10 Storage Predictions For 2009

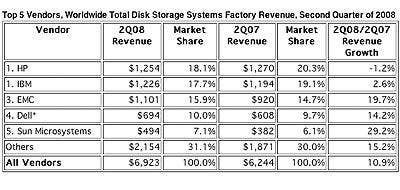

Even when business shrinks, customers collect and store data. Storage vendor product sales so far seem to be holding up despite the overall drop in IT spending caused by a very noticeable decline in customer spending and in IT budgets, but all bets are off for next year. EMC, for instance, expects its fourth quarter sales to be noticeably higher than last year's, but NetApp's forecast is more cloudy. IBM's third-quarter storage sales fell, while HP's rose. However, the mix is changing.

Midrange storage systems sales at companies like HP and EMC are rising faster than sales of vendors' large flagship arrays as customers look for ways to cut costs and vendors bring more enterprise-class features into their midrange products. And that's great news for the channel in 2009, as solution providers are much more likely to be involved in the sales of midrange storage products, both from the major vendors and from alternative vendors.

When the sales of "other" storage vendors, and when those of Sun Microsystems, rise considerably faster than those of most of the established top vendors, the logical conclusion is that customers are looking for alternative storage solutions. And that should mean more opportunities for solution providers to go in and compete against the established vendor in an account.

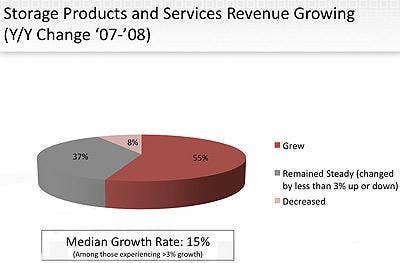

Customers need smarter ways to utilize their existing storage equipment, and are depending more and more on solution providers. Most storage solution providers say their late-2008 business is doing well, and expect that to continue as customers cut in-house IT skills. And while the 2009 picture is cloudy, most VARs are cautiously optimistic.

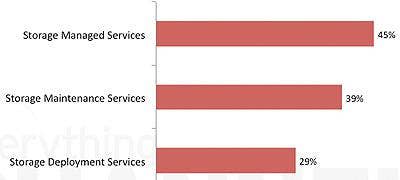

Services will continue to grow as a part of storage solution providers' business. According to our 2008 State of Technology: Storage survey, managed services are already being offered by 45 percent of storage solution providers, with considerable numbers of them also offering maintenance and deployment services, trends that will continue to grow in 2009.

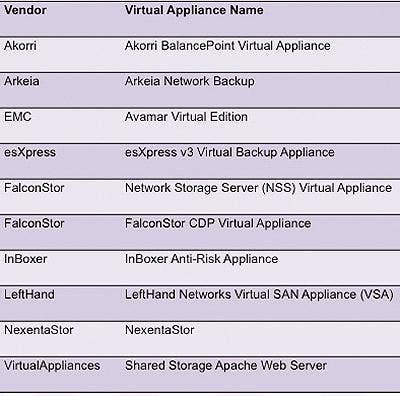

The quickening pace of moving from physical servers to virtual servers will help customers cut capital expenses by cutting server purchases. But it will be a boon to storage solution providers, who in 2009 will use it to virtualize or improve their disaster recovery, data replication and backup/recovery business, and to build more virtual storage appliances.

Of the various types of storage services solution providers offer, helping customers store data online will be huge in 2009. Customers have been trying online storage for backup, archiving and file sharing, and are liking it. Solution providers will make online storage services, either by offering their own solutions or working with third-party service providers, an even more important part of their business in 2009.

As the online storage-as-a-service continues to grow, what other hardware can go online? Servers? Virtualization makes it possible. Desktops? Already being done. This starts to sound a bit like cloud computing. The difference in 2009, however, is that a very real cloud computing infrastructure is being laid down, with storage vendors and solution providers taking the lead.

Vendors heavily into tape are being propped up by OEM contracts, while tier-two and tier-three disk vendors without a strong channel strategy or product differentiation will find it hard to rise above the crowd. This, combined with a mixed environment for hardware purchases, foretells an uptick in storage vendor closures or acquisitions in 2009.

Customers will delay purchases in 2009 more than ever before, and will demand immediate returns on their investments once the contracts are signed. Solution providers who focus on storage will benefit most of all, as they can use new technologies and services like virtualization, thin provisioning, and deduplication to give customers a fast ROI on improving their storage infrastructure with little or no new hardware purchases.