Q&A: EMC's Chris Riley Talks Sales Strategy And Future In Face Of Looming Acquisition By Dell

Managing EMC's Channels In The Days Before Being Acquired By Dell

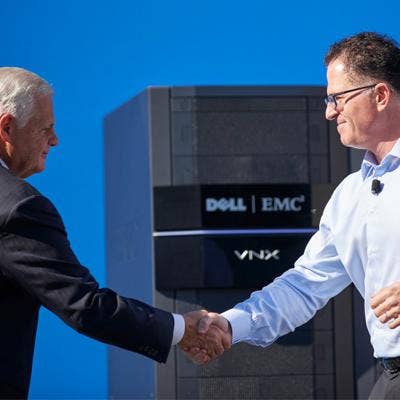

The biggest topic of conversation at the recently concluded EMC World and EMC Global Partner Summit was the upcoming acquisition of EMC by Dell, which is expected to close in the coming months. But while EMC Chairman Joe Tucci and Dell Chairman Michael Dell talked about the merger onstage, nearly all EMC and Dell people are precluded by SEC regulations from discussing the merger until it closes, as the two companies are still technically competitors.

Understanding what the troops in the field will see from the coming merger is an exercise in reading between the lines. CRN's meeting during EMC World with Chris Riley, senior vice president of U.S. enterprise sales for channel, partners and alliances, was no exception. Riley was as open as he could be, given the rules under which he plays, as he laid out EMC's sales and channel situation and strategy going forward.

For insight about how EMC is getting ready for the acquisition, turn the page.

Have you started talking to your Dell counterpart yet?

No, we can't do that.

I noticed that [EMC Senior Vice President of Global Alliances] Jay Snyder said at EMC World that he'd been talking to some of the sales people. …

Right. As part of some of the integration work on alliance partners.

Have you thought at all about some of the differences and some of the things that may change going forward as the acquisition closes?

Day 1 of close, nothing's going to change. We'll have our program. Dell will have its program. In the beginning of 2017 is when we'll announce the combined one channel program that Dell EMC will operate under.

What are some of the differences between the two programs? You've been competing against them for a long time, right?

A little bit, yeah. At times. They tend to operate more in the midmarket and [small and midsize business] space. What I would say, if you erased the logo off of both companies' channel programs, they are actually very similar.

Really?

Yeah. Very, very similar.

Marginally different?

Marginally. The emphasis we put on emerging products and growth areas in the business and some of the partner rebates and [market development funds] programs. So very similar.

What was EMC's key message at the Global Partner Summit?

I think it's a little bit more clarity that nothing's going to change for the remainder of 2016 and the first month of 2017.

No program changes at all, then?

No program changes.

Is that a result of a decision made before the acquisition was announced, or did you decide no changes because of ...

What we have today is working at EMC, and what Dell has today is working.

The reason I ask is because you used to have big channel partner updates every year, but it's pretty quiet this year.

We think we have a great channel program. Our channel revenue is up in all segments. Dell's channel growth, I'll let them speak to that. It's something to be very proud of. Our Net Promoter scores with all our channel partners [are up]. I think the portfolio for flash, for data protection, for emerging technologies, software-defined, has never been stronger. And converged infrastructure, it's just a rocket ship in terms of growth. [We're] coming out with hyper-converged. Our pipeline is big, and 90 percent of [our hyper-converged] is going through the channel.

As the growth of flash continues, do you expect a quickening of the movement away from traditional storage solutions?

I'd say first, our focus with customers is around the modern data center. There's certain attributes that a modern data center has. First of all, flash. 2016 for us is the year of all-flash. It's scale-out. We're the only company that has all-flash scale-out platforms across all sectors. Cloud-enabled, the ability to move from edge to core to cloud seamlessly with software. And then software-defined. For us, the enablement of our channel partners around the modern data center has been where our focus is on.

Do you see your partners actually moving in that direction or do you still have a lot that have been mired in more traditional data center infrastructures?

I think they're doing a wonderful job. They bring so many more components outside of just infrastructure to the table. It might be applications. It might be strategic consulting. They're able to put a much larger wrapper around outcome for customers. Our strength is in leading with converged, and then moving through the portfolio to help deliver a technical solution to customers.

How has leading with converged infrastructure changed over the last year?

We have VCE Vblocks, which is arguably the market share leader by a long shot. Then we've introduced VxRacks and appliances. The appliances are hyper-converged, and today that business is exploding. Customers are adopting it, and they're adopting it through our channel partner community. The route to market for appliances is largely going to be through the channels, all sectors.

What about reference architectures? I'm not hearing much about that anywhere.

You do a reference architecture if you don't have an engineered system. Our competitors do a reference architecture because they don't have a division like VCE that's putting it all together.

Is VSPEX still a part of your business?

Well, the next evolution of that was, and is, the appliances, so that's VxRail. It's based on compute and capacity with VSAN in a hyper-converged footprint.

OK, so going forward, then, we will hear less about VSPEX and more about the converged appliances. …

Yes, converged and hyper-converged. And all of our products fit into converged and hyper-converged footprint [including] VMAX, XtremIO, Unity and obviously the direct-attached with software-enabled ScaleIO.

W ith the introduction of EMC Unity, are VNX and VNXe approaching end of life?

No, at the high end, they will still be there, but Unity will try and come in on the low end to mid part of the VNX portfolio.

OK, so going forward, there'll still be a VNX line, then.

At the high end.

Is it correct then to say that EMC Unityis the new low end for EMC?

Yes. Largely it will be delivered through converged.

So less in terms of stand-alone EMC Unity sales, more in terms of converged offerings?

Yeah. The way I'd look at it is, if you come from the bottom up, it’s about product. If you come from the top down, it’s about solutions and customer outcomes. We're focused on, what is the customer trying to achieve? And time to value is going to be key for converged. Now, do they still have some environments where they have a mixture of compute and capacity and they're putting it together? Absolutely. That would be more of the product sell.

But what we see from our customers is [a need to solve] the customer challenge. They're trying to remove the complexity and improve the time to value, speed to market, agility, uptime, availability, provisioning, converged, hyper-converged.

How does the emphasis on software-defined fit in there?

If you're solving for the customer, there's an edge, there's core, and then there's cloud. In some of those environments, at the edge, you would take Data Domain Virtual Edition, and put that on a hyper-converged platform and back up into the core, and then burst it through DD [Data Domain] Boost into the cloud. You would look at what's the right workflow and the right availability and cost profile and where does that data sit? Is it active, is it cold, is it archived?

How does that compare to, let's say, an [Amazon Web Services] strategy?

Again, when we can take our software technology and move it to all those locations, AWS or any of the mega cloud providers could be a target for archived backup. But when you do that, in the example of backup, for which we have compressed and deduped data, along with copy data management and the ability to use policy to take you from 10 copies to three, you'll get that data more efficient. Then move it into an EMC cloud that has all that software.

Move [that data] into AWS, and you have to hydrate it, so you lose all the benefits of dedupe and compression. And the cost of the public cloud is in the egress and the bandwidth [of the data]. So it gets very costly to get data in and out of a public cloud, if it's not software-enabled. Software is a big part of our modern data center strategy.

When will the Virtustream Storage Cloud and the new software-defined storage solutions EMC is talking about be available to the public?

They're available immediately. Directed availability was about three weeks ago. … We've already been speaking with the customers, we already have a pipeline. Customers are already preparing to move some of that archived data, or the appropriate data, into the Virtustream Storage Cloud.

How much of that business will be partner-driven?

Today, well over 60 percent of our business goes through the channels, so 60 percent of that architecture, edge or cloud, will be architected and delivered through our channel ecosystems.

CRN recently reported in one story that Dell partners are willing to sign with EMC, but in another story found that EMC partners are less willing to sign with Dell…

I work with all of our channel partners across the enterprise. I'd say that 95 percent of the partners are absolutely picking up Dell, or already have. CDW, WWT [Worldwide Technologies] -- I mean these are half-a-billion or billion-dollar-plus partners, they are jumping in both feet forward.

CDW had a big Dell relationship before …

No, not a big Dell relationship before. … I mean, they announced it, I believe it was in October, November. You can probably go back and take a look.

Then WWT, which was a large Cisco, large HP partner, [just] started aggressively working with Dell, because they're a very, very large EMC storage partner.

So how does the distribution change after the acquisition closes? Dell has a big partnership with Ingram Micro, but the partnership between EMC and Ingram Micro endedlast year. With all the new solutions coming out, the focus on edge to core to cloud, how will that impact distribution?

I think I'd try and couple distribution with market segmentation. If you look at Arrow and Avnet, as an example, they focus more on the enterprise, where Tech Data and Ingram Micro would [handle] some enterprise business along with midmarket as well as inventory and inventory management. We're going to [work] very closely with [Dell Chief Commercial Officer and Enterprise Solutions President] Marius Hass and the Dell commercial go-to-market motion. And you'll continue to see Avnet, Arrow and Tech work with EMC in the high end of the market.

Going forward, then, on the distribution side, there will still probably be some bifurcation of the market?

I think all that will be rationalized. But in that volume business, you want to partner with the leaders in volume and channel distribution, and those are Tech and Ingram. I wouldn't see a change in status here, in either go-to-market enterprise and/or commercial.

A ssuming everything goes according to plan …

Yeah, and it is. It’s going to be very, very healthy for our customers. If you look at what are the most important attributes to success, first and foremost it would be, do our customers see a benefit to the combined companies? Do our people and do our partners see value in the combined company? I think that would give you the voice of the field and the voice of the workforce. Then, are we able to innovate, to bring a pipeline of innovative solutions across the board -- from the consumer portfolio to the data center products to the cloud and security -- to market?

The announcements we made [at EMC World] in our pipeline and innovation have been off the charts. In two weeks, you'll see Dell's [announcements], and that's going to be off the charts. Together, we're going to be able to help customers really move to the modern data center architecture.