Avi Networks CEO On Citrix And F5's Technology 'Gap', New Cisco Reseller Agreement And 440% Bookings Growth

Avi Networks CEO On The Record

Over the past 12 months, Avi Networks grew bookings by 440 percent and increased its customer base by 270 percent, with a massive channel surge insight thanks to a new reselling agreement with Cisco.

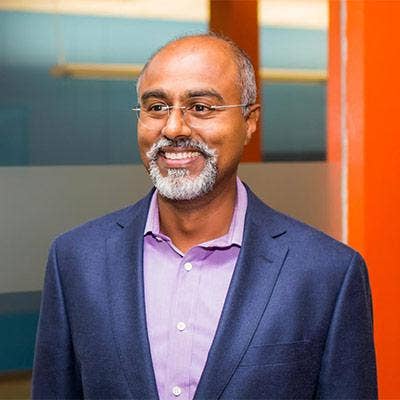

Touting itself as the leader in next generation application services, Avi CEO Amit Pandey said his startup is driving sales through innovative technology not offered by competitors F5 Networks and Citrix. Pandey is the former CEO of Zenprise which was acquired by Citrix in 2013.

In an interview with CRN, Pandey talks about "doubling down" on public cloud through integrations with AWS, Google and Microsoft, technology differentiator and why Cisco partners should be pumped about Avi.

Who are you competing with most in the market and why are they choosing Avi?

Our main competitors are the traditional players like F5 and Citrix, but their products don’t actually fit very well when somebody is considering automation or public cloud or containers. Partners who sell F5 and Citrix still want to work with us because they have a gap in their portfolio. We've been quite fortunate in our space because there has been little investment here for the last 20 years. There's a gap around these new technologies. The closest competitor is somebody taking F5 and trying to build a lot of glue and stuff themselves around it, but that's tough because it's an appliance architecture. We tend to get a lot of dissatisfied people looking for alternatives. While F5 and Citrix play here, I think our channel partners quickly see that it isn't going to work.

How are customers changing their buying habits?

With the move towards microservices and containers, customers are questioning their decisions. They're changing the strategic decision they want to make with their technology vendors. [Customers] look at their traditional stacks and say, 'Gosh, do I really want to sign up with my traditional load balancing vendor or my traditional supplier to redo what I did four years ago?' People don’t want to get locked into a decision for four years when they need to be flexible.

When we first got started a few years ago, I think the channel partners were a little bit hesitant because they have been working with F5 and Citrix, and things like public cloud and automation and the data center were just starting to kick off. That's changing now.

Can you give us an example of a recent customer win?

We had a very large bank, one of the top four banks in the United States, essentially award us a deal for moving forward with their infrastructure because, after a lot of evaluation, they cited the concern that they needed a more future proof technology. They needed a technology that would work not only in their traditional data center applications but could bridge the gap as they move into public cloud, and as they start building microservices-based architectures. They love that, with us, they can manage applications in containers and VMs in the cloud, but also do their bare metal with very appliance looking use cases. We've seen that with large technology companies that have decided to work with us. We've seen that with retailers that are using us. It's becoming a broad-based movement.

You just signed a reseller agreement with Cisco where Cisco partners can now sell Avi. Why now?

We think now is the time for us to start engaging more with the channel. So this Cisco relationship is a great way to do it by giving us access to all of Cisco's channel partners which is really fantastic leverage for us. When you start working with a company with the caliber like Cisco, it gets the attention of their channels and their customers.

The good news for partners is that we've really doubled down on cloud. So we're seeing a lot of traction across not just AWS, but in Google Cloud, Azure, SoftLayer – we're being used in multiple clouds for our customers.

How can partners leverage your cloud traction with Amazon, Google and Microsoft?

It is a complete integration with these cloud platforms. So it's completely turnkey. We work seamlessly with the native orchestration for AWS and Azure and Google Cloud so that if somebody is running an application on-premise and they're moving it to the cloud, essentially it's a push-button approach. It's the exact same infrastructure.

Why is that great news for the channel?

It's great because when a partner goes in and works with a customer, they can give them assurance that the technology is future proof. It doesn’t matter if the customer is on AWS today and wants to move to Azure tomorrow … it's a fantastic multi-cloud strategy. Most of our channel partners have very consultative relationships with their end users and end customers, it's a great way of positioning the fact that they can help them with transition to the cloud with a multi-cloud and hybrid strategy.

Talk about Avi's licensing model?

Avi licenses are completely transferable. They work everywhere. It doesn't matter whether you're using containers, or Amazon, or Azure, or VMs or bare metal. That's assurance on the commercial side of things, but then architecturally, it's the same product. We've been able to show the customer that they can run their apps anywhere with the same console and spin them up whenever you like. The license model also lets you – let's say you're shrinking your data center down and growing your public cloud presence – it's not an issue with us.

What types of partners are you onboarding and looking for?

We do tend to focus on partners who are working on things like automation. Using technology like Ansible, Puppet and Chef. We focus on partners who are helping customers with understanding containerization – so people who are working with Docker, Mesosphere, Kubernetes and OpenShift. We're also work with partners in the Open Stack area. Also for [VMware] NSX and [Cisco] ACI – so for software-defined networking related initiatives.

Partners who have expertise in these areas that I just mentioned tend to be a better fit for us. They bring some serious value-add to customers and their think next generation data centers and public cloud.

What percentage of your overall revenues are coming from indirect versus direct?

Our channel partner portion for our overall revenues has probably grown by 10X. It's a massive growth. … We are taking more and more of our deals through the channel. In Europe, that number is almost 100 percent, and in the U.S., that proportion is becoming quite significant. When we first started, it was probably 10 percent, but now that number is quite significant.

Why should partners be bullish about Avi? Are you projecting similar large growth over the next 12 months?

Booking growth of 440 percent and customer growth of 270 percent over the last [12 months] – these numbers are just the beginning. These numbers happened without a significant channel and without the Cisco partnership. Now we're working closely with partners like Trace3 and Sovereign Systems – these are channel partners that see the wave coming and want to make sure they partner with the leading vendors of the next wave of data center technology. It's exciting times for us.

We're seeing a lot of traction with some of the biggest companies on the planet. Although we started at the top of the pyramid, it's moving quickly into the mid-enterprise.