CRN Exclusive: VMware Channel Chief On Major Partner Initiatives In 2017, Dell's OEM Partnership And Fixing vSphere Channel Rift

VMware Channel Chief On 2017 Road Map

VMware Channel Chief Ross Brown is leading the charge for several significant channel initiatives in 2017 with the goal of making it easier for partners to do business with the company and drive more recurring revenue.

"There's lots of work going on to get more solutions-oriented, to clean up the engagement with our customers and partners so they have a better experience, and to simplify the interactions of VMware tools for partners," said Ross Brown, senior vice president of worldwide partners and alliances at VMware, in an interview with CRN.

Brown also talks about the new NSX-T product, Hewlett Packard Enterprise's acquisition of SimpliVity, and how VMware is not "doing anything different with Dell than what we would do with any other OEM."

Can you talk about working under the Dell umbrella now as it relates to VMware's channel partners?

It's been interesting because the $1 billion in synergy comes because Dell is investing to grow their VMware capabilities to scale faster. Not that we're doing anything different with Dell than what we would do with any other OEM. So it's been an interesting thing where we create product offers and bundles for Dell and then we immediately turn it around to Cisco and HPE and see who wants to do it as well. We also go them and ask them to innovate and come up with ideas. Some of them have done quite well in coming back to us saying, 'Hey, what do you think about doing a product targeting this market, where we have this hardware and your software as a special bundle?'

So we work very closely with a broad group of OEMs around the world including Lenovo, Super Micro and a bunch of others to make sure customers can choose to deploy vSAN on any platform they want.

As an HPE OEM partner, what's your take on their hyper-converged acquisition of SimpliVity?

HPE is a significant OEM for us and continues to be even after the announcement of HPE's acquisition of SimpliVity. Of course they're going to try to lead with their hyper-converged infrastructure offering – but they also sell vSAN Ready Nodes and they sell quite a bit of them. So it's one of the areas where we work very closely with them on customer choice, but if a customer is going to choose vSAN they still want it to be an all-HPE shop. The same goes with other OEMs that we have. It's less of a black-and-white [scenario than] Dell-EMC versus HPE-SimpliVity versus Cisco-Springpath – it's much more blended. We work with all of them to try to maintain a position of neutrality between them.

What's VMware's biggest channel initiative in 2017?

There's a bunch of them. What's in flight right now, a lot of it is very oriented around some things that are about the partner experience. Without getting into internal projects, we have a pretty big initiative around the experience partners have in interacting with us both in tools and coming to our portal. So we've been cleaning it up. We at one point had 108 different contract vehicles for partners to engage with us on, so we got that shrunk down across [everything because] that leads to conflicting contracts and conflicting experiences on benefits and whatnot.

What is VMware doing in 2017 to drive more service opportunities for partners?

We've been doing a significant amount of work around externalizing our own professional services and delivering it through partners. So we have an initiative going on right now that's somewhat limited as we're starting to roll it out with some of our premier partners of taking VMware professional services and delivering it through our partners, not a subcontractor, but [partners] leading it ,which has higher margin and puts them in a leadership position with those customers around the technology.

Can you give an example?

So this year we'll move around $50 million of booked professional services through the channel as a first step, then we'll eventually move more and more of that business to our partners to act as both the delivery agent and the person who's driving that customer's primary experience.

What's one internal channel initiative VMware is doing this year?

We've been revamping the partner business manager role. Moving it from, what I'll call a poorly defined role, to one where there's job levels and paths where people can go as a career. And that notion of creating career partner-facing people who may start out doing inside sales partner management and eventually manage a global [systems integrator] account is part of the goal we have there.

What's a major initiative for you on the OEM side of the business?

We have a lot of work on the OEM side, and a huge amount of work in our global [systems integrator] relationships around how we scale out the industry solutions that they have. You can think of the Accentures, the CSCs and Capgeminis of the world who are leading the digital transformation of a lot of businesses and they're unique in a sense that, in many cases, they operate across all layers. So they do storage, networking and design, compute and memory, the application layer and all those things. Whereas we find that a lot of the large solution partners have a tendency to have almost a 'major' in just one layer [such as], 'We're a really significant networking VAR who can also sell servers and storage, but our main business is networking.'

So what is VMware doing to form a tighter relationship with these systems integrators?

So we have significant efforts going on to engage with [systems integrators] in our key accounts and build up a VMware-architected solution for both our Cloud Foundation on-premise [solution] and then Cloud Services on AWS when it releases or the Cloud Foundation on Bluemix and IBM.

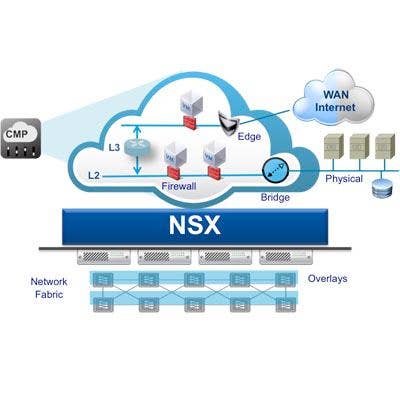

How big of a channel push is VMware doing around your new NSX-T product ?

You'll see very little of the NSX-T business now because it's very oriented at nontraditional vSphere server stacks. In those cases, there's two things. One is, there's not a lot of partners in this space now. There's a lot of born-in-the-cloud partners that exist around the SaaS and the PaaS areas, but doing virtual networking and being able to do that in container environments – that's a Venn diagram that has a very small overlap of skilled people. … It's a brand-new category and there's not a lot of capacity in the market around it.

So if the channel focus right now is still on NSX, when do you think you'll push NSX-T?

Our focus is on NSX-V [NSX for vSphere] right now where we have stable, mature products that are tested and scaling out with customers. We're starting to build out the NSX-T approach – that's going to be largely led by our specialists in the beginning because we still have to work with customer environments and get repeatable sales and repeatable engagements around deployments so we need to teach partners how to do it well.

You did a significant revamp of your Advantage+ partner program last summer. What has the traction been like over the past six months?

One thing that's gone surprisingly well for us since the changes in Advantage+ has been the momentum of partners from what I'll call 'light engagement' with us – people at the Professional tier of our program who maybe did one or two transactions every year -- we've seen over 500 of them move up into the Enterprise tier and invest to grow the business since we changed the program and the economics. And that number continues to grow. We're starting to grow both the number of partners at the more productive tiers of our program, but also their engagement is going up.

Just how much more engagement are these 500 VMware partners doing now?

Prior to the changes in Advantage+, we would average seven to 7.5 registrations per partner, per quarter – that number is now up to 11.5. So we're starting to see a significant increase in partner activity as a result of the changes.

Where else is VMware gaining traction in the channel?

So we had this weird thing where some of our largest vSphere partners were reticent to go with us to talk about NSX and vSAN and in accounts where we were teaming closely with them, we were a little big frustrated. So our strategy has been to go engage with other partners in those accounts because – I understand the pressure if you're one of Cisco's largest partners, that partnering up with us to go put NSX in when they're still working on their [Cisco] ACI and NSX compatibility strategy – it feels very much a 'keep VMware out of the network layer because we're worried about maintaining control for future products.'

It put them in a weird position because you had one major vendor asking them to team deeper and another major vendor, who is often leading the sale in these partners doing transactions and deployments, saying, 'No. If you go [with VMware], we're going to go to another partner with some of these deals.'

So what did VMware do to combat this issue?

We've had to go work with some partners who were much deeper technically, but who had a much smaller reach, and augment it with our sales specialists.

What's been changing in the last six months since the changes to our Advantage+ program is it's now economically interesting for partners to pursue customers for NSX opportunities with or without our sales team. … A lot of customers are realizing the advantages that they get out of NSX from anti-hairpinning technology, speeding up corporate applications, and the microsegmentation.

What's happened over the past six months … is [we have] got into large Fortune 500 accounts, getting deployments moving, getting partners involved in the deployment process and getting their technical skills up -- now we're starting to see adoption in organic sales of partner-initiated NSX opportunities at scale. The same with vSAN.

What are these customers saying now that they've deployed NSX?

They're now asking [partners], 'Why didn't we hear about NSX from you as our trusted adviser? Why are hearing this from other partners VMware is bringing in? And why does it seem like you're not working for the solution we need, [but] working for the vendors needs inside of their accounts?'

Customers are going to partners and saying, 'I expect to hear about these things from you, not the vendor, as my trusted adviswr.' That has [partners] shifting from, 'It's kind of dangerous to talk about this given our other vendor relationships' to 'We have to or we're not going to have a happy customer.'

Can you sum up VMware's channel charge in 2017?

So there's lots of work going on to get more solutions-oriented, to clean up the engagement with our customers and partners so they have a better experience, and to simplify the interactions of VMware tools for partners.