Affinity Index: Server/Application Virtualization

VMware is by far the market leader for server virtualization, with competitors Microsoft and Citrix far behind. But when one expands the market to include application virtualization, the race gets much closer for two reasons: VMware has little application virtualization business, while Microsoft and especially Citrix do.

As a result, VMware scores the highest in terms of overall solution provider affinity in the SMB market while its competitors are closing more virtualization deals, according to a survey by the Institute for Partner Education & Development (IPED).

The Channel Affinity Index rankings could change in the future as the three jockey for position, with VMware looking more at the application virtualization side and Microsoft and Citrix looking to gain on the server virtualization side.

The following slides illustrate some results in the server/application virtualization category. ChannelWeb is providing further findings in other product categories throughout December.

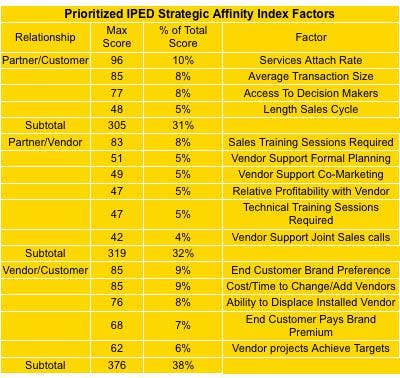

In the Channel Affinity Index, VARs scored vendors in 15 different factors, which the respondents also weighed according to importance. In server/application virtualization, services attach rate is the most important factor determining their choice of vendor, accounting for 10 percent of the total score. That most likely stems from the amount of services required to implement virtual solutions of any type.

Nearly as important are end-customer brand awareness and the difficulties related to adding or changing vendors, both of which were cited by 9 percent of solution providers as top keys to determine affinity.

It appears, however, that solution providers are willing to do virtualization implementations on their own; vendor support joint sales calls accounted for only 4 percent of the total score, the lowest of the 15 factors.

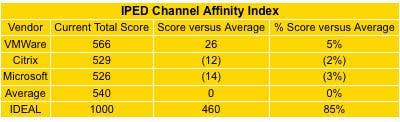

VMware dominates the server virtualization market, while Citrix and Microsoft dominate the application virtualization and are building their server virtualization market. This comes through in the Channel Affinity Index with fairly close scores among the three vendors.

VMware has the strongest channel affinity, according to the survey, suggesting that its dominance in server virtualization draws it the kind of loyalty and brand recognition that comes with its market share. Solution providers may also find VMware is the server virtualization base for building infrastructures on which other types of virtualization can be built.

VMware has continued to grow its server virtualization business in the face of stiffening competition from Microsoft and Citrix. Its momentum continues to carry it forward to provide a platform on which solution providers can provide a variety of services to customers.

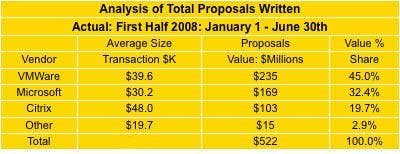

Therefore, despite its position in terms of application virtualization, VMware still generated the lion's share of server and application virtualization proposals, about 45 percent in the first half of 2008 compared to 32 percent for Microsoft and 20 percent for Citrix.

That Citrix compares so well to Microsoft also suggests that its strategy of combining its legacy application virtualization business with its acquisition of its XenServer technology is attractive to the channel.

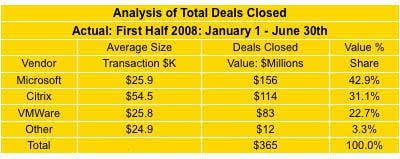

Solution providers have found enough in Microsoft's and Citrix's offerings to be able to close more deals for server and application virtualization than they do with VMware.

Microsoft managed to close nearly 43 percent of the channel deals for server and application virtualization during the first half of 2008, followed by Citrix at 31 percent and VMware at nearly 23 percent.

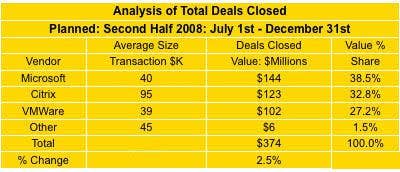

Microsoft, Citrix and VMware will maintain their competitive positions in terms of planned deals closed in the second half of 2008, according to solution providers surveyed by IPED. However, Citrix and VMware will grab market share from Microsoft, solution providers responded.

It is no surprise that Citrix and Microsoft came out so strong in the survey despite VMware's server virtualization market share, said Dave Spear, vice president of sustainability at Istonish, a Denver-based solution provider.

"It would sound fishy if the survey results were based on server virtualization only," Spear said. "But if you talk server and application virtualization, then Microsoft and Citrix will come out on top."

Citrix has had application virtualization technology almost since its founding, and its XenServer server virtualization technology has been catching up to that of VMware, Spear said.

Meanwhile, Microsoft is trying to leverage its Hyper-V server virtualization technology, but still has a lot of work to do to catch up with VMware. "Hyper-V is still complex," Spear said. "But it's free. And in the meantime, VMware is trying to develop applications, but it still has a lot of work to do."