophistication and functionality, doesn't want to pay through the nose and doesn't want to rely on painfully over-stretched consumer and SOHO-grade products. Netgear feels their pain. Earlier this year, the company launched a new line called ProSafe Wireless Management, including three releases that target sub-500-, sub-200- and sub-50-user customers respectively. The mid-sized release, ProSafe 16-AP Wireless Management System WMS5316 ($910), offers central wireless management for 16 APs, rogue AP detection, load-balancing of clients and guest access controls. The most advanced of the three, ProSafe 20-AP Wireless Controller WC7520 ($6,280), scales up to 1,500 users, and offers voice-over-WiFi support, SpectraLink Voice Priority QoS compliance and wireless security with rogue AP detection, heat maps and triangulation, and sports a controller that scales up to 50 APs on a single unit.

Ruckus ZoneFlex 7300 Line

Ruckus Wireless busted out as an SMB-focused wireless upstart, pushed upmarket with some higher-end gear for enterprise, and then this year focused new attention on the midmarket, with the release of its ZoneFlex 7300 line of 802.11n access points. The portfolio includes the single-band 7343 and dual-band 7363 APs, priced at $499 and $599 respectively. Ruckus designed the APs with aesthetics in mind, as well as BeamFlex, a multi-antenna ray that's controlled by software and enables APs to direct and redirect signals in realtime over the strongest available paths. Ruckus contends its ZoneFlexes outgun rival products from Cisco and Aruba from a technical standpoint, at much cheaper prices. Solution providers are listening.

SolarWinds Orion Network Performance Manager

SolarWinds' Orion suite of network management tools, including Network Performance Monitor for fault and network performance management, and Network Config Manager for network change and configuration automation and management, has gained a lot of fans in the channel thanks in part to scalability. That is, SolarWinds tools claim to cover business of anywhere from 100 to 5,000 employees, ranging from $2,475 starting price for up to 100 elements and $20,975 for unlimited elements. SolarWinds tools started landing on the channel radar about 4 years ago, and almost every software update has made for richer, deeper features in each, from VoiP performance monitoring to Top 10 views of the network, customizable widgets and altering for events, sustained conditions and device states.

Aerohive Hive AP120 And Hive Manager Online

Aerohive built its buzz, so to speak, on "cooperative control architecture," which offers customers the ability to deploy 802.11n wireless access points without having to add to or upgrade existing WLAN controllers. The company made its name targeting enteprise customers but has begun to push toward midmarket following last fall's release of HiveAP 120, a dual-radio access point that brings the features of Aerohive's higher-end Hive AP 300s to smaller-sized businesses, and HiveManager Online, a SaaS-deployed Wi-Fi management package that effectively removes cap-ex and maintenance costs of dedicated management servers and is offered as pay-as-you-go subscription pricing. Expect to hear more from Aerohive this year.

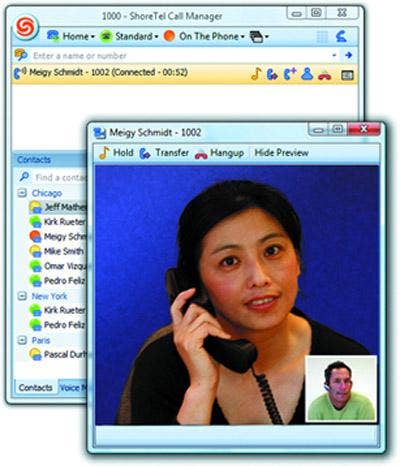

ShoreTel ShoreWare Call Manager

At the heart of ShoreTel's channel-charming Shoretel UC System is ShoreWare Call Manager, an application that comes in four editions -- personal, professional, operator and mobile -- and provides everything from realtime alerts for contacts, to messaging tools and voicemail management functions through Microsoft Outlook. The UC System as a whole, which includes ShoreWare, IP phones, voice switches, contact center tools, converged conferencing, system monitoring software and various applications, has been a perennial midmarket favorite for years now, and ShoreTel has continued to sharpen its channel execution while freshening up the features for more demanding UC environments. Next up is ShoreTel for IBM Lotus Foundations, a bundle that combines ShoreTel UC gear with IBM Lotus Foundations Reach for SMBs, and ShoreTel's brand new TCO Guarantee program, in which ShoreTel will use third-party testing on its UC deployments and then lower competitive prices if total cost of ownership (TCO) is found to be lower than ShoreTel's.