Report: Here's Who FireEye Could Be Eyeing For An Acquisition

On The Hunt?

After making two acquisitions earlier this year, a report by financial services company The Cowen Group speculated that FireEye could be on the acquisition trail again. FireEye acquired threat intelligence company iSight Partners in January and security orchestration company Invotas in February. The Cowen report said it expected FireEye could invest in the areas of endpoint security, the Internet of Things, device visibility, cloud and security analytics, and laid out some possible targets for the Milpitas, Calif.-based company. FireEye declined to comment on the report. Take a look at some of possibilities the report said could make sense for FireEye.

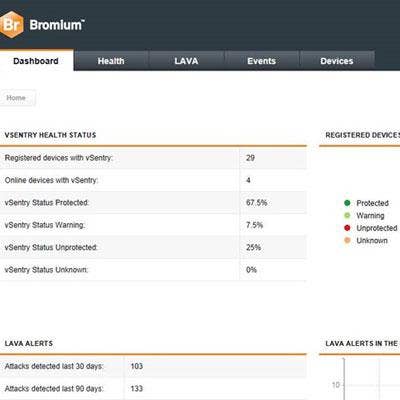

Bromium

Like many big-name security companies in the market, FireEye is investing in expanding its endpoint security portfolio (or HX Series). For that reason, the Cowen report predicted that the security vendor would invest in a next-generation endpoint security player that would integrate well with the HX product line. The report said that Bromium would be a likely target because it is "reasonably priced" and features like threat isolation and analytics "could potentially be infused" with existing offerings.

ForeScout Technologies

ForeScout Technologies and FireEye already have a tight relationship, with former FireEye CEO Dave DeWalt sitting on FireEye's board of directors and a formal partnership unveiled between the two companies earlier this year. ForeScout has been on a rapid growth path, with offerings that link together disparate security solutions for threat intelligence, visibility and automated policy enforcement across a client's network, endpoints and applications. The Cowen report said the company could be an "interesting play" for FireEye, although it noted that "valuation would be the biggest obstacle to the deal," with the startup valued at more than $1 billion.

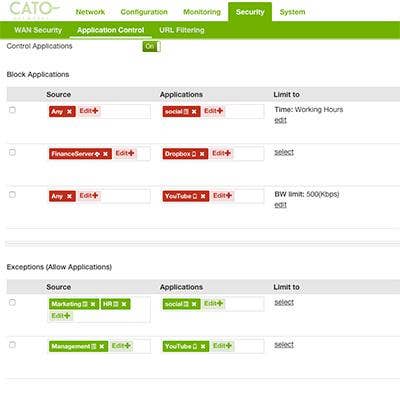

Cato Networks

If FireEye were to invest in the firewall market, the Cowen report said Cato Networks could be a likely target. The Tel Aviv-based startup, founded by respected security investor Shlomo Kramer, launched into the market in February with a Network Security-as-a-Service platform that uses the cloud to consolidate WAN and Internet traffic and layer enterprise-grade security solutions -- such as a next-generation firewall -- on top. While this type of acquisition is less likely, the report said Cato Networks "could potentially have appeal should [FireEye] want to extend its presence [in the firewall market], including to branch offices and mobile users."

Securonix

Securonix is all about transforming security data into intelligence, using security analytics and its real-time detection and response platform. Based in Los Angeles, the company offers threat intelligence to bolster a company's SIEM, privileged account monitoring and user behavior analytics, among other things. The Cowen report said Securonix could be a "possibility" for FireEye given its "wide range of solutions" around threat detection, access and breach analysis. However, the report did note that FireEye's own Threat Analytics Platform has seen slower traction.

What About The Other Way Around?

Cowen report aside, rumors have again emerged that FireEye could be the target of a buyout bid itself. In mid-June, Bloomberg reported that the security vendor had fielded multiple offers, turning down at least two that were below the price range it was looking for. Citing unnamed sources, the report said those bidders included Symantec, which ultimately said last month that it intended to acquire Blue Coat Systems for $4.65 billion. The rumors aren't new for the company, which has seen a drastically dropping stock price over the past year and general turmoil around executive shifts and a lack of profitability.