Q&A: Eaton's Del Misenheimer On Moving Forward In A Sea Of Data Center Power Changes

Lithium-ion Batteries And Software-based Efficiencies Will Revolutionize The Data Center

Some major technology shifts are impacting the data center business, including the rise of hyperscale data centers, the turbulence in the server market, and the increasing need to ensure networking gear stays online to ensure continued business operations.

These three trends converge in the data center power business, where vendors and their channel partners are looking to address increasing requirements for always-on operation while making sure power is continuously available.

Del Misenheimer, senior vice president and general manager of Eaton's Power Quality division, sat down with CRN at this week's Eaton Partner Summit in Atlanta. He discussed the coming changes in battery technology and the need for software to ensure the power hardware remains online while providing a new revenue opportunity for partners.

Click through to learn more about what's changing in the data center business.

As the IT world embraces the cloud while remain firmly rooted in the data center, how does this impact the data center power business?

The trend around the focus on energy efficiency is still there. As you look at energy efficiency, the big question is, "What's the best type of [energy] storage?" Here, you talk about lithium-ion. And once you talk about lithium-ion, are there opportunities to drive different types of backup power? Especially as you're getting into the hyperscale cloud segment ... They're using the largest kVA systems. In the transition to that business, how do you get more power, more reliable, more efficient, at those customers? At the same time, we're looking at whether that transition to lithium-ion is going to be occurring.

What other issues are you seeing?

Another area of discussion is uptime. It does become more and more critical. Sometimes it's application-specific. You may see even lower redundancy in some applications when it comes to large content providers where they can maybe run with less redundancy. But as you get more into hosting and cloud services, the level of expectation of reliability goes up. So we see uptime as a big push.

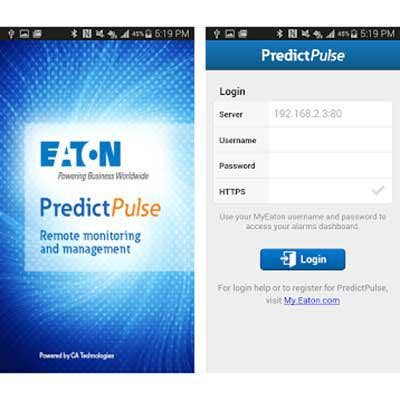

Also, with all of the big data applications that are out there, being able to provide predictive analytics is increasingly important. We have a monitoring solution. We've now adapted it to PredictPulse [predictive monitoring and management software]. With PredictPulse, we've had the first versions of predictive analytics around UPS so we can actually provide predictive alerts. We're not really going out to sell software or a management system, but actually a packaged service solution.

How does PredictPulse work?

We're actually collecting data about those UPSs every 15 minutes. There's over 200 points of data we're collecting. We're running that through big data, through algorithms we've developed related to what are the critical failure points, usually around batteries, fans, and capacitors, and then looking at those attributes and determining the remaining useful life of those components. We have the service teams out in the field. We have 24-hour response service centers. And then we're taking those big data, predictive alerts and feed those back to us so ... if there's a data center problem, we actually get the alert as fast as someone on-site does ... we're shifting to a proactive, more predictive, solution.

Has that predictive data that you’ve collected and are using changed how Eaton's partners do business?

It has in the large-scale data centers. We'll be developing those algorithms for some of the smaller solution providers. We could run a solution like that for a hospital tomorrow. It's not just large data centers.

PredictPulse could be sold through channel partners. We've even done a rollout to a large retailer where there's over 200 small retail stores that have the 9PX UPS, power strips, ePDUs, and PredictPulse, and a service agreement. They have critical loads. They don't want to go down. But it's not around the complexity of knowing six months before a failure. It's more about the fact that they have a store manager there, or a retail clerk, and if the infrastructure goes down, they don't want to lose a whole day's worth of sales … It's a managed service where the customer doesn't have to do anything. That's a solution provided by our partners.

What is ePDU?

Rack power distribution. That's our brand. We use "ePDU" to represent the difference between a floor-standing model vs. a rack-mounted power distribution strip.

How will Eaton bring lithium-ion batteries to the data center?

We're looking at multiple vendors. And if you look, there's certain companies that do certain chemistries around lithium-ion.

The number one issue around lithium is safety. No one wants the Samsung incident. There are different grades of lithium. We use a lithium iron phosphate type, not a cobalt-based lithium. It's not as compact and dense in energy terms, but it's still much greater than lead acid. But it also doesn't have some of the runaway temperature issues. [Lithium-ion battery use] will vary depending on the different market segments, and then the overall payback justifications.

Will lithium-ion supply be an issue given that everyone from smartphone makers to electric car makers are rushing to lithium-ion batteries?

The price of lithium itself hasn't dropped. People are investing in mines every day. There's a lot of investment in lithium mining. The price of lithium has been going up. But the technology to actually build and put the batteries together has been dropping [in price] dramatically. So we're starting to hit that crossing point. At some point, probably within the next 12 months, we'll see some parity start to come in, at least in a managed, monitored deployment. And depending on the size and rating, it will probably be closer on large [units] before it will on small. And that's going to set us up to look at opportunities, particularly in the large [data centers] first. Because that's where some of the larger payback is.

SMBs have been a big part of the standard UPS market. Do you see growth in that business, or is it shrinking?

I think if you look at market numbers, you see pure single-phase UPS is a flat market over the foreseeable future, because some of the applications are going to change. There's no question that server sales as a whole are continuing to drop. From a hyperscale standpoint, the workload density is much higher. But you also have more networking switch applications with the connection to the cloud or to web services. And customers are putting more UPSs, and higher-level UPSs, on those network switches. So those applications are actually balancing out to where you're not really seeing a declining market. But it's not growing at the same rate as maybe some of the other segments.