The Rise And Fall Of VCE: The History Of An Unusual Partnership

History To Judge The Success Of VCE

VCE was founded in June 2009 to design reference architectures based on EMC storage, Cisco server and networking, and VMware virtualization technologies, but over time it became a seller of Vblock converged appliances integrated by the factory before shipping. While VCE's parents never unveiled the profitability of VCE, they did brag about the company having a $2 billion annual run rate. So even if it made no money, the parent companies did quite a bit of business that might have went to other converged infrastructure developers.

Was VCE successful? Five years after its founding, it has been absorbed into EMC, with Cisco's stake reduced to 10 percent and VMware's to piddly. However, it was, and remains, the standard against which other converged infrastructure, and the new hyper-converged infrastructure, vendors measure themselves.

What a long, strange trip it's been for VCE. Turn the page, and relive the journey with CRN.

The Beginning: EMC Acquired VMware, December 2003

To understand VCE, it is necessary to go back to the days before it was founded.

The seeds of VCE were planted in December 2003 when EMC unveiled the $635 million acquisition of VMware, which at the time was focused on virtualizing servers. Cloud computing was still a thing of mystery for most businesses.

That acquisition was widely criticized at the time for diluting the focus of EMC, which was, and still is, the largest storage vendor that is not part of a server vendor. However, EMC continues to get the last laugh as VMware, which is still 80-percent-plus owned by EMC, generated $1.5 billion in revenue and 87 cents per share in its recent fiscal third quarter.

Interest In VMware Soars: Cisco And Intel Invest In VMware, July 2007

Intel in July 2007 invested $218.5 million in VMware to acquire a 2.5 percent share in that company. That news was followed a couple of weeks later with word that Cisco invested $150 million for a 1.6 percent stake in VMware.

The foundation of VCE was in place with EMC, Cisco and Intel now all owners of VMware. Intel eventually would cash out.

Thinking Cloud: VMware Shifts Conversation From Virtualization To Cloud, September 2008

VMware was, and is, the leading developer of server virtualization technology. But in September 2008, VMware shifted its primary focus to cloud computing for the first time with the unveiling of a partner ecosystem that included multiple server, storage, networking, security and services partners.

Enter The Server: Cisco Introduces UCS Servers, March 2009

Cisco, historically one of the biggest networking vendors in the industry, stunned the IT world by unveiling the Cisco Unified Computing System (UCS) blade server line. Cisco said its UCS servers were designed primarily to optimize the performance of VMware environments.

Despite attempts by other more established server vendors to dismiss the potential competitiveness of the upstart, Cisco's UCS servers are currently integrated in the converged infrastructure offerings of storage vendors EMC, NetApp and Hitachi Data Systems.

EMC in a blog post this week said it started talking to Cisco about servers as far back as 2007.

V+C+E: Not Quite Yet VCE In June 2009

The last block fell in place in building the VCE foundation when VMware, Cisco and EMC held a joint press meeting at EMC World 2009 to unveil a partnership between the three related to developing cloud computing platforms.

This wasn't VCE yet. It was originally called the VMware-Cisco-EMC alliance. Later, it would be called VCE, which was short for "Virtual Computing Environment." Eventually, it was just VCE.

First Vblocks: Unveiled, But From Acadia Not "VCE," November 2009

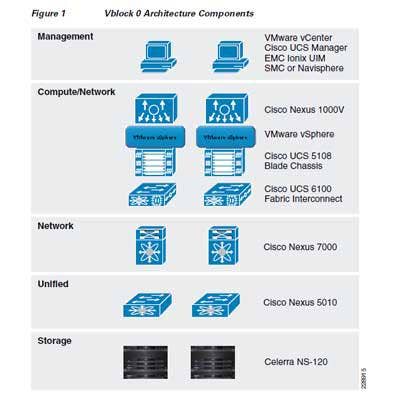

Cisco, EMC and VMware in November 2009 introduced Vblocks, a series of preconfigured, pretested solutions based on Cisco UCS servers and its networking switches, EMC's Symmetrix or Clariion storage arrays, and VMware's vSphere server virtualization platform.

The Vblock solutions, which were aimed at helping customers build virtual data centers and private computing clouds, were not yet actual products. That would come later. Instead, Vblock was more of a reference architecture for building such solutions.

EMC and Cisco at this time also introduced a soon-to-be-launched joint venture called Acadia. Acadia, which also featured investment from VMware and Intel, was slated to be a separate legal entity that would ensure the Vblock Infrastructure Packages were built in a standardized and repeatable fashion for customer data centers.

Sounds a lot like VCE, right?

FlexPod: Cisco Partners With EMC Archrival NetApp, January 2010

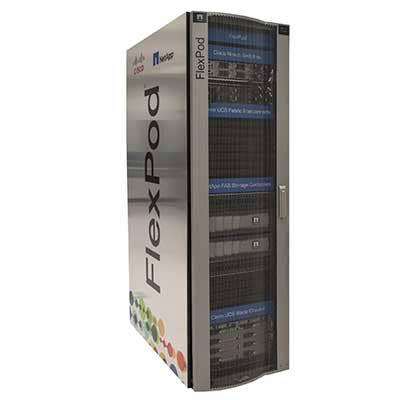

Cisco wanted to prove that, despite its close relationship with EMC, it was an independent server vendor, and did so in a spectacular fashion by unveiling a relationship with NetApp, EMC's top storage rival.

The new (at the time) Cisco and NetApp relationship, which also included VMware, promised to deliver new reference architectures based on their technologies for data center efficiency with a joint customer support framework. That reference architecture would eventually have a name: FlexPod.

Cisco in late 2012 signed a similar relationship with EMC rival Hitachi Data Systems.

Enter The Channel: Vblock Gets Indirect Channel Go, April 2010

VMware, Cisco and EMC, whose relationship by this time was called the VCE coalition, in April 2010 detailed for the first time their channel plans for sales of the three different Vblock infrastructure solutions then available.

Bringing In The Big Guns: Acadia Gets A Big-Name Leader, May 2010

Former Hewlett-Packard President and Compaq CEO Michael Capellas was tapped in May 2010 to lead Acadia, the Cisco-EMC joint cloud computing effort.

As CEO of Acadia, Capellas was charged with building up the VCE Coalition’s presence in the channel through Acadia, which at the time was seen as a potential challenge in light of Capellas’ lackluster reputation with the channel based on his role as the former CEO of Compaq, a position he held from 1999 until Compaq was sold to HP in 2002.

EMC In Charge: EMC Exec Appointed VCE President, March 2011

Frank Hauck, EMC executive vice president and a member of the EMC executive office of the chairman, became VCE's first president in March 2011. A 20-year EMC veteran, Hauck at VCE reported to Capellas, chairman and CEO of VCE.

As president of VCE, Hauck focused on such areas as customer service, new product delivery and adoption of new technologies.

Hauck's move to VCE was a significant step in the growth and future development of VCE, which had 800 employees at the time, up from about 80 employees only two years earlier.

Channel Clarity: VCE Unifies Channel Program, April 2011

Despite the fact that VCE's Vblock systems by 2011 were sold to customers as a packaged solution, solution providers were still dealing with placing separate orders with VMware, Cisco and EMC, as well as dealing with their separate channel programs and discount programs.

That changed in April 2011 when VCE said that all orders from solution providers, including those received via distributors, would go through VCE, which provided the solutions with VCE part numbers and warranties.

VCE also unified its deal registration process and discount structure so that partners dealt with just one vendor, and introduced its first MDF program aimed at helping fund partners' demand generation activities.

However, the three parent vendors continued to offer extra discounts above what was offered by VCE as a whole.

Rumors: Distributors To Build Vblocks, February 2012

By early 2012, rumors were circulating through the channel that VCE might bring the integration of Vblocks, which had been done in the company's own facilities, to the distribution level. Solution providers also were getting excited about the possibility that VCE might soon introduce new lower-end models of the Vblock.

As is often the case, the rumors were half-right.

EMC, Cisco and VMware, rather than farming out the integration of Vblocks to the distributors, had a more interesting strategy in mind. More about that in a minute.

And those lower-end Vblocks? We'll get to that in a bit too.

VSPEX: VCE Partners Unveil Reference Architecture, April 2012

Rather than go lower end with Vblocks and farm out assembly to their distributors, EMC, Cisco and VMware instead released a series of reference architectures called VSPEX showing how solution providers could build solutions.

VSPEX brought VCE full circle to day one. When the VCE Coalition was first founded, it was targeting the release of reference architectures, but instead changed its business plan to focus on selling only completely integrated Vblocks. Now the partners were taking their Vblock experience as a starting point for offering VSPEX reference architectures featuring the same components found in the Vblocks.

So, instead of VCE, partners could choose "V+C+E."

The vendors eventually signed distributors to provide VSPEX assembly services for solution providers who requested them.

Going High And Low: Vblock Line Gets Significant Expansion, May 2012

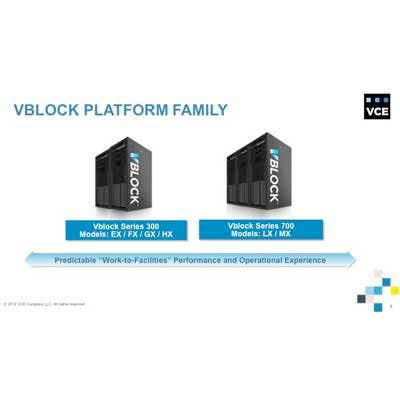

New to the VCE lineup as of May 2012 was the Vblock Series 700 Model LX system, which is based on the entry-level VMAX 10K model of EMC's enterprise-class storage array. It supported applications running over 2,000 simultaneous virtual machines.

EMC also prepped the release of entry-level Vblocks based on the company's new entry-level VNXe storage array family.

VCE also started including EMC data protection technologies to give Vblocks backup, recovery, replication, business continuity and data mobility for virtualized environments. Applications include Avamar virtual server backup software, Data Domain backup and recovery software, and RecoverPoint replication software.

Cisco Gets Its Say: Cisco Exec Takes CEO Role, July 2012

Since EMC is by far the majority investor in VCE, it has gotten the lion's share of the executive positions in the joint venture.

That changed in July 2012 when Praveen Akkiraju, a 19-year veteran of Cisco and most recently Cisco's senior vice president and general manager, Services Routing Technology Group, took the CEO position along with a seat on the board of directors at VCE.

Akkiraju's hire was significant in that it marked the first instance of a major Cisco executive stepping in at a company management team heavily dominated by former EMC executives.

EMC And Cisco: BFFs (Best Frenemies Forever), All Of 2014

EMC and Cisco have armed themselves for a potential break in their relationship. Yet that break is not inevitable.

EMC, for instance, could completely divorce its storage intellectual property from hardware, making it possible to turn any industry-standard server into a powerful storage solution. Vmware can now virtualize both storage and networking on industry-standard servers in much the same fashion as it did servers. EMC also has strong partnerships with Cisco rivals including Brocade and Lenovo.

Cisco, meanwhile, wrestles with VMware over control of the software-defined networking business, and is rumored to be looking to acquire storage technology after its disappointing acquisition of all-flash storage vendor Whiptail.

Gartner Magic Quadrant: VCE At The Top, June 2014

VCE was at the top of research firm Gartner's first-ever Magic Quadrant for converged infrastructure. Gartner gave VCE top billing, it said, because VCE has proven itself across major global enterprises in the banking, retail, health-care and manufacturing industries, and has a single-source cooperative support model that includes support from all three vendors.

However, Gartner said at the time, VCE faces potential conflicts between its core vendors, as well as competition from the VSPEX and FlexPod reference architectures, which are built by those core vendors. Gartner also said VCE's message that the three vendors are working together on converged infrastructure might not play well with customers who prefer a single-vendor solution such as those provided by Oracle, IBM and HP.

Modernizing The Vblock: Three New Models, Including All-Flash, October 2014

VCE rolled our three new models in October, taking advantage of its parents' latest technology.

The all-flash Vblock System 540 combines EMC's XtremIO all-flash arrays, Cisco UCS servers, and Cisco switches that support Cisco's ACI software-defined networking technology. It is targeted at databases, virtualized servers and mission-critical business apps.

VCE also introduced a new top-of-the-line model for enterprises, the Vblock System 740, which features EMC's new VMAX 3 storage. There's also the Vblock System 240, which features EMC’s entry-level VNX5200 storage and is aimed at midsize businesses and remote offices.

Separate No More: EMC Unveils Plans To Absorb VCE, October 2014

EMC in October confirmed weeks of speculation about VCE by unveiling a plan to make VCE part of the EMC Information Infrastructure business, or EMC II, which is led by CEO David Goulden.

After buying out most of Cisco's 35 percent share in VCE, EMC plans to move VCE into its federation of subsidiary companies, which includes VMware, Pivotal and RSA. However, according to EMC, Cisco and VCE executives, the primary focus of VCE -- the building of Vblock converged infrastructure solutions containing EMC, Cisco and VMware technology -- will not change.

EMC and Cisco said the move will help the companies increase their agility while maintaining their close partnership over the longer term.

The End Or New Beginning: History Will Judge, Some Day

Now that VCE is on the way to being part of EMC, with Cisco playing a minor role in terms of equity stake, its future is in the hands of the planet's biggest storage vendor, one that is being pushed by a group of vocal investors to do some merger or acquisition deal with its large-cap peers to unlock the value of its various parts.

Was VCE a success or a failure? While VCE's profit/loss record has never been revealed, all indications are that it was a money-losing operation. Yet it led to EMC's highly successful VSPEX reference architecture program (as well as NetApp's highly successful FlexPod program), and was responsible for selling a lot of EMC and Cisco gear as integrated solutions.