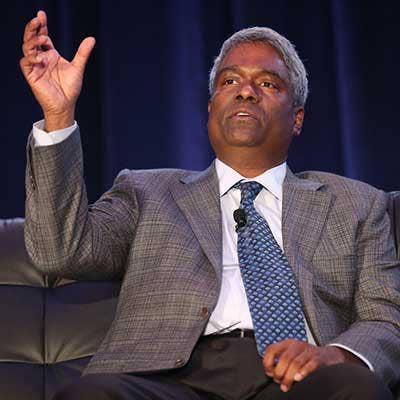

BoB Conference Exclusive: NetApp's George Kurian On The Pitfalls of Dell EMC, Flawed Hyper-Converged Technology And How His Mom Was A Decade Ahead Of Her Time

Kurian On Record

There's a major transformation underway in the storage industry, with the cloud, hyper-converged infrastructure and other factors driving major industry shifts.

While some companies, like Dell and EMC, are looking to consolidate, NetApp CEO George Kurian said the Sunnyvale, Calif.-based storage vendor is positioned to win as an independent company, with a focused strategy that makes calculated decisions to drive leading technology and partnerships in the market.

In a keynote interview with The Channel Company CEO Robert Faletra at the 2016 Best of Breed Conference in Atlanta, Kurian talked about the Dell-EMC deal, why hyper-converged is overrated, the future of the cloud, the upcoming presidential election and much more. Here are edited excerpts of the conversation.

You've been CEO now for 16 months. You've got an engineering background, but now you're a CEO so you've got to think a little differently. What do you want to see from the channel?

Strategy is defined as much by what you don't do as what you do. As a core part of the strategy, we feel that the scale and size that we are, we need to be the world's best at doing a few things, which requires us to partner with the world's best at doing all of the other complementary things. We offer a set of capabilities to customers. Those capabilities are typically consumed as part of broader solutions. There are complementary skills, there's knowledge and intimacy with the customer, there's reach from multiplying our go-to-market capabilities with yours, so there are lots of distinctive areas where the channel has an extremely important and enduring role going forward.

In the wake of the Dell/EMC merger, can you survive as an independent storage company or do you need to meld this together in some other way to compete with the HPEs and the Dells and even the Ciscos?

First of all, we think we are the first of the data management companies for the era of hybrid IT. All of these combinations or separations happening in the IT industry are focused on building siloed environments for the enterprise data center, and what customers really want is to bridge the world of enterprise IT with the world of cloud IT. We started that journey four years ago, well before these transactions were created, building a solutions set called DataFabric, and it's focused on enabling world-class data management, spanning your on-premises data center with the public cloud. We've got hundreds of customers using that together with our technology together with the world's leading hyperscalers, and I think VMware's solution being deployed on Amazon [Web Services] is essentially an endorsement of our view, albeit four years after we started. We think that integration happens as much up the stack as it happens across on- and off-prem. The second thing is that i think there is a role for partnerships -- an enduring role for partnerships.

Is it more difficult for you to compete now that Dell can reward partners for building more of its technology into their solutions?

I think that's looking at the industry one way. There's certainly value that we bring to the channel by allowing them to lead certain types of transactions, build more complex solutions -- better solutions -- with our technology, as well as to create the ability to do services businesses that are profitable on top of our platform. Very simply, we're taking share from EMC today. We're the fastest-growing SAN vendor in the market; we're the fastest-growing all-flash array vendor in the market, and, despite their reach, we've got better solutions. That's allowing us to grow faster.

So you think it was a mistake for Dell to buy them?

You know, I wish Michael [Dell, CEO of Dell Technologies,] well. The history of large, complex technology integrations and mergers is not good. You know, at a time when the industry changes very quickly, you tend to focus internally as opposed to externally. If you go back through the literature, vertical integration was something that was talked about at length in the '90s. In the '90s, it was supposed to be three companies serving all of the needs of enterprise IT: Microsoft -- which was supposed to buy SAP -- Oracle and IBM. And look at the world of enterprise IT today. It's far more diverse than that. The range of innovations, solutions and disruptive business models are [a lot] different.

Can you talk about DataFabric and why it's a competitive advantage, particularly from the solution provider perspective?

It is the single best investment protection argument that you could make to a CIO of any institution. ... CIOs and institutions are sitting there saying, "Hey, should I buy equipment on-prem? Should I decide to move my workloads to the cloud? What portfolio of my workload should I move to the cloud?" And there's a lot of analysis and stall in terms of those decisions. What we are able to tell the customer is that every investment they make with NetApp technology is guaranteed 100 percent portable to any of the public clouds. You can buy our solutions today, you can train your team to learn our technology, and we will be giving you a road map to all of the hyper-scalers as well as all of our cloud service provider partners. And we are doing that for the most complex piece of technology that they have: their data.

How does that impact the way NetApp positions itself?

It positions us uniquely and with differentiation from both the startups, who don't have the resources to build hybrid IT, and the vertical stack providers, who say the world begins and ends on-prem. So in transaction after transaction, we are able to give customers the confidence to make decisions today with our technology in a way that nobody else can. This isn't something you can turn around and whip out in a couple of years. We've been working on this for four years, co-developing it with the hyper-scalers, so it gives us a unique position in the industry.

There are a lot of forces at work in the storage market now. Will it get back to high growth or consolidate down and we'll just see incremental growth?

First of all, there are shifts happening in the storage market under the top-line heading of, "The Market's Flat." Just like all of IT is relatively slow-growth and there are shifts with some segments growing a lot faster. Even in the storage business there are some segments that are growing a lot faster. Scale-out storage, where we are the market leader, is certainly the de facto design principle for customers going forward. Solid state is a core part of storage platforms. We are No. 2 and growing three-and-a-half times the market, so we are clearly seeing that getting adopted in volume. We are seeing the use of storage as software -- stand-alone software. We made our flagship operating system Data ONTAP -- the industry's No. 1 -- and SolidFire -- the best platform for Web-scale data centers -- available as software so that you can build these composable landscapes that combine on-prem with public environments. So there's a shift going on.

You're pivoting to focus on data management. How will that help you grab market share?

I think data growth continues unabated, so at some point all of these technologies will start to get reflected in how people are going to use them for business advantage. Data is essentially the heart of the digital transformation that many people talk about. You can't do transformation if you don't use data, and so we feel that having a focus on data management gives us a unique place at the table. I think how storage is delivered as far as business solutions has certainly evolved. IT decisions are increasingly made in a lot of disparate environments, and that's where the channel has a really important role to play. You all put together really creative solutions combining our technology with data analytics solutions and cybersecurity solutions, and offer really good business value to the customers. I think that's a really important role, and a really strategic role, for you to play alongside us.

You don't have a hyper-converged solution. Is that something you will need at some point?

I grew up in India where everything takes 3,000 years of history and I live in California where everything is supposed to replace the latest buzzword that went before it. We have attention deficit disorder. When I think about hyper-converged, hyper-converged has a place in the world. We always look at those technology trend and ask what the benefit and value proposition it has for customers. In the case of hyper-converged, it is quick time to value and an easy button. It's pretty simple. It does not replace converged systems by any means, and anyone who is telling you that Amazon designed their data center on hyper-converged infrastructure is simply misrepresenting the facts. There is a place for hyper-converged and it is typically in smaller or departmental environments and its used where you don't have specialized knowledge…Gen 1 of any technology is always flawed in some way. I think many of the hyper-converged solutions today are flawed. They are essentially trying to replace direct attach storage with the term called hyper-converged and there are limitations in direct attach storage and there are limitations in hyper-converged storage.

When you say hyper-converged solutions are flawed, who are you talking about? Simplivity? Nutanix?

All of the players in the market today. They all have the same challenge, which is when you share a compute processor with compute cores and storage, you have all of the challenges that direct attach storage has. We know that from talking to customers. What we are focused on is to give our channel partners and customers a solution that will give the benefits our customers want, which is rapid time to value and speed to market. We innovated in FlexPod, with FlexPod Automation, so you can get accelerated benefits and time to value from a deployment standpoint. For customers that don’t have specialized expertise, SolidFire is the compelling alternative to hyper-converged solutions. We are focused on this space, so you will hear more innovations from us to come. Stay tuned.

When you got to NetApp, you talked quite a bit about needing to transform the business. Can you talk about what that means and what you learned that might be applied to people here trying to transform their businesses?

We used the word "transformation" to first underscore the fact for both internal and external audiences that we were not trying to take on incremental change, but fundamental change. The reason to take on fundamental change is that the world is changing around you, and perhaps we didn't take it on as early and as aggressively as we needed to. We've changed ourselves in multiple ways. The first in the portfolio innovation that we've brought to market. I think you can see several examples where we shifted the portfolio from the old world to the new world and have seen spectacular success. We also in the first year of my tenure made the largest acquisition in our company's history around a technology called SolidFire that allows enterprises to build data centers that look like Google and Amazon data centers for themselves.

What other changes did you make?

We improved the way we deliver those capabilities to customers. This is around refining our focus from a go-to-market perspective so that we're clear about where the channel can play and lead and where NetApp will focus its resources, about bringing advanced marketing tools so that we can enable the go-to-market teams with digital experiences and also to engage the new decision-makers that make decisions on data management platforms. It's about using the supply chain effectively so that we are now accelerating the pace of innovation from enterprise speed to cloud speed. You can see our new hardware platforms are shipping on a cadence of once every nine months. It used to be once every 33 months when I joined NetApp, and changing the fundamental way we engineer core business processes for the company so that we're a lot more efficient. And then finally I think the third aspect of it is many CEOs talk about innovation and transformation, but I think an important -- perhaps the most important -- aspect of transformation is to take on the hardest part of it, which is transforming yourself.

What does "transforming yourself" involve?

In times of change it is important for the leadership of the company to be brutally honest about, "Are we the right leadership team to take the company forward, so we've changed five of the top nine executives of the company, bringing in new experience, perspective, the ability to see new opportunity where one team sees barrier, the ability to see the need to move faster where one team sees risk. Those are the fundamental elements. We've got a new NetApp, and we're seeing the results of it. There's still a substantial amount of work to do but we are differentiated in the market, we're seeing success with the new portfolio, and we're leading into the changes the industry wants us to make.

Changing culture is generally the hardest change to make inside a company. How did you make that happen?

Cultural change is a work in process. When I think about culture, I think about the fact that there are values and habits of behaviors, and those two together among other things form the essence of culture. NetApp was always recognized as a great place to work, as a place that has high integrity and is a good team to work with and work for. I think where we lost the plot a little bit was around our habits and behaviors. I think the core of that was that we focused too much on being a great place to work as opposed to what made us a great place to work in the first place. The reason we got to be a great place to work was because we had a core mission, a purpose that we came to work for every single day, which was to change the world and make it a better place by enabling the genius of our customers ... By re-establishing that mission and focus, we're now getting back to the same sense of pride and ambition and execution that will put us right back on top of those Great Places To Work charts again.

You have a twin brother who is also very accomplished, Thomas Kurian (pictured), who is a president at Oracle. You actually switched jobs for a period of time. Talk about that, because that's unique.

My twin brother and I were both born and raised in India by a very forward-looking set of immigrant parents. My mother especially has been the force that has shaped our lives and our aspirations. She was a lady that was a decade or two decades ahead of our time, and she held us four boys to delivery against commitments that we made to our friends or to our family. She held us accountable for the values. She also gave us the confidence, the love and support, that allowed us to chart our own course and dreams. Thomas and I are the best of friends, so we've been lucky in that we've both been able to enjoy and revel in the other's success. There's no sense of competition. In fact, we're constantly learning from each other and sharing our experiences. I can tell you that Oracle and NetApp, there couldn't be two more different companies. I started my career at Oracle several years ago and introduced Thomas to it. So I'm really proud to see the successes that he's been able to achieve there.

So when you guys switched jobs, did you tell the companies or just start showing up at the other place?

We could do that and I'm not sure many people would figure it out for awhile!

The all-flash move, it's coming on fast now. You bought SolidFire to advance NetApp's move there. What is the outlook for all-flash? Will we see any disks in three years?

First of all, the flash technology has progressed a long way from when it first started. One of the lessons I'll share with you is when we look at technology trends, it doesn't always mean that the first to market is the winner. I'll just remind people that the first to market in the solid-state array or all-flash array business was Violin Memory or Fusion-io. Those companies are barely alive or not alive anymore. So when we look at what a new technology does, we want to time it to the first to mainstream market; what does the mainstream market look for in terms of business value, customer requirements and the readiness of the underlying technology. Solid state is today ready for taking over primary workloads in customers' data centers. We don't think there will be much need for performance drives, meaning the 10000 rpm or the 15000 rpm drives over the next two to three years. There's still a place for archival, there's still a place for capacity-oriented storage, but all of the performance-oriented storage moves to solid state, and that's a substantially larger market than what people had forecast.

Will the adoption of solid state technology push out refresh cycles?

What you find historically in the adoption of new technology is it's retrofitted into systems, and people use it as a like-for-like replacement of the old world. Then they start to see how it impacts their business and drives value. We've got lots of customers that historically have a batch-oriented business process now that has moved to a real-time business process just because of the value that we bring in solid state. As corporations learn how to use the technology for maximum advantage, you'll see more applications. Over a period of time I think solid state becomes a core part of customers' data centers. We're pleased with where we are. We are the No. 2 player in the market but growing three-and-a-half times the market, so we're excited about our position.

What's your pitch on solid state drives?

I think, first of all, if you are not selling NetApp solid state, you should be talking to us about selling NetApp solid state. We have world-class software combined with innovation that we are doing jointly with the providers of solid state chips, like Samsung and Toshiba, that differentiate our offerings in the market. That's why we're growing. I think if you're talking to a customer and you are talking to them about a transactional workload, like a database or a virtualization environment, you should absolutely be leading with solid state…You want customers buying today to have that infrastructure in place for five years. It is without question over that time period a better total cost of ownership tomorrow with solid state. That wasn't the case 18 months ago. 18 months ago you couldn’t tell, but today that is true. On a go-forward basis, the value proposition of solid state is just better than performance products.

Is it the channel's job to drive demand for your products or is it your job?

We have both got a role in driving demand for our products. Our core competency is to enable you with the best technology and the best enablement that a manufacturer can provide. We also have the responsibility to create awareness and preference for our solutions through the marketing programs, the demand generation programs that we do ourselves or in concert with you. At the same time what we look for from channel partners is to complement what we bring by knowing customers, figuring out which customer use cases are best solved using our technology and engaging with us at the point of the customer.

Is your channel where it needs to be?

First of all, I think the reason customers come and work with NetApp is we are the world's best at what we do. We are focused on it and we can partner effectively with virtualization platforms, with computing platforms, with cloud service providers because we are none of those. Everybody who builds a vertical stack is imprisoned by that vertical stack, as much we are liberated by the fact that we are focused… An extraordinary part of strategy is to say what you're not good at and what you are going to let someone who is better than you take the lead on. That is a core part of why we implemented the hard deck. We said in certain sets of accounts we are going to focus our resources and in other places we are going to let the channel lead, rather than getting confused about where we each play. In terms of the reasons [to partner with us] and the value channel partners can get from working with NetApp: we are focused, we have world class solutions, we have a strong and loyal channel partner program, and we are not confused about who we are. You can work with us and know the channel has an enduring and important role with us. And, you can build a really profitable business with us.

Talk about the cloud – has that been a good thing for NetApp or a not so good thing for NetApp?

I think that, when I look at an innovation like the cloud, I would tell you that, first of all, it is not going to replace on-premises computing ... It is going to be part of every company's portfolio in some form or fashion, whether it's software-as-a-service or platform-as-a-service, or all the different flavors… For years, NetApp was really well understood in the industry for having the capability to help people manage, secure, and make their data always available. But, the consequences you had to make was you had to bring your data on my systems to do so. What we said was, what happens if we took our intellectual property, our tools and our expertise and put them where people put their data. Wouldn’t that give us access to a heck of a lot more footprint than we've ever had? And, if the cloud providers are going to consolidate so much of the world's data in one place, wouldn't we be able to access this enormous amount of customers in an incredibly more efficient way than we've been trying for 20 years to access? In all of these transitions, I think it's important to keep the lens on, first of all if it's real and enduring, and the second, if it's enduring, how do you make it an opportunity and balance it with risk?

But you do think it's enduring?

We absolutely think hybrid IT is enduring, meaning a combination of on-premise, some managed services environments and some public cloud environments. That is what I think most customers will want.

There's been a fair amount of consolidation in the storage market. What is driving that?

I think, first of all, in terms of innovating in the storage market itself, we have combined organic innovation with inorganic. If you bought NetApp technology just five years ago, the same technology that we delivered five years ago is today 70 times better in performance, 35 times better in scale. Nobody else in the industry can give the customer that kind of return on investment. We acquired SolidFire, not because we couldn't innovate in our organic business, but we saw a completely new design paradigm for data centers that customer wanted, which was to bring to their own environments what AWS, Google and Facebook had designed … SolidFire complements the portfolio that we have. Other big storage companies have acquired platforms. I think some of them have not invested in organic innovation as much as us. I think it's part of the go forward plans of any company: when the market changes quickly, you've got to have the ability to innovate both organically and inorganically.

Is the consolidation we're seeing around storage today a good move?

I think in terms of the history of computing manufacturers buying storage companies, that's not been good. If you look at Sun, they bought StorageTek and didn't do much with it. You look at all the large computing manufacturers, they bought a series of storage companies and had an existential conflict of business models where the computing side of the business is an integrated business model with external sources of innovation…and the storage business is a value business, not a volume business, with the operating systems historically done by the storage manufacturers and the chips being the drivers of the solid state businesses. The history of computing companies buying storage companies has not been stellar. That may change going forward, but if you look at it purely from the historical track record there are fundamental reasons why there is that existential crisis.

What is the advantage for NetApp of remaining independent?

At a time when everyone is getting married or divorced, by being really focused on what we do we can move faster than they do. That is why we have taken on transformation at such a fundamental and accelerated way. We think if we can transform to what the world needs ahead of where everybody else is, then we are in a better position than everyone else is. I will give you a simple example. Most of the hardware companies decided to build a cloud in some form or another and competed with the cloud service providers. We didn't. We realized at the outset that the cloud service providers were our channel to market or were people we needed to coexist with and will be platforms on top of which we needed to build innovation. That has given us a five-year lead on anyone else. If you go down that path to try to compete with someone else, you spend three years deciding to compete, you spend another three years competing and then you spend three years grieving that you lost to the competition. That's a long period of time in the technology industry. By not making that mistake, we are much further ahead in terms of building a compelling solution for hybrid IT.

As other big companies get into the storage business, does that have the potential to cut you out of the game if you partner with them?

There will always be overlaps within the technology industry. We will always have people that we coexist with. We coexisted with Microsoft for years, for decades, when they had storage solutions. My own view is that there are two inevitabilities. One is customers want their suppliers to work together, regardless of if ABC company has an alternative. If customers want technology, they will want that technology, whether its computing or virtualization, to work with us. The second is the responsibility on us is that we are the best in the world at what we do. We are really focused on that.

How does the Internet of Things change your business over the next few years?

The Internet of Things is about connecting an incredibly large number of devices and having all of them share information so you can optimize a business process, a manufacturing process, a supply chain or a customer experience. We have seen clear examples of the business value of the Internet of Things in enterprises… As they build out autonomous cars or various types of predictive analytics around sensors or maintenance models, they use our storage platforms to process data, analyze it and make good decisions. We think there is a great opportunity for us to be part of a solution set that enables customers to draw insights from the Internet of Things so they can optimize their business process and get value. A simple example of that is we also, for our customers, treat our hundreds of thousands of deployed systems as "things." They have built into them various types of telemetry that tell us about the performance and the health of that systems and we have applied big data and machine learning analytics to provide predictive fault management. We will tell you this is an issue that is coming up. That is an example of the Internet of Things at work.

When you go into customers, do you talk to the IT folks or the CFO and CEO? What is the discussion around?

I meet with a broad range of stakeholders at customers. I meet with CEOs as well as COOs or CFOs, people in the IT department and then the CIOs as well. I think at the CEO level everyone is dealing with transformative change in their business. Digitization is going to be an important part of the conversation of CEOs and they are often asking me about the program that we have put in place, the success that we have demonstrated, how do we govern that, and what was the philosophical approach we took as an owner or an operator of the business. With CFOs and CIOs, there is increasingly a focus on risk management and new consumption models for the business… It's an evolving dialogue and I learn a lot from those discussions and bring it back to our own teams and to our sales teams.

When you talk to customers and you get into a cloud discussion, part of the reason to go to the cloud is that IT is just not a core competency. Is that true?

Absolutely. Enterprise is certainly much more complex, so there is no "one size fits all." There is really a portfolio of things they want to deploy on-premise and [things they want in the cloud.] I was in Germany last week and I met a chocolate manufacturer. They don't have a lot of [IT] skills and are a midsize company… They chose to deploy a lot of infrastructure on a cloud provider and realized that wasn't going to give them the full benefits of what they wanted. When they chose to do an assessment of their applications portfolio, we are a deployed solution on premise and we built a bridge using our SnapMirror and our storage technologies for them to take a portfolio of their workload to the cloud and meet the German government mandate. That becomes a discussion around where they want to focus.

Is our corporate tax structure a problem that needs to get fixed?

I think the challenge that all of IT is dealing with is set in the context of a slow growth economy. Very simply, when look at spending as the CEO of a Fortune 500 company, on IT I always check of whether that is the best use of an investment dollar, rather than spending it on R&D or on sales or on employee benefits. The landscape that we are living in is one of sustained low growth for a period of time, which is why we hyper-focused on transformation to make us fundamentally more productive and focused so we are focused on the best opportunities in that broader landscape and the fastest growing ones. In terms of the policy frameworks that he outlined, I think tax reform, I think immigration reform, I think adding the skill base in the US economy with both a better educational system and the more refined immigration policies are both key components of the road forward.

Silicon Valley has been a reluctant participant in the political landscape. Do you think they should get more involved?

I'm cautious about making that statement. I think Silicon Valley has been blessed by the fact that we are a less regulated part of the world than many other parts of the world, so we've had the freedom to innovate in a lot of places. I think that CEOs as experts in policy, we've had a mixed track record. I think Silicon Valley certainly needs to engage the political discourse, but do so in a way that takes a broader perspective of the country as a whole and relies on informed sources. I think it's okay to have a voice in the discourse, but it should be an informed voice that takes the country as a whole, rather than a narrow perspective on the country's challenges.