CRN Exclusive: F5 CEO Talks Channel Sales Initiative And Entering Hyper-Converged Market

Rivelo Looks Ahead

F5 Networks is striving to expand into new markets such as security and the service-provider space after it reached record annual revenues of nearly $2 billion for fiscal year 2015, which ended Sept. 30. In order to be successful, CEO Manny Rivelo says, F5 needs to drive channel programs, onboard new partners and create a new sales initiative for solution providers.

The Seattle-based application delivery controllers' leader is also driving expansion into new markets through strategic technology partnerships with the likes of hyper-converged infrastructure market leaders Nutanix and SimpliVity as well as security specialist FireEye.

Rivelo talked to CRN about entering the hyper-converged market, when its partnership with FireEye will materialize, and how F5 is changing its channel sales strategy to better drive partner profitability.

What is F5's new sales initiative?

We're extending into new markets that (are) either technology segments such as security or industry segments like service provider or as-a-service to our Silverline service offering. In that specific area, we know we need to drive channel programs, sign up new channel partners that focus on those verticals or technology segments, (incentivize) our sales organization, and create special sales organizations to target those markets better than just have the generic sales organization try to cover those specialties markets.

What can F5 channel partners expect with this new sales initiative push?

We're investing aggressively on sales enablement -- productivity tools things that allow our sales organization to better understand how to position our technology and where the opportunities lie. We're very excited about some new programs [we're] bringing forward. We expect that to push through the channel organization over the coming quarters here. We really want to focus on expending into more markets moving forward.

We are also focusing on how we expand into the cloud because customers want hybrid applications. So we've been aggressively over the last couple of years defining a software strategy that allows us to provide the same value that we've been providing on-prem, off-prem for customers.

Does the sales plan include more market development funds (MDF) for the channel?

The channel programs haven't been fully defined yet or rolled out, but yes. It's actually incentivizing the channel through different vehicles.

That's also working with partnerships. For example, we have strong partnerships with Cisco, VMware – we just signed a strong partnership with FireEye. So how do we align those channels together so we can jointly go to market is what we're looking at. So, it's going to be channel programs, incentive programs for the channel, etc.

When do you think your partnership with FireEye will materialize?

We've already won some transactions. We've won a significant transaction, multi-million dollar transactions. Our products have zero overlap. We fit well together and complement each other and make our technology stacks work better and are integrating that seamlessly as we move forward.

We think that will materialize quickly here over the coming couple of quarters and then have a significant impact in the second half of the year. Our sales organizations are getting their hands around it. We plan to tell our security channel partners and joint channel partners about the value proposition. We think that will have a material impact on our business here in the coming year.

You've formed partnerships with hyper-converged leaders Nutanix and SimpliVity. What attracted you to the hyper-converged market?

What's interesting about the hyper-converged market is the way it builds itself out is very linear in costs. It integrates all of their compute, storage, networking, virtualization -- so it makes it very, very simple. That technology is excellent technology for the enterprise customers (that have) been trying for a long time to create cloud-like infrastructures, but it's not simple to do. These companies are trying to address that challenge. It's a great growth driver in the enterprise and service provider space.

What is your hyper-converged strategy?

Our strategy is to put our software in those hyper-converged infrastructures or the workloads that customers are deploying on those hyper-converged infrastructures. We're excited about it. We have to drive that through our channel partners and that’s going to take a little time. The work we have to do is specialization-focused to ensure we're getting the right programs up. It's about having the right execution.

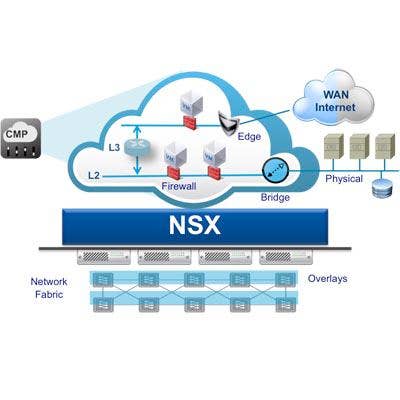

Regarding software-defined networking (SDN) you work with both Cisco ACI and VMware NSX. Who are customers picking more for their SDN solutions?

We see people picking both for sure. It really depends on who you talk to. When we talk to the network teams -- where historically Cisco has a very strong presence -- you see a lot of Cisco in those accounts because the infrastructure is there. When we talk to the application teams, they historically worked better with VMware with their virtualization stacks. So we're seeing both, to be honest. Customers have proof of concepts on both and plan on implementing them both inside their network.

It depends on whether you want to virtualize it in the compute fabric or virtualize it in the network. So there's going to be a mixture of both and I think those turf wars are still out there. We are starting to see OpenStack grow though.

So will OpenStack be the winner looking ahead?

Customers are talking more about OpenStack in the service provider arena. Customers are looking for choice and our strategy has been to make sure we provide integration with leading solutions in the market so that we can be there for the customers in the choice they want.

We're not trying to pick who the winner is. We're just trying to be there for the market. The market is large enough that I think you'll be seeing solutions from all three of them emerging over the next couple of years.

There is a tremendous amount of market consolidation industry-wide; Dell-EMC comes to mind. What is F5's view of this market consolidation?

There's definitely some big M&A in the market today and Dell-EMC is a primary example of that – it's the largest deal ever. That is going to continue for the foreseeable future because people want to be able to be more of a full-service provider. Customers are not looking for us to integrate the stack and bolt it down and lock it in with proprietary technology. They're looking for companies to offer open products that are integrated well together to take the cost out.

If any component or any vendor doesn’t do their job, they can be replaced with somebody else. It's a wonderful movement and much more tied to how software works anyways.

What is F5's current strategy around M&A?

We look at M&A deals all the time. We have a small M&A team looking at those deals as a way to growing our business. Historically it's been technology tuck-ins where we’ve looked at things that are on our roadmap that we want to accelerate. That's the preferred path because it's easy to absorb, the risk profile is a little lower. We do look at larger deals.

Is a larger acquisition possibly ahead for F5?

The challenge looking at larger deals is because of the consolidation and attention on the market today, it puts some companies really out of a reasonable pricing range if you're looking for a return to your investors.

We'll look at M&A although it tends to be in a logical adjacency. We're not looking to expand to a new footprint altogether in a technology that we can't get the leverage out of a distribution. But if there is a logical adjacency to what we're doing that we can leverage our distribution capabilities, that's where our sweat spot is. If it's a small-size, medium-size company then it's easier to absorb, less risk. But we're not against looking at larger transactions.

For FY15, services revenues grew 17 percent year over year, while your product revenue grew 6 percent. Is your plan to become more of a service organization?

Our goal isn’t to be a services company and to sell or lead with services. Our goal is to be a product company and then attach services. The focus inside is really product acceleration – even our service organization is focused on that. They're generating some new service programs and increasing focus on things like premium plus – an advance service where we provide additional support to our customers to make sure the networks are operating correctly. When we attach it to customers, we see customers absorb the technology quicker, implement more value or stickiness out of the technology inside their network, and even see customers' satisfaction scores increases.

How will you drive more product revenue in FY16?

We have new innovation coming out for the second half of the year, which we think will help us from a growth driver perspective that has everything to do with a platform refresh we have coming out, new software releases and various other things.

Our goal is to focus on product revenue growth. We've had a deceleration there over the course of the last several quarters and we want to get that back up.