Dell EMC's David Goulden On What It Means To Be The Biggest Player In Storage

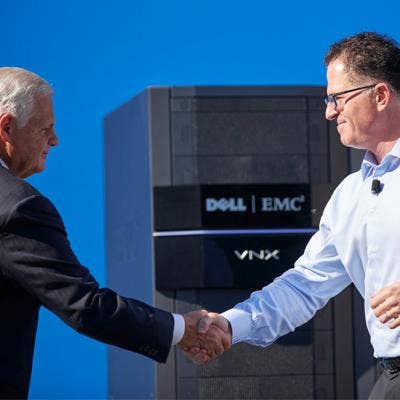

A Year Later, Not Dell, Not EMC When server-centric Dell unveiled plans to acquire enterprise storage-centric EMC, a lot of folks were scratching their heads. However, in the nearly one year since the merger was closed, the new Dell EMC has changed almost beyond recognition. David Goulden, president of Dell EMC and the former president of EMC Information Infrastructure, talked with CRN about the changes that have been made since the acquisition closed, and how Dell EMC as a whole has become a strong technology and channel play.

Get more of CRN's coverage of Dell EMC World 2017.

What are some of the big changes at EMC since its acquisition by Dell?

EMC World last year was mainly about EMC, with a little bit on the coming attraction [with Dell]. What I hope people will see when they come to this year's

Dell EMC World is actually a new company. The proof will be in the eating. But you will see people not talking about 'ex-Dell' or 'ex-EMC.' It's all Dell EMC.

How has the channel partner landscape changed along with that?

With [Global Channel President] John Byrne and [Senior Vice President of North American Channel Sales] Gregg Ambulos driving the Dell EMC channel partner program, that seems to, from my interactions with the partners, be well-received. I think the partners, the ones I've dealt with, are as excited as the customers are about the whole portfolio. … [Partners won't just] single-source everything. But if they want to have the most strategic partner who can provide most of what they want to do, then that is Dell EMC. They can go from the client to the data center to the cloud through Dell EMC.

Dell EMC is focusing heavily on making the new 14th-generation PowerEdge servers a key component of the company's storage lines going forward. What else has Dell brought to EMC?

Our new go-to-market model [has] two global go-to-market structures in the Dell EMC business. One is aimed at the 3,000 or so biggest customers in the world, and that's the enterprise model. And that looks more like the old EMC model. … The other go-to-market model, which is called the commercial model, which is focused on the next 500,000 customers, looks a little bit more like ex-Dell than it looks like ex-EMC. That's where we leverage our call centers, a lot of the channel partners who sell in the midmarket, inside sales, the whole Dell sales motion, web sales, etc. And that looks a bit more like ex-Dell, with the appropriate EMC resources moved in that segment.

What does it mean for Dell EMC to be the biggest player in a storage industry that is starting to consolidate?

We absolutely recognize the maturity of that marketplace, driven by a whole bunch of forces. Driven by more cloud-based storage. Driven by better compression algorithms, by dedupe, by all sorts of things that are going on. Because people's data is still growing rapidly even though the total external storage space is relatively flat. … It's not that data is not growing. It is. It's the underlying infrastructure that's becoming that much more efficient. We understand that. We recognize it. We're going to play for the long term in the marketplace, as we always have.

How is that impacting Dell EMC in particular parts of the storage market?

At the macro level, you're right. The external storage market, and that's what IDC tracks, is a maturing and consolidating market. But within that, you've still got sectors like all-flash, which is growing rapid double-digits. The hyper-converged appliance part of the storage market is also growing double-digits. Object storage for unstructured data is still growing rapidly.

So even though you've got an overall market that is flattish at the top, there are things that are cooling off and things which are warming up inside it. Now we are still the only player out there that can claim to have a complete range of storage offerings. And each of them are best of breed, which are VMAX, Unity, Data Domain, Compellent, Isilon, Elastic File Storage, VxRail. We absolutely can be the one-stop shop in that market, and customers can invest in confidence, because we're spending a ton of money on R&D behind those.

What does Dell EMC need from its channel partners to help grow the business even as it continues to evolve?

We are encouraging our channel partners to look at our entire portfolio because the portfolio in the end will be important for them. There's no such thing as one size fits all in storage. The other thing which I'd point out is that what's happening in storage is going to require some big investment. Think of media changes as we go from flash drives to NVMe, the protocols going from Fibre Channel to native NVMe protocols, 64-bit file systems, software-defined:

These are all important technologies that partners need to get behind in the portfolio. Because through the portfolio, we'll evolve and incorporate all these technologies.

A lot of this month's Dell EMC storage refresh emphasizes improved performance and capacity. That's to be expected. But where are the real breakthroughs?

Here's part of the challenge on the storage side. There are so many exciting announcements, and each one is something we position as a breakthrough. For example, let's go over Isilon. We've got a brand new architecture for Isilon [called] Infinity architecture. It makes the nodes more flexible. It lets you scale out, and lets you mix and match different nodes, including all-flash nodes, with an incredible performance advantage compared to some body else trying to produce an all-flash file system, for example. That by itself would be a highlight, but we've got eight of those [kinds of highlights]. … Perhaps the wood's being lost for the trees, but there's a lot of interesting stuff in the portfolio. It's not just the speeds and feeds.

Where do you think EMC would be if it hadn't been acquired by Dell?

That's a little speculative. We don't know because we chose a different course together. And we chose that course together close to a couple of years ago now. I would tell you it was thought about very strategically by the boards of both companies. Dell was private by then, and EMC was still public. But I think both of us could see there were big changes coming in the industry. And when changes occur, that's when you've got to make the bigger moves.