10 Ways Cisco Can Get Its Groove Back

What Ails Cisco?

2011 will be remembered as a hard year for Cisco, one in which the networking titan was besieged by questions about its apparent lack of focus, its ongoing string of disappointing earnings results and the shaken faith of many of its devoted channel partners.

At Cisco Live in Las Vegas earlier this month, Cisco celebrated new products and its customer base, but lurking in the background was nothing but more questions: How will Cisco's ongoing restructuring make Cisco a better company to partner with and buy from? How will Cisco fend off an ever-more-aggressive attack on its core networking businesses from HP, Juniper and others? And will the "simplification" plan laid out by Cisco executives be a transformation, or a remote fix?

Based on interviews with Cisco executives, Cisco partners and analysts, here are the ways it appears Cisco plans to get its mojo working again.

Get Tough

Cisco is in the midst of what will, after all is said and done, be its most dramatic restructuring in at least a decade. The company confirmed plans to lay off 6,500 full-time employees, which when combined with the 5,000 employees headed to Foxconn as part of a Cisco factory sale in Mexico, and the 550 employees who exited with Cisco's shuttering of the Flip video camera line, will make Cisco more than 12,000 employees lighter than it was a year ago.

At Cisco Live, Cisco Chairman and CEO John Chambers addressed Cisco partners and customers, and set the tone thus: "We will do whatever it takes to make you successful."

Simplify, Simplify, Simplify

Soni Jiandani, senior vice president of Cisco's Server Access and Virtualization Technology Group, said Cisco's Unified Computing System (UCS) now boasts more than 5,400 customers worldwide and is adding 1,000 per quarter. At Cisco Live, Cisco execs cited recent IDC data showing Cisco as the No. 3 x86 blade server market share holder in the world, and the No. 2 blade provider in the U.S., behind HP.

Jiandani said about 60-70 percent of Cisco UCS customers are former HP server customers, and 30-40 percent are former IBM or Dell customers. The bottom line? Among strategic bets, Cisco's decision to go all-out in data center and compete with the reigning server incumbents appears to be paying off.

Left to right: Lew Tucker, Cisco's cloud CTO; Jiandani; Praveen Akkiraju, senior vice president, Cisco Services Routing Technology Group; Steven Senecal, manager, global server engineering, Travelport; and Lou Modano, head of global infrastructure for NASDAQ OMX.

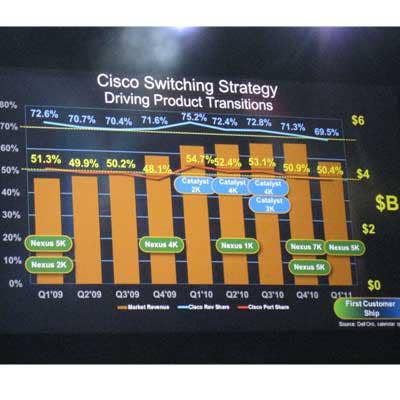

Aggressively Defend The Base

One of Cisco's big moves at Cisco Live was the launch of an updated Catalyst 6500 -- Cisco's most popular switch line.

According to Cisco, the updated feature set, including Supervisor Engine 2T 2-terabit card, allows VARs to sell investment protection to customers, because the Catalyst installed base is so large and it's a natural upgrade path. HP, however, jumped all over Cisco's claim that a Catalyst upgrade is a better investment than a rival HP switching architecture, setting off a week's worth of chest-puffing between the two vendors.

Cisco, in uncharacteristic fashion, railed back against HP's claims, accusing HP of spreading "blatantly misleading information." Maybe it's a sign of the newer Cisco -- which doesn't often explicitly call out competitors in public -- not willing to let rivals try to mess with its top sellers.

Listen To Cisco Partners

Top Cisco partners attending Cisco Live had a familiar refrain in interviews with CRN: a simpler Cisco will be a better Cisco.

Sudhir Verma (right), senior director of consulting services for Force 3, a Crofton, Md.-based solution provider and Cisco Gold partner, was among partner executives who thinks Cisco has wised up.

"Market pressure has forced them to look at the partner landscape in a whole different way and it's definitely changing the way they interact with us," Verma said. "This whole restructuring and changes are good. It makes them re-focus. For all of us, that's a win-win."

Left to right: Gregory Stemberger, principal network engineer at Force 3; Jason Oh, practice director, Borderless Networks at Force 3; and Verma.

Invest In Cisco Partners

In an exclusive interview with CRN earlier in July, Rob Lloyd, Cisco's executive vice president, worldwide operations, went on record to tell Cisco partners that they will see more, not fewer, resources available to them as a result of Cisco's restructuring.

More details of what those resources entail have since emerged. Cisco will be pushing a strategy called partner-led, which will theoretically mean a greater emphasis by Cisco on sales through channel partners in all but Cisco's most strategic accounts.

Partners say the strategy still lacks some particulars, but Cisco recently confirmed that there'll be a practiced channel hand running it: Andrew Sage (pictured), newly Cisco's vice president, worldwide partner-led.

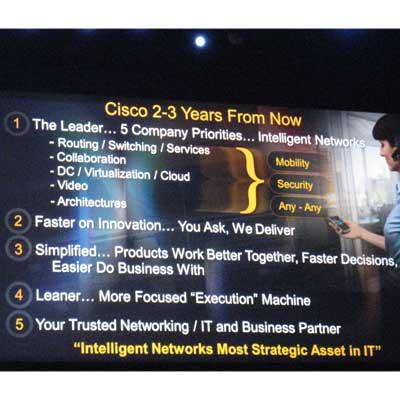

Prioritize

No more talk of "30 adjacencies," Cisco's promised. Instead, a focus on five areas where Cisco is crucially aligned: its core networking businesses (including routing, switching, security and mobility), collaboration, data center (including virtualization and cloud), video, and the business architectures that tie those technologies together.

Dave Elsner, vice president of sales and marketing for Nexus Integration Services, a Valencia, Calif.-based solution provider and Cisco Gold partner, told CRN that he welcomes Cisco returning its focus to the core networking solutions on which its top partners drive sales.

"They built this phenomenal LAN/WAN network, and started overlaying all of these things and probably got too diversified and too thick," Elsner said. "It's good for the partner, because when they're not in the consumer markets, when they're not in things like Flip video, that puts the attention back on the growth of what's important to me."

Build The Cloud Story

Cloud computing was a frequent topic of discussion at Cisco Live, and more specifically, what Cisco's role in the cloud evolution will be. Cisco has already gathered a head of steam behind UCS and its other data center, virtualization and cloud-enabling technologies, but at Cisco Live, a panel of Cisco partners told attendees that the cloud conversation is rapidly shifting from the "what" to the "how," and enterprises are asking about business objectives from cloud, not just the tech itself.

"It's a migrational path," offered Wyatt Starnes, vice president of advanced concepts at Harris Corp., Melbourne, Fla. "It's not a jump you sort of make in one day."

Left to right: Lawrence McNutt, COO of Special Order Systems, Loomis, Calif.; Starnes; and Phil Harris, senior strategic advisor for VCE.

Don't Fall Back On The Cisco Legend

The "Cisco Live dancers" (pictured) certainly weren't sitting still, and neither should Cisco. Cisco partners agree that it's time for the networking kingpin to wake up and smell the changed landscape.

"The 'We're Cisco' argument isn't scaring anybody anymore, and that's the big difference," said a longtime channel observer in attendance at the conference, who requested anonymity. "Every aspect of every business they have is under attack. Every competitor has a good anti-Cisco story. It's no longer enough to ride the Cisco name and expect the best."

The partner-led initiative is a good first step, most VARs agree. Ashish Upadhyay, senior manager for advanced technologies at World Wide Technology, St. Louis, said "partner-led," to him, means consistency.

"That allows us continued investment into Cisco technologies, and allows us to do business more of a partnership model," he said.

Embrace Change

No less than Capt. James T. Kirk himself urged Cisco -- urged all attendees at Cisco Live, in fact -- to embrace change, and accept it as a fundamental part of life.

Actor William Shatner, joining Cisco executives for a sit-down discussion at the final Cisco Live keynote, was equal parts hilarious and poignant. But his big takeaway was something most partners hope Cisco is taking to heart, and something Cisco CEO Chambers seems to agree with.

"The change will be for the better because it has happened," Shatner told more than 15,000 Cisco Live attendees. "Embrace change."