6 Blockbuster Security Acquisitions You Could See In 2016

On The Block?

It’s a new year, which inevitably means rumors are abounding as to which security vendors will make it through the year as an independent company. That shouldn’t come as a big surprise, with major vendors looking to stake their claim through a blockbuster acquisition in one of the hottest (if not the hottest) areas of IT going into 2016. As the year gets under way, investors and analysts have already started casting their votes as to which vendors they think will be the target of a blockbuster acquisition. Take a look at some of the speculation as to which companies it could be.

FireEye

The perennial security vendor on the list of companies that might be the target of a blockbuster acquisition is FireEye, and this year is no exception. In 2015, the rumors flew that Milpitas, Calif.-based FireEye had been the target of a $9 billion buyout bid by Cisco, a rumor that former CEO John Chambers promptly denied. In the company’s most recent earnings call in November, FireEye CEO Dave DeWalt avoided questions about whether the security vendor was evaluating a buyout, saying only that he would ’do what’s right for shareholders.’ Now, a report by FBR Managing Director and Senior Analyst Daniel Ives says that FireEye is one of the 10 companies he predicts will get bought in 2016, naming Cisco as a likely acquirer.

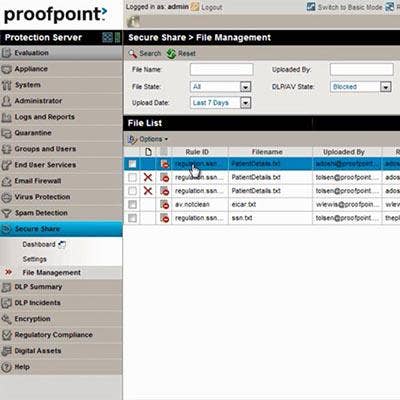

Proofpoint

Rumors of a Proofpoint acquisition have been floating for months, most likely by an acquisition-hungry Symantec. FBR’s Ives reiterated those rumors in his report on the cybersecurity market going into 2016, adding that other big names such as Cisco, Microsoft, Hewlett Packard Enterprise and Oracle also could be in the running for the Sunnyvale, Calif.-based security vendor.

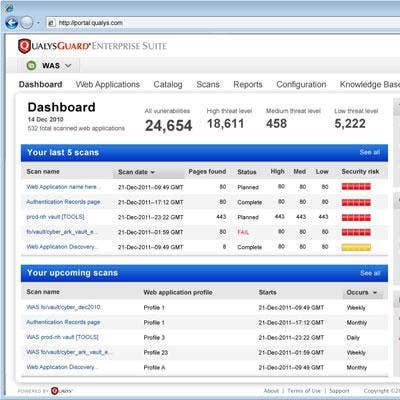

Qualys

Based in Redwood City, Calif., Qualys offers a full portfolio of cloud-based security solutions for the Web and network. The FBR report said Qualys could be another company that is the target of big names such as Cisco, Microsoft, Hewlett Packard Enterprise and Oracle. A company such as Qualys, the report said, could help fill gaps in those larger companies’ portfolios.

Fortinet

Over the past few years, Fortinet, Sunnyvale, Calif., has popped up in the rumor mill as a potential acquisition target, especially around the time Cisco acquired SourceFire in 2013. The FBR report predicted that Fortinet would be one company that would benefit from strong overall growth for next-generation security solutions over the next year, saying the company was ’well-positioned.’ FBR said Fortinet could be one of the top candidates for big vendors looking to invest big in security in 2016, again singling out Cisco, Microsoft, Hewlett Packard Enterprise and Oracle.

CyberArk

A December blog by investor Cesar Bracho said CyberArk could be a strong buy for a larger security vendor, with the Newton, Mass.-based company’s stock rising significantly since its IPO in 2014, with strong cash flow and profitable growth numbers. The FBR report agreed, saying that CyberArk could be exposed to strong growth trends in 2016.The blog said CyberArk’s market cap sat around $1.3 billion, making it more affordable for large tech giants than some of the other companies on this list.

Imperva

Rumors of a possible Imperva sale began to accelerate in 2014 with the appointment of new CEO Anthony Bettencourt, who replaced founder Shlomo Kramer. Bettencourt helped lead the two previous companies at which he was CEO through acquisitions, including the 2014 acquisition of Coverity by Synopsis for $375 million and the 2012 acquisition of Next Page by Proofpoint. FBR listed Imperva, Redwood Shores, Calif., as one of the companies that could be exposed to the benefits of strong demand for cybersecurity in 2016.