The 10 Biggest Tech Mergers And Acquisitions Of 2017 (So Far)

The Movers And Shakers

Going private, consolidation, breaking into new markets with new services – there are all kinds of reasons for companies to acquire other firms. In 2017, we were expecting lots of M&A activity and, so far, we've seen several big deals signaling new products, services and capabilities coming to the market for solution providers.

There was incredible M&A momentum heading into the year. According to the 451 Research's M&A KnowledgeBase, tech companies announced $500 billion worth of transactions in 2016, ranking that year as the second-highest annual total since 2000.

The big surprise so far is Dell EMC – they're not on this list. In fact, Dell EMC has sold off five separate businesses since Dell and EMC announced their history-making merger in 2015. But while Dell hasn't yet made a big buy this year, Accenture was also left off this list for a different reason: It has too many deals to sum up in just a few dozen words.

Who's left? All the big names you'd expect and a few you wouldn't: Cisco, HPE, Windstream and even Xerox make up this list of the 10 biggest M&A deals announced so far in 2017.

(For more on the "coolest" of 2017, check out "CRN's Tech Midyear In Review.")

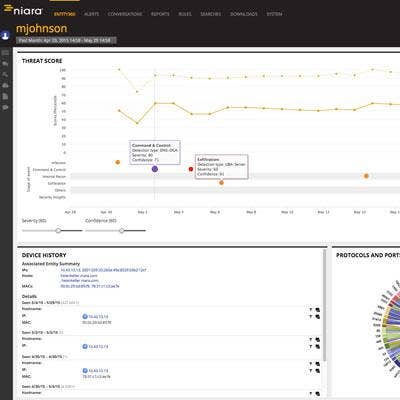

HPE Acquires Niara

We don't actually know how much HPE spent on Niara, but we do know that Niara had raised $29.4 million in funding to date as a startup. The security analytics and network forensics platform provider was bought by HPE in February as a way to enhance the company's Aruba ClearPass network security portfolio for wired and wireless network infrastructure. In this case, HPE acquires to add value to its existing products and enhance the services that channel partners can provide using its technology. It isn't the first software-related purchase from HPE in 2017; the company also bought Cloud Crusier, a cloud IT consumption, metering and analytics platform, in January for an undisclosed sum.

Perficient Buys Clarity

In June, solutions provider Perficient bought Clarity, a 160-person Chicago software consultancy that has annual revenues of $27 million. The company was purchased to fold into Perficient's dedicated Microsoft business group, thanks to its custom app and cloud development capabilities. That nearly doubled the unit’s current size to 330 employees.

"We’re super bullish on Microsoft. Our relationship with them has only gotten better every year," Perficient CEO Jeff Davis said. "We swept top (national solution provider) partner in all three regions and believed a lot in their direction with Azure and also what they've done with Office 365 ... We have a great amount of confidence to invest more in the Microsoft space."

Park Place and Presidio are other examples of solutions providers this year that have been looking to add value by purchasing other solutions providers with specialized skills.

Extreme Buys Avaya's Networking Business Unit

In March, Extreme Networks said it would buy Avaya's Networking business for $100 million just months after Avaya said it was seeking Chapter 11 bankruptcy protection. Extreme Networks CEO Ed Meyercord said he expects Avaya's networking business to generate over $200 million in annual revenue for his company. Would you spend $100 million to get $200 million? It sounds like a good deal so far.

Xerox Buys MT Technologies

Xerox's Global Imaging Systems (GIS) division purchased an Ohio-based dealer of multivendor office equipment and managed print services in May as a boost to its distribution network and a strike against competitors like HPE and Ricoh. This was the first move in Xerox's $100 million effort to convert multibrand solution providers into Xerox-exclusive partners – a little competitive chess play to make the channel more interesting.

Palo Alto Networks Buys LightCyber

The Palo Alto Networks $105 million purchase of LightCyber in February was a classic technology add-on. "The LightCyber team's vision to bring automation and machine learning to bear in addressing the very difficult task of identifying otherwise undetected and often very sophisticated attacks inside the network is well-aligned with our platform approach," Palo Alto Networks CEO Mark McLaughlin said in a statement. Palo Alto is no stranger to making strategic buys that boost its technology portfolio; the company acquired Cyvera in 2014 to add endpoint security capabilities and CirroSecure in 2015 to add capabilities for SaaS application security.

Cisco Buys MindMeld For $125M

In May, Cisco made a bold move into a new market to boost the capabilities of its Cisco Spark unified communications product line and platform. The company said it would buy artificial intelligence startup MindMeld for $125 million. "The workplace of the future is one powered by AI," said Rowan Trollope, senior vice president of Cisco's IoT and Applications Group, in a statement. "This is a significant step toward making that workplace a reality."

Windstream Buys Broadview For $227M

Expanding UC capabilities and market reach was also a theme in Windstream's agreement to acquire Broadview Networks for $227.5 million in cash. "Broadview has been successful transforming its legacy telecom business into a leading provider of unified communications services to businesses that are ready to make the shift to the cloud for their communications services," said Mike Robinson, president and chief executive of Broadview, in a statement.

Cisco Buys Viptela $610M

In May Cisco made it clear that it is serious about the software defined WAN (SD-WAN) market. Cisco said it will spend $610 million in cash and equity awards to acquire Viptela, a developer of software-defined, wide-area networking (SD-WAN) technology that is already popular with several large telecom carriers, like Verizon, and Fortune 500 companies. "For customers with broad, complicated deployments with a variety of technologies like MPLS, Viptela is the best," Prashanth Shenoy, vice president of product marketing for enterprise networks at Cisco told CRN.

HPE Buys Nimble Storage For $1B

Hewlett Packard Enterprise splashed some cash for flash in March when it announced the $1 billion purchase of Nimble Storage, the manufacturer of predictive all-flash and hybrid-flash storage systems. HPE said the deal would enable it to offer a full range of flash storage systems for customers of all sizes. Strategically, it helped add to HPE's capabilities in the highly competitive flash storage systems market, where it battles rivals Dell EMC, NetApp and Pure Storage.

Cisco Buys AppDynamics For $3.7B

One of Cisco's biggest acquisitions is all about helping companies make sense of the data in their enterprise and make decisions more quickly. As Cisco explained, AppDynamics would help its customers translate operational application data into business insights and provide end-to-end insight across their technology stack. The purchase also represents a new wave of software-led efforts for Cisco. In its last fiscal quarter as an independent company, AppDynamics saw year-over-year revenue growth of over 50 percent, with approximately 75 percent of last year's product revenue purely subscription-based.

Apollo Global Management Buys West Corp.

In May, New York-based Apollo bought Omaha, Neb.-based West Corp. in a deal that had an enterprise value of roughly $5.1 billion, a calculation that includes West Corp's net debt of more than $3 billion. West's predicament was that its unified communications business was still making money, but it was getting harder to show growth to investors in a highly competitive market. More than 60 percent of West's business came from its unified communications and telecom practices.

In a new portfolio, Apollo may be able to help West grow again, or at least remove it from the spotlight glare of Wall Street.

Private equity's influence in the channel of late has resulted in big deals and new channel opportunities. Earlier this year, KKR & Co. scooped up Optiv Security, No. 25 on the CRN Solution Provider 500, for a reported $2 billion. Apollo Global also led a group of investors who purchased San Antonio-based public cloud pioneer Rackspace for $4.3 billion in August 2016.