A Most Interesting IT Experiment: The History (So Far) Of VCE

VCE: Short History Of A Big IT Experiment

What a long, strange trip it's been for VCE, the joint-venture developer of Vblock converged infrastructure solutions set up by VMware, Cisco and EMC.

Set up originally in June of 2009 as a way to build reference architectures based on the three partners' storage, server, networking, and virtualization technologies, it eventually morphed into an independent builder of integrated solutions which are shipped to customers only after being fully bundled and tested in VCE's own facilities. VCE is already experiencing a billion-dollar annual run rate.

Take a trip back in time to look at how VCE got its start long before it was officially formed.

For a closer look at VCE's future prospects, see a preview of our exclusive report, "The VCE Gamble: You Got To Know When To Hold 'Em, Know When To Fold 'Em." The full article is available exclusively in the CRN Tech News app.

{C}

December, 2003: EMC Acquires VMware

To understand VCE, it is necessary to go back to the days before it was founded.

The seeds of VCE were planted in December of 2003 when EMC announced the $635 million acquisition of VMware, which at the time was focused on virtualizing servers. Cloud computing was still a thing of mystery for most businesses.

That acquisition was widely criticized at the time for diluting the focus of EMC, which was, and still is, the largest storage vendor which is not part of a server vendor. However, EMC continues to get the last laugh. VMware, which is still well over 80-percent owned by EMC, generated $1.1 billion in revenue and $192 million in earnings in its recent fiscal second quarter.

July, 2007: Cisco And Intel Invest In VMware

Intel in July, 2007 invested $218.5 million in VMware to acquire a 2.5-percent share in that company. That news was followed a couple weeks later with word that Cisco invested $150 million for a 1.6-percent stake in VMware.

The foundation of VCE was in place with EMC, Cisco and Intel now all owners of VMware.

September, 2008: VMware Talks Cloud Computing

VMware was, and is, the leading developer of server virtualization technology. But in September, 2008, then-President and CEO Paul Maritz shifted VMware's primary focus to cloud computing for the first time with the unveiling of a partner ecosystem that included multiple server, storage, networking, security and services partners.

March, 2009: Cisco Introduces UCS Server Line

Cisco, historically one of the biggest networking vendors in the industry, stunned the IT world by unveiling the Cisco Unified Computing System (UCS) blade server line. Cisco said its UCS servers were designed primarily to optimize the performance of VMware environments.

Despite attempts by other more established server vendors to dismiss the potential competitiveness of the upstart, Cisco's UCS servers are currently integrated in the converged infrastructure offerings of storage vendors EMC, NetApp and Hitachi Data Systems.

June, 2009: V+C+E, Not Quite Yet VCE

The last block fell in place in building the VCE foundation when VMware, Cisco and EMC held a joint press event at EMC World 2009 to unveil a partnership between the three companies and how they would develop cloud computing platforms.

This wasn't VCE yet. It was originally called the VMware-Cisco-EMC alliance. Later, it would be called VCE, which was short for "Virtual Computing Environment." Eventually, it was just VCE.

Pictured: Chuck Hollis (left), EMC's vice president and CTO of global marketing; Ed Bugnion (center), Cisco CTO; and Parag Patal, VMware's vice president of alliances

November, 2009: Vblock Solutions First Announced, But Not VCE Yet

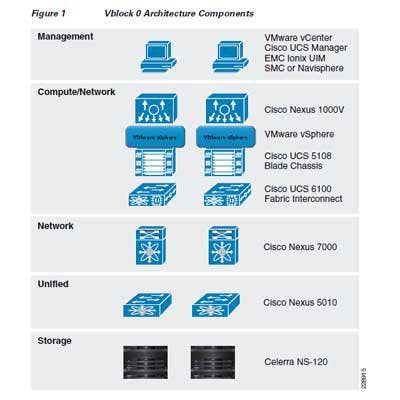

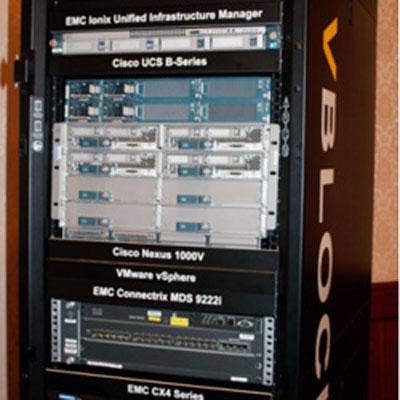

Cisco, EMC and VMware in November, 2009 introduced Vblock, a series of preconfigured, pretested solutions based on Cisco UCS servers and its networking switches, EMC's Symmetrix or Clariion storage arrays, and VMware's vSphere server virtualization platform.

The Vblock solutions, which were aimed at helping customers build virtual data centers and private computing clouds, were not yet actual products. That would come later. Instead, Vblock was more of a reference architecture for building such solutions.

EMC and Cisco at this time also introduced a soon-to-be-launched joint venture called Acadia. Acadia, which also featured investment from VMware and Intel, was slated to be a separate legal entity that would ensure the Vblock Infrastructure Packages are built in a standardized and repeatable fashion for customer data centers.

Sounds a lot like VCE, right?

January, 2010: Cisco Signs With NetApp

Cisco wanted to prove that, despite its close relationship with EMC, it was an independent server vendor, and did so in a spectacular fashion by unveiling a relationship with NetApp, EMC's top storage rival.

This new Cisco/NetApp relationship, which also included VMware, promised to deliver new architectures based on their technologies for data center efficiency with a joint customer support framework.

Cisco in late 2012 signed a similar relationship with EMC rival Hitachi Data Systems.

April, 2010: Vblock Channel Expansion Plans

VMware, Cisco and EMC, whose relationship by this time was called the VCE Coalition, in April of 2010, detailed for the first time their channel plans for sales of the three different Vblock infrastructure solutions then available.

May, 2010: VCE Coalition, Acadia Gets A Big-name Exec:

Former Hewlett-Packard President and Compaq CEO Michael Capellas was tapped in May, 2010, to lead Acadia, the Cisco-EMC joint cloud computing effort.

As CEO of Acadia, Capellas was charged with building up the VCE Coalition's presence in the channel through Acadia, which at the time was seen as a potential challenge in light of Capellas' lackluster reputation with the channel based on his role as the former CEO of Compaq, a position he held from 1999 until Compaq was sold to HP in 2002.

March, 2011: Long-Term EMC Exec Appointed VCE President

Frank Hauck, EMC executive vice president and a member of the EMC Executive Office of the Chairman, became VCE's first president in March, 2011. A 20-year EMC veteran, Hauck reports to Michael Capellas, chairman and CEO of VCE.

As president of VCE, Hauck focuses on such areas as customer service, new product delivery and adoption of new technologies.

Hauck's move to VCE was a significant step in the growth and future development of VCE, which had 800 employees at the time, up from about 80 employees only two years earlier.

April, 2011: VCE Finally Unifies Channel Program

Despite the fact that VCE's Vblock systems by 2011 were sold to customers as a packaged solution, solution providers were still dealing with placing separate orders with VMware, Cisco and EMC, as well as dealing with their separate channel programs and discount programs.

That changed in April, 2011, when VCE said that all orders from solution providers, including those received via distributors, will go through VCE, which is providing the solutions with VCE part numbers and warranties.

VCE also unified its deal registration process and discount structure so that partners could deal with just one vendor, and introduced its first MDF (market develop fund) program aimed at helping fund partners' demand generation activities.

However, the three parent vendors continued to offer extra discounts above what was offered by VCE as a whole.

February, 2012: Bringing VCE and Vblocks Down-market

By early 2012, rumors were circulating in the channel that VCE might bring the integration of Vblocks, which had been done in the company's own facilities, to the distribution level. Solution providers were also getting excited about the possibility that VCE might soon introduce new lower-end models of the Vblock.

As is often the case, the rumors were half right.

EMC, Cisco and VMware, rather than farming out the integration of Vblocks to the distributors, had a more interesting strategy in mind. More about that in a minute.

And those lower-end Vblocks? We'll get to that in a bit.

April, 2012: EMC, Cisco, And VMware Unveil VSPEX Reference Architecture

Rather than go lower-end with Vblocks and farm out assembly to their distributors, EMC, Cisco and VMware instead released a series of reference architectures called VSPEX, showing how solution providers could build integrated solutions.

VSPEX sort of brings VCE full circle to Day One. When the VCE Coalition was first founded, it targeted the release of reference architectures, but instead changed its business plan to a focus on selling only completely integrated Vblocks. Now the partners are taking their Vblock experience as a starting point for offering VSPEX reference architectures featuring the same components found in the Vblocks.

So, instead of VCE, partners can now choose "V+C+E."

The vendors eventually signed distributors to provide VSPEX assembly services for solution providers who requested them.

May, 2012: Higher-end, Lower-end Vblocks Introduced

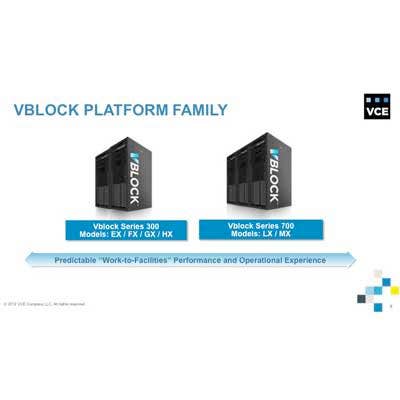

New to the VCE lineup as of May, 2012, is the Vblock Series 700 Model LX system, which is based on the entry-level VMAX 10K model of EMC's enterprise-class storage array. It supports applications running over 2,000 simultaneous virtual machines.

EMC also said that a new version of its entry-level VNXe storage array family would soon be the base for a new class of entry-level Vblocks.

VCE also started including EMC data protection technologies to give Vblocks backup, recovery, replication, business continuity and data mobility for virtualized environments. Applications include Avamar virtual server backup software, Data Domain backup and recovery software and RecoverPoint replication software.

July, 2012: Cisco Finally Gets A Top Exec Role In VCE

Since EMC is by far the majority investor in VCE, it has gotten the lion's share of the executive positions in the joint venture.

That changed in July, 2012, when Praveen Akkiraju, a 19-year veteran of Cisco and most recently Cisco's senior vice president and general manager, Services Routing Technology Group, took the CEO position along with a seat on the board at VCE.

Akkiraju's hire was significant in that it marked the first instance of a major Cisco executive joining a company management team heavily dominated by former EMC executives.