10 Things We Learned At Cisco Partner Summit

Cisco Partner Summit Post-Mortem

Heading into Partner Summit, Cisco was riding a wave of good notices following its painful restructuring year. But with another Cisco Partner Summit in the books, it's time to read between the lines. CRN spent a few days post-Partner Summit decompressing and also going over scores of interviews with partners, Cisco executives and other observers. Here are 10 impressions of Cisco -- of technology strategy, of channel strategy, of competitive strategy -- we came away with, along with a few "elephant in the room" questions.

Photo Credit: Bay Area Event Photography

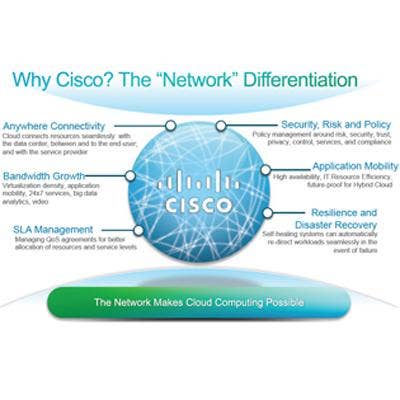

Cisco Has Big Cloud Plans

There's more to come from Cisco in cloud, including a new platform called Cloud Connect, said to optimize the performance of operations in public, private and hybrid cloud environments with an eye toward simplicity and security. That was the message, anyway, from Cisco CTO Padmasree Warrior, who said one hook for solution providers will be Cloud Connectors -- modules that attach to the Connect platform and allow partners to build custom applications that leverage Cisco's software.

That announcement builds on the already-established foundations of Cisco's cloud strategy, which include a channel offering, the year-old Cisco Cloud Partner Program, and the CloudVerse framework. More is expected from Cisco during a May 22 launch event, and also at June's Cisco Live conference, and what partners will be waiting for is a clearly-defined profitability plan in the midst of so much talk about cloud.

Cisco Has Big Security Plans

Chris Young (left), Cisco's senior vice president, security technologies business unit, was mentioned so often by Cisco senior management during the show -- from John Chambers to Padmasree Warrior -- you'd think he were taking over the whole company. Young, who joined Cisco in November after highly regarded stints at RSA and VMware, is the first SVP-level security executive Cisco's had in its engineering organization.

All those mentions, coupled with several executives making repeated mentions of Cisco's evolving security strategy, add up to a potentially major move on the horizon for Cisco. It has been speculated for some time that Cisco is at work on a next generation firewall (NGFW) product to succeed its ASA line, but still other pundits believe Cisco will acquire a NGFW vendor to fill security holes. Something's coming.

It's Huawei, Not HP, Cisco Fears

Sure, we expected this to be the case; Cisco's had Huawei in its crosshairs for at least a year now, and has stepped up the frequency and intensity of its public attacks on the Chinese telecom giant.

Throughout Partner Summit came mentions from the stage -- Cisco's Rob Lloyd, EVP, worldwide operations, highlighted Huawei among three specific competitors during his closing keynote -- and also behind closed doors. During their meetings, partners told CRN, Cisco executives asked repeatedly about Huawei, including how often and how frequently Huawei's U.S. channel executives have been contacting partners and what products they see coming.

"These were a lot of the same questions Cisco was asking us about HP in 2009 and 2010," one partner told CRN during the show.

It's Microsoft, Not Avaya, Cisco Fears

With Avaya in an ongoing corporate tailspin, it's clear now that Cisco has shifted its focus to a far more dangerous UC challenger: Microsoft.

Redmond was among three major competitors called out by Cisco's Lloyd from the stage, and most partners view Cisco's Jabber for Everyone decision -- through which it will make Jabber available at no additional license cost for customers already using Cisco Unified Communications Manager -- as a counterstrike against the growth of Microsoft Lync.

It's with good reason Cisco makes these moves. The consensus among analysts and partners is that Lync, which had neither really moved beyond the curiosity stage two years ago nor beyond the early adoption stage a year ago, is making inroads aplenty. And with questions still unanswered about how Microsoft will leverage its Skype acquisition with Lync and various other software product lines -- Cisco, you'll recall, described that acquisition as "bad for customers" -- this battle's only starting to heat up.

Yes, SDN Is A Cisco Priority

Cisco's had so many questions about Insiemi, the software defined networking (SDN) technology startup its funding, that at Partner Summit, it decided it had better just go ahead and lift the veil.

In what amounted to a non-announcement announcement, Cisco confirmed several details of Insiemi, including that it has put $100 million into the company so far and may go up as high as an additional $750 million with the expectation it will acquire the company. Cisco's done these "spin-in" moves before, and the same engineering team that was part of Andiamo Systems and Nuova Systems -- Mario Mazzola, Prem Jain and Luca Cafiero -- is again at the helm.

Photo Credit: Bay Area Event Photography

Also, There's No Shame In Spin-In

Cisco's taken knocks for the spin-in strategy before, and that trend's continuing with Insiemi, with the thought being that such a strategy lionizes certain all-star engineers and creates jealousy and disillusion among less-favored factions of Cisco's engineering corps.

Regardless, said Cisco CTO Padmasree Warrior (left), Cisco's going to keep forging ahead.

"If there's any company that's going to reinvent networking, it will be Cisco," Warrior told CRN. "We have the talent and the breadth and the depth to do that. It goes beyond just SDN to certain elements of network visibility, such as analytics and big data. But, we want our partners to understand that Cisco is working on enabling all the capabilities needed for the network of the future."

New Cisco Programs Have Wood Behind The Arrow

Heading into Partner Summit, it was clear Cisco's two marquee announcements -- its new Cisco Services Partner Program and the midmarket-focused Partner Plus program within its Partner-Led strategy -- would be a hit with channel partners.

And by all accounts, they were; partners told CRN repeatedly that they appreciated the "if x, then y" simplicity of each program -- a clearly defined way for the channel to make money and actual brass tacks programs to be part of instead of so much pie-in-the-sky talk about strategy.

Cisco's Incentive Programs Still Matter

There's a decidedly healthy cross-section of the Cisco channel that makes its money using Cisco's various incentive programs, from the all-important Value Incentive Program (VIP) to the Opportunity Incentive Program (OIP) and the newer Teaming Incentive Program (TIP).

Based on the strength of applause for minor announcements made by Cisco -- it confirmed new OIP and TIP discounts for various Catalyst (left) and Nexus switches -- and the relief from solution providers that Cisco is finally smoothing out TIP's rougher edges at the field level, it's hard to overstate the bearing these programs have on partner profitability.

Photo Credit: Bay Area Event Photography

Cisco's Cius Is Struggling

Cisco's Cius Android tablet was announced nearly two years ago, took more than a year to reach general availability for partners, and is now a mystery. Cisco made little -- if any -- mention of Cius in its keynote presentations at Partner Summit, which was surprising given how much attention it has received as an enterprise-grade UC endpoint since its 2010 announcement. Partners tell CRN they're just not seeing the customer appetite for Cius -- not in the land of iPads making enterprise inroads -- and when a much-hyped Cisco product does well, Cisco is quick to wave its flag, as evidenced by its frequent mentions of Unified Computing System (UCS) growth.

What else are we to think but that Cius isn't taking off? If the opposite is true, Cisco needs to come to the table with some concrete numbers, fast.

VCE's Future Is Still a Question Mark

Cisco's Rob Lloyd, in no uncertain terms, told CRN before the Partner Summit that VCE was a success and that Cisco would continue to fund the joint venture, which is dedicated to churning out fully integrated Vblocks. And by most partner accounts, VCE has turned the corner on its relationship with the channel -- many solution providers cited the efforts of D. Martin, vice president, global channels, with listening to channel criticism and fine-tuning VCE's partnering model.

But at Partner Summit, particularly when the recorder was turned off, came no shortage of stories about problem-plagued Vblock deployments, sniping between the various sales teams of Cisco and EMC over Vblock deals, and the implications of EMC's VSPEX reference architecture move. All of the stakeholders in VCE are adamant about VSPEX not being a competitor to Vblock, but partners aren't buying it -- most said they peppered Cisco and EMC executives with that very question throughout Partner Summit and still aren't quite satisfied with the answers.

Complete Coverage From Cisco's 2012 Partner Summit

Cisco Partner Summit:

Subtle Cisco Moves With Big Implications, Part 1

Subtle Cisco Moves With Big Implications, Part 2

The Cisco Elephant Not In The Room

Cisco's Lloyd Confident With Sales

Cisco Lifts The Veil On SDN Spin-In Insiemi

Dinner With Cisco’s John Chambers

Is Cisco Poised To Make A Splash In Security?