Cisco Widens Leadership Gap Against Microsoft In Collaboration Space

King Of The Hill

The worldwide collaboration market share numbers are in, and Cisco is the winner -- again -- according to Synergy Research Group. The networking giant is widening its collaboration leadership gap even further between it and its main competitor -- and partner -- Microsoft.

"Cisco has that integration between the user experience on the device levels, which can be mobile devices, room systems, personal systems -- Microsoft doesn't have that," said Chris Bottger, senior vice president of collaboration services at IVCi, a Hauppauge, N.Y.-based solution provider and a top Cisco collaboration partner. "They simply don't have that. Microsoft is in their own little world and don't go outside that."

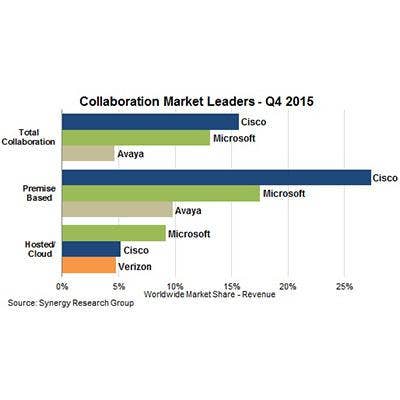

Cisco is the collaboration market leader, owning 16 percent of the total market, while Microsoft trails in second at 13 percent, according to fourth quarter 2015 market share data from Synergy. The report came the same day Cisco unveiled its plan to purchase collaboration specialist Synata.

Total revenue from collaboration hit a record high during the fourth quarter at $9 billion.

Cisco's Still No. 1

"Cisco has a broad and strong product portfolio, and also clearly intends to keep its foot on the gas," said John Dinsdale, chief analyst at Reno, Nev.-based Synergy Research, in an interview with CRN. "Across all of collaboration, it has increased its market share over the last four quarters."

Cisco has been the longtime collaboration market leader, although Microsoft had started to close the gap in 2014, when the two were in effect join market leaders, said Dinsdale. "But since then, Cisco has pulled away again," he said.

Dinsdale told CRN that worldwide collaboration revenue for 2015 was about $35 billion.

Microsoft Comes Up Short

Microsoft placed second, with 13 percent in total market share, 3 percentage points below Cisco, at 16 percent, in the collaboration market.

"Microsoft and Cisco are competing and coming at the market from two different perspectives, but ultimately they're converging on the same spot," said Marcus Schmidt, senior director of product management at Chicago-based West Unified Communications Services, in an interview with CRN. "Skype for Business is coming from Microsoft's traditional strength, which is productivity and collaboration, with things like Sharepoint, Yammer and Office 365, and moving more into the audio and video side. They're trying to move into the more real-time communication pieces that audio and video represent."

Although Cisco won the overall collaboration battle, Microsoft was the market leader for hosted/cloud collaboration solutions.

Microsoft Leads Hosted/Cloud Collaboration

Microsoft was the market leader for hosted/cloud collaboration, capturing 9 percent market share, compared with Cisco's 5 percent share.

"Microsoft is coming from a different place and has a different focus, but the fact that it is the leader in the cloud/hosted segments and its revenue growth is almost double the overall growth in those segments tells you how well-positioned it is for the future," said Synergy's Dinsdale.

Cisco Behind In Hosted/Cloud Solutions

Cisco placed second, with just over 5 percent of the hosted/cloud collaboration market share, followed by Verizon with around 4.5 percent in the space.

West's Schmidt said that although Cisco Spark has "great vision," it might take a while for the cloud calling platform to catch up with the features most enterprise customers expect.

Overall revenue from hosted/cloud solutions continue to grow strongly, up 10 percent year on year, according to Synergy. Revenue from premise-based collaboration systems, in which Cisco is the dominant market leader, declined 3 percent year over year.

Premise-Based Leader: Cisco

Cisco is the dominant leader in the premise-based collaboration market, capturing 27 percent market share, 10 points ahead of second place Microsoft, at 17 percent.

"Microsoft is not willing to commit on any one, right solution," said IVCi's Bottger. "So they keep outsourcing it to different companies and what have you, because they keep saying, 'We're not a hardware company.' So they will never be able to have that tight integration and they don’t understand anything outside of the PC level of it.

"Cisco says, 'Yeah, PC, fine -- a lot of things happen at the desktop. But a lot of things happen away from the desktop as well -- on your phone, in your room systems, other devices and other pieces of hardware.' Then, when you tie into the integration that they have with Apple, then their stuff takes on another level where it really becomes a user experience."

Bronze Metal For Avaya

Although Cisco and Microsoft dominated the collaboration headlines in 2015, Avaya remained in the market leader conversation.

Avaya was behind only Cisco and Microsoft in overall collaboration market share, coming in third by capturing a solid 4.5 percent share. The Santa Clara, Calif.-based unified communications and collaboration specialist also came in third place in the premise-based market, owning nearly 10 percent.

Other Top Collaboration Leaders

Other top collaboration leaders in the market are IBM, Polycom, Mitel, Unify and ALE, according to Synergy. In hosted/cloud collaboration leadership positions after Microsoft and Cisco were Verizon, AT&T, Google and Citrix.

Synergy's Dinsdale said IBM, Polycom, Mitel, Verizon, AT&T, Google and Citrix own 2 percent to 4 percent of the overall market, while Unify, ALE and several others are around 1 percent market share.

In 2015, the total collaboration market grew 4 percent year over year, and Dinsdale expects record revenue numbers and steady growth to continue.

"We forecast the total collaboration growth rate will continue to be in the low single digits," said Dinsdale. "Within that, the hosted/cloud segments will grow much more rapidly, while growth of the more mature premise-based segments will be considerably lower."