Cisco Earnings Preview: Microsoft Integration, Security Growth And Switching Revenue Decline

Plenty Of Questions For Cisco

The networking giant has been making waves in the industry over the past few months with Cisco’s stock hitting a 9-year high in August at over $31 per share. The company’s significant push around security, which partners say could include the acquisition of Imperva, and the debut of a new server that integrates with systems from collaboration rival Microsoft, sets the stage for an interesting fiscal 2016 fourth quarter earnings call this week.

Questions include whether Cisco’s bread-and-butter switching business can bounce back after two consecutive quarters of declines and what is the company's current position in the hyper-converged systems market. Wall Street expects the San Jose, Calif.-based network leader to post revenues of $12.57 billion and earnings at $0.60 per share for the quarter, which ended July 30.

CRN breaks down the six most important questions on channel partners' minds ahead of Cisco’s earnings call on Aug. 17 at 4:30 p.m. EST.

Where Does Cisco’s Microsoft Relationship Stand?

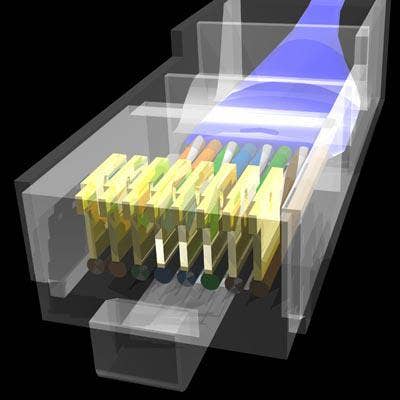

In a landmark move, Cisco launched a new product this week that allows interoperability between Cisco collaboration products and Microsoft’s Skype for Business, as well as other competitors' products.

The new Cisco Meeting Server solution allows anyone to create and join meetings regardless of whether they’re using Cisco or another vendor's hardware or software products, such as Polycom video endpoints or Microsoft Skype for Business.

Cisco Meeting Server will likely be touted during the earnings call, but it will be more interesting to see how Cisco executives talk about the product in regards to the future of its Microsoft relationship, as the two are the dominant players in the collaboration space.

How Big Will Collaboration Grow? Is The SMB Market A Target?

To piggy-pack off the Cisco Meeting Server announcement, channel partners have been bullish about the company’s collaboration push since Rowan Trollope, senior vice president and general manager of Cisco's IoT and Collaboration Technology Group, took over management of the collaboration business in 2012.

Cisco’s collaboration business has skyrocketed over the past year, climbing 10 percent year-over-year to $1.07 billion during the company’s fiscal 2016 third quarter. The networking giant is on track to pull in between $4 billion and $4.5 billion in collaboration revenue for fiscal year 2016, in part due to the revamped Cisco Spark system.

Additionally, the new Cisco Meeting Server was built for both enterprise and SMB markets, the latter an area where Cisco typically doesn’t heavily invest. In May, Cisco also launched the Meraki MC74 phone system targeting the SMB market. It will be interesting to hear if Cisco talks about a push into the SMB collaboration market.

Can Switching Bounce Back?

One negative trend that's top-of-mind for solution providers is the back-to-back quarterly declines in network switching sales, which remains Cisco’s largest revenue stream. For its third fiscal quarter, Cisco reported a 3 percent year-over-year drop in switching product sales to $3.45 billion, while the company reported a 4 percent decline in those sales in its second fiscal quarter.

Cisco has blamed the decline mainly on macro-related weaknesses in Cisco’s campus business, which is driven by product refreshes, as enterprises are hesitant to make the upgrade.

Double Digits Security Growth? Imperva Acquisition?

Cisco’s security business has been growing by double-digits over the past two quarters, increasing 17 percent year-over-year in the third fiscal quarter and 11 percent in the second.

The 28,000 attendees at Cisco Live last month heard more about security compared to any other market segment. With Cisco striving to become the security market leader, the company must report another positive quarter.

A key area for Cisco in security is acquisitions. The company has acquired three security vendors – Lancope, Portcullis and CloudLock – over the last 12 months. Channel Partners say security provider Imperva should be next for Cisco as it fills in gaps in Cisco’s end-to-end security strategy. Although Cisco likely will not discuss potential acquisitions, it will be interesting to hear what executives say if analysts ask about the possibility of an Imperva acquisition.

Will Cisco Break Out HyperFlex Numbers?

Since the general release of HyperFlex in March, hundreds of customers have purchased the Cisco hyper-converged infrastructure system. Cisco and its channel partners, however, have been vague about the product's market traction in the hyper-converged space, with some solution providers saying HyperFlex is not quite ready for enterprises, while others say customers are buying.

The fourth fiscal quarter being the first complete quarter in which HyperFlex has been on the market, partners are hoping Cisco gives a benchmark figure on HyperFlex sales.

Hyper-Converged Relationships?

Cisco’s strategic partnerships in the emerging hyper-converged market appear to be shifting, as sources tell CRN that the company is getting closer to making a bid to buy hyper-converged vendor and partner Springpath. The networking giant also has a partnership with hyper-converged specialist SimpliVity, while rumors of Cisco and hyper-converged vendor Nutanix forming a partnership aren’t going away.

Partners would like to see Cisco give a clearer hyper-converged roadmap around its technology partnerships.