Cisco Partner Summit Preview: 10 Things Partners Hope To Learn

Ready For Showtime

Next week, thousands of Cisco partners will flock to Boston for the networking giant's annual Partner Summit event, where they'll have a chance to hear the latest and greatest from Cisco's top channel execs.

In the meantime, some Cisco partners are keeping a running tally of topics they want to learn more about at this year's event, with everything from SDN to new business models topping their list.

Here's a look at 10 questions that will be top-of-mind for Cisco partners attending Partner Summit 2013.

Is SDN Hype Or Here To Stay?

Software-defined networking (SDN) has been the talk of the networking world for well over a year, and Cisco, through Cisco ONE and its support of the SDN-focused OpenDaylight Project, has positioned itself at forefront of that conversation.

But is SDN really the future of networking -- or just a buzzword bound to be forgotten? Some Cisco partners will be searching for an answer at Partner Summit next week.

"I want to learn more about software-defined networking. It's an industry buzz term right now, kind of like when people used to talk about SOA, or service-oriented architectures," said Michael Girouard, executive vice president of sales of TekLinks, a Birmingham, Ala.- based solution provider. "[SDN] could go the same way as SOA, meaning it's a great conceptual thing, but never really materialized into a tactical architecture. I'm really curious to see how this will evolve."

What's Next In The Services Market?

Cisco, in a move it dubbed its biggest services announcement in 15 years, unveiled its new Services Partner Program at least year's Partner Summit in San Diego.

Steven Robb, president of LaSalle Solutions, a Rosemont, Ill.-based solution provider, said this year he's interested in learning what's next for Cisco and its partners in the services market, particularly since services like lifecycle and information management have become such a significant part of LaSalle's business.

Specifically, Robb said he'd be curious to hear any news related to the open APIs Cisco offers for its Smart Services, which lets partners create their own apps and workflow integration software to use alongside Cisco's.

"I see Cisco being one of the market leaders in the sharing of information, and the recognition of that information is as important, if not more so, than speeds and feeds," Robb said.

How Will Cisco Lead Partners To New Business Models?

TekLinks' Girouard noted that his company, like many solution providers, is in the midst of business model transformation, moving away from pure hardware resales and toward the recurring revenue opportunities afforded through selling services and the cloud. At Partner Summit, Girouard said he'd be interested to hear how Cisco will help partners like TekLinks navigate this transition.

"We're constantly looking to our partner members to see how they are going to mature to the cloud services niche," Girouard said. "And it's not like Cisco or EMC are missing the mark -- it's probably not in very high demand in the reseller space, but we believe it soon will be, and it's a race for us. Since we were one of the first doing [managed services and cloud], we are investing a lot in the space to capture share."

How Will Cisco Enable Partners To Sell To LoB?

In many organizations, IT decision-making and budgets are shifting from the office of the CIO to the lines of business. And according to Steven Reese, chief technology officer at Sigmanet, an Ontario, Calif.-based solution provider, software-defined networking will only accelerate this shift. That's why, at Partner Summit next week, Reese said he'd like to hear how Cisco can help partners have these new customer conversations.

"When you think about selling a switch or selling a router or even selling telephony, historically, we have sold to IT, and it's kind of the businesses job to figure it out. There's very little software that is sold that way. When you sell SAP, you don't sell it to the IT director. You don’t sell Oracle to the IT director; you sell Oracle to the lines of business," Reese said. "Software sales are really a results-led sales engagement model, which means we all have to speak a different language -- us as partners, and Cisco as a manufacturer."

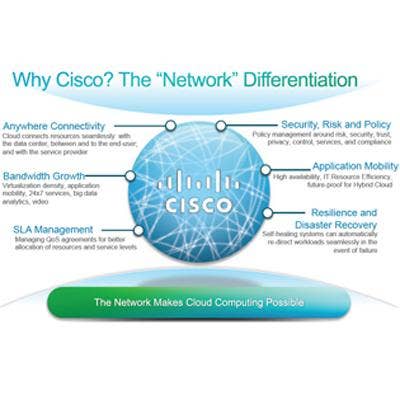

What's The Direction Of Cisco's Cloud Partner Program?

Even for solution providers that have already achieved Cisco's Cloud Builder designation, getting a handle on what's next for Cisco and its cloud strategy will be a big focus at this year's Partner Summit.

Sudhir Verma, chief services officer at Force 3, a Crofton, Md.-based solution provider and certified Cisco Cloud Builder, said he is anxious to hear more about Cisco's Cloud Partner Program, especially since Cisco often updates or repurposes its partner programs around the July or August timeframe.

"It's very difficult today to not have a cloud story and be successful," Verma said. "So, as I relate that back to Cisco, where are they going with [cloud]? What is their cloud story and how are they going to make sure their partners are ready? Our customers are asking that same question."

How Can Partner Certifications Resonate With Customers?

Cisco and its partners are diligent about education and training, which means it's no cake walk for solution providers to earn a top-tier certification. That's why partners like TekLinks' Girouard would love to see Cisco push out a strategy for making these elite certifications more recognizable and meaningful to end customers.

"Partners have been asking for a long for [Cisco] to create some meaning around their partner accreditation levels to the end user," Girouard said. "I have been branded Master-certified. That takes a lot effort and investment, and the only ones who know what a Master-certified partner is are other partners and Cisco. I would love to see a huge branding exercise around Cisco-Powered Data Center Services and Master-certified, or a whole campaign around 'buy your Cisco equipment from Master-certified partners, and here's why they're so valuable.'"

Are Updates In The Works For Cisco's Global Partner Network?

Like he did in Cisco's Services Partner Program, LaSalle Solutions' Steven Robb sees a lot of value in Cisco's Global Partner Network (GPN) and is eager to learn more about how the program can benefit both LaSalle and its customers. The program, rolled out last year, provides Cisco partners with access to global commerce capabilities, making it easier for them to do business around the globe, regardless of their size.

"Cisco has been consistently building this Global Partner Network program to help customers and partners deliver products around the world," Robb told CRN.

How Should Partners Position Meraki Solutions?

Cisco last year bolstered its wireless and cloud-based network management practice with its blockbuster $1.2 billion acquisition of Meraki. But, according to TekLinks' Girouard, the unique value proposition of selling a legacy Meraki solution versus one of Cisco's traditional wireless solution still isn't entirely clear.

"There is enough overlap between [Cisco's] current wireless solutions and the Meraki solution where I understand at a high-level what the difference is, but there needs to be some clear delineation, which I'm hoping to get, between when to position the Meraki solution versus the traditional wireless stuff," Girouard said.

In addition, Girouard said he would like to hear what the managed services play could be around Meraki, given its centralized and cloud-based management system.

What's Cisco Game Plan For Staying On Top?

Sigmanet's Reese also said he hopes to learn more about Cisco's strategy for staying competitive against rivals like Juniper Networks and Huawei, particularly after Huawei's recent vow not to sit idly by as competitors take swings at its brand.

"Competitive manufacturers like Huawei, Juniper and others are continuing to take their gloves off and they are continuing to discount heavily to win business away from Cisco," Reese said.

Ultimately, Reese said he's curious to know how an increasingly competitive landscape might impact partner profitability models, along with Cisco's own pricing models, down the line.

What's Cisco's Road Map For UC?

While SDN and the cloud are poised to be a big focus at this year's Partner Summit, Cisco's Unified Communications (UC) strategy will still be top-of-mind for many solution providers at the show.

TekLinks' Girouard, for his part, said he would be curious to hear about Cisco's plans, if any, for integration between some of Cisco's UC solutions like WebEx, Call Manager and its Hosted Unified Communications Services.

"We are just waiting to see some integration progression where you can push and sell a true UC platform that includes desktop collaboration, presence, voice, video -- whether its desktop video or room-based video -- as well as voice over IP. I'm hoping to learn something about that," Girouard said.