CRN Exclusive: Aruba Channel Chief On Why Partners Need More Software Skills And How HPE Is Opening New Doors

Aruba Channel Chief On How Partners Can Stay Ahead

Aruba Networks partners should be enhancing their software skill set and API development tool set if they want to be a leading-edge solution provider, said the company's channel leader, Donna Grothjan.

"Software – whether they choose to partner with developers or choose to buy an ISV – partners are going to need to understand the user aspect," said Grothjan in an interview with CRN at Aruba Atmosphere 2017 conference in Nashville, Tenn. "So partners have to think about how you're going to appeal to the line-of-business folks and, therefore, it's going to be based on user experience and user experience is based on applications."

Grothjan also talked to CRN about how Hewlett Packard Enterprise is bringing in larger deals for Aruba's channel and if partners can expect any changes to the Partner Ready For Networking program this year.

How important is it for partners today to get skilled around APIs, and what is your advice for the channel around building a larger software practice?

From a software and development perspective, the APIs are important if partners want to look at how they're going to create new revenue streams for their customers. When you have retailers, for example, how do you help drive more foot traffic into their stores? How do you ensure they're measuring how long somebody actually stays in a store versus what they actually buy? All of that is based on the application and the intelligence and the analytics. So therefore software – whether they choose to partner with developers or choose to buy an ISV – partners are going to need to understand the user aspect. Normally from an infrastructure perspective you're not thinking about the user, but you usually are from an application perspective. Partners should really be thinking about it from a user perspective.

Are APIs the next big thing for Aruba partners? Is that the future systems integrator?

If you decide that you don't want to do it yourself, you're going to have to partner to understand it because that's ultimately going to lead the sale of the rest of the infrastructure. If you're not leading based on the application required or the business outcome you're solving for, you won't be involved in the right conversation at the right time.

What's important is that the decision-makers are shifting; it really is becoming line-of-business especially from an edge perspective. So partners have to think about how you're going to appeal to the line-of-business folks and, therefore, it's going to be based on user experience and user experience is based on applications.

How big is Aruba's future in the intelligent network edge? Is that a segment partners should be eyeing in 2017?

Security and analytics are critical to the solution from an edge perspective, especially for Internet of Things. So if a partner isn't considering it, they need to consider it. They need to have an understanding of the value and the value to their customer. Then they can make their decisions around where they choose to invest, but it's going to be a critical aspect of a customer requirement.

What has HPE brought to the table for the average Aruba channel partner?

Aruba before was known as a technology company. By having the brand of Hewlett Packard Enterprise – Aruba as an HPE company -- it actually gives partners more stability going into and talking to the customer because now it's not a single product vendor, now it's a portfolio of products across Hewlett Packard Enterprise. If a customer chooses to focus in mobility, you also have wireless and switches.

The acquisition has really allowed that opportunity for a partner to potentially call a customer that they haven’t called on before or a customer that wasn't interested in having a discussion before or a customer who was interested in our technology but didn't ultimately make the buy because they didn't know the future of the company.

Is HPE leading to bigger deals for Aruba partners?

Yes. When we look at our market share over the last few quarters, we've grown our market share over 4.5 percent. The majority of the business today is in the enterprise space -- those are large deals. So, yes, I would say that's the case.

How is it exactly leading to larger enterprise deals?

When we were Aruba [as a stand-alone company], we were less than $1 billion. We were a market leader, but large corporations typically limit the amount of strategic relationships they have because they only want to work with so many vendors. Being part of HPE, they have a lot of global accounts where they are the strategic vendor. … So the consideration is now there. It's almost as if there's an automatic consideration where there might not have been a consideration before.

Is HPE working with Aruba partners on deals?

We work a lot with the global account managers at HPE jointly on deals. So we've seen a lot bigger opportunities and our partners have the opportunity to work with those global account managers where they may not have worked before. We've won some big deals and all of them have involved partners.

What is another benefit to the channel as an HPE company?

We're able to refresh our certifications and our content much quicker than maybe Aruba had as a stand-alone company. We're able to bring things to market quicker.

Aruba co-founder and CTOs Keerti Melkote's vision is around artificial intelligence and machine learning. How should channel partners be preparing for this today?

He's stating a clear vision of where we're heading so we can start to set the expectations with the partners. We clearly have to help educate them on what does that mean to [them] and how they would apply it. Keerti described a great vision on where we're going and at one point we'll say, 'OK, here's how we're going to turn that into something you can tangibly do.' The point is to help get folks tou nderstand where we are going, start the dialogue so that we can start deciding and working with them on how does this impact them, and what do partners need from us. What he was sharing was really the view of where we're heading.

What would be one or two Aruba solutions partners should dive into this year if they haven't already?

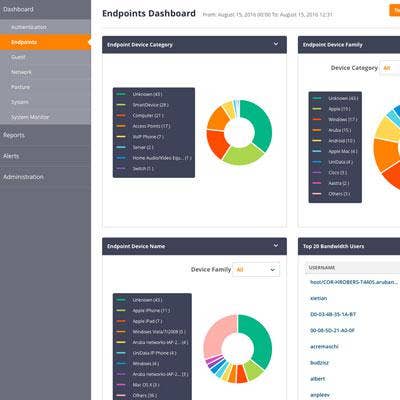

Definitely Aruba ClearPass and location-based services. … The way that we've structured the competencies are that we want to incent our partners to be competent in a particular area like security and policy management. We want more partners to become competent in ClearPass.

The new Aruba-HPE Partner Ready For Networking program is now four months in. What traction have you seen with the HPE partners?

Yes, there's traction. But we also talked to the partners [at Aruba Atmosphere] about how we would like to see more of them earn the specializations for both wireless LAN and switching because as we go into fiscal year 2018, it is a requirement for Platinum or Gold status. So we are seeing traction, but it comes with ensuring they're taking the certifications that ultimately will get us there.

Where have you seen an uptick in the Partner Ready For Networking program?

We've been pleasantly pleased with the uptick of a lot of the switching partners seeing us as a high-growth area and really investing in that mobility-first story that we have. … We've seen a dramatic uptick in certification and specializations from both HPE and Aruba [partners].

Can partners expect any changes in the Partner Ready For Networking Program in 2017?

Fiscal year 2017 [which began Nov. 1] is a transition year for us. We're taking partners who were part of their legacy program and we're bringing them together to create a single networking channel. … It's all about having that landscape for fiscal year 2018. By design we're not creating anything new because we really need our partners to want to be part of the program in fiscal year 2018.