2008 Channel IT Spending Survey: Cause For Cautious Optimism

End users are worried about the value of the dollar, inflation and fears of a long-term recession, but at the same time nearly three-quarters of businesses either expect the business climate to remain steady for the next 12 months or they are adjusting their sales/earnings upward.

The findings are just some of the data gleaned from the 2008 Everything Channel IT Spending Survey. The following slides break down how large, midsize and small end users feel about the economy, what technology they plan to implement in the next 12 months and what they're looking for from their technology providers.

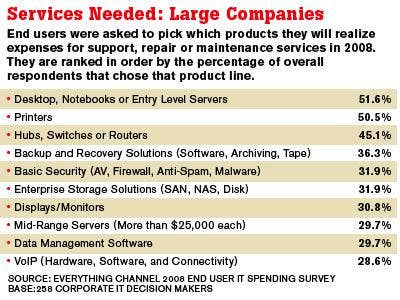

Desktops are a staple of all businesses, but more than half of large businesses expect to spend money supporting, repairing or maintaining systems and entry level servers this year.

Midsize users cited printers more than any other product category in any business size as the product they plan to spend money supporting this year.

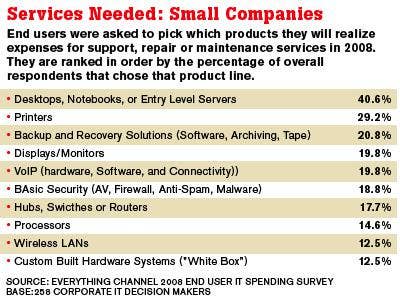

In general, fewer small businesses plan to spend money supporting, repairing and maintaining products than midsize and large end users.

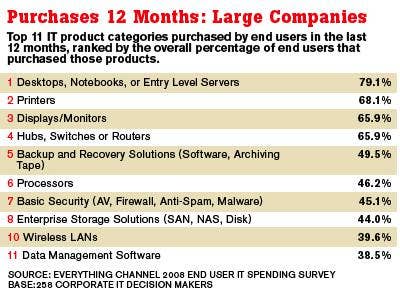

Nearly 80 percent of large companies also spent money buying new desktops, notebooks and entry-level servers in the last year.

More midsize companies also spent money on desktops, notebooks and servers in the last 12 months than on any other product line, although printers were a close second.

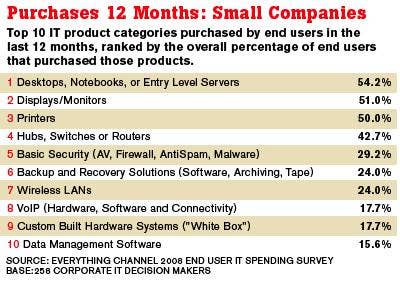

More small businesses also spent money on systems, but the overall percentage was much smaller their midsize and large counterparts.

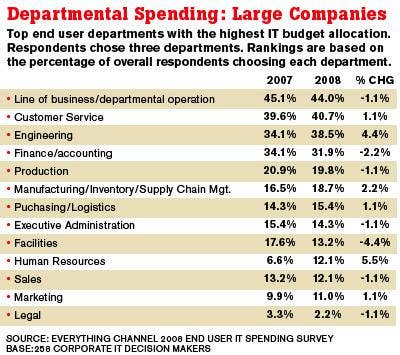

For large companies, line of business/departmental operations is the department with the highest IT budget this year, but human resources and engineering departments showed the biggest percentage increases from 2007.

Line of business also has the highest IT budgets for midsize departments, while finance/accounting, sales and engineering showed the largest increases.

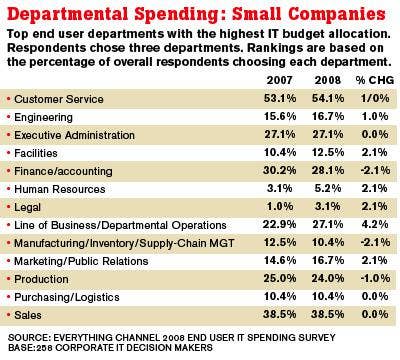

Departmental spending is not as prevalent at small businesses, but they chose customer service as having the highest IT budget.

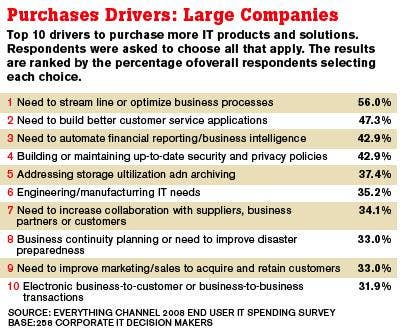

More large end users said the need to streamline or optimize business processes was the No. 1 driver for purchasing IT products or solutions. Meanwhile, establishing or improving electronic transactions between businesses and customers was not a key driver.

Midsize companies are also looking to optimize business processes, but they're looking to improve employee communications just as much.

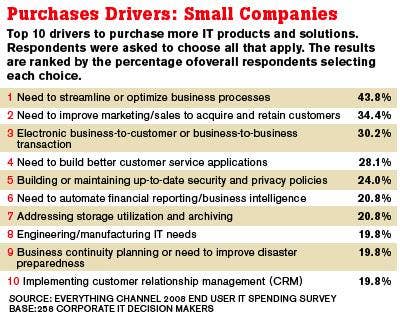

Like their large and midsize counterparts, small companies are looking to streamline or optimize business processes. Those businesses were also looking to improve marketing/sales in order to acquire and retain customers.

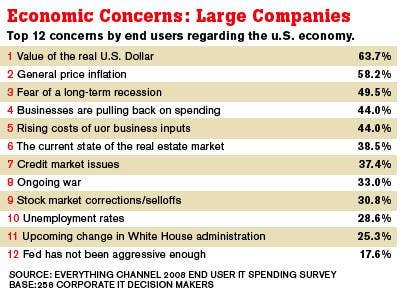

The weakening dollar, general price inflation and fear of a long-term recession are the top three things on large end users' minds. Solution providers say they haven't seen those fears translate into delayed purchases.

Midsize companies are even more worried about the value of the U.S. dollar and inflation than large end users.

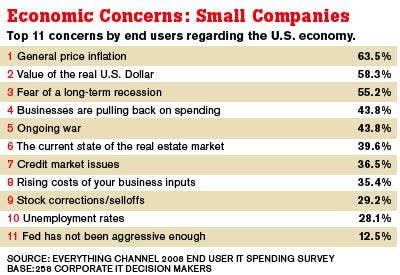

Small companies are most anxious about inflation and they're more fearful of a long term recession than midsize or large companies.

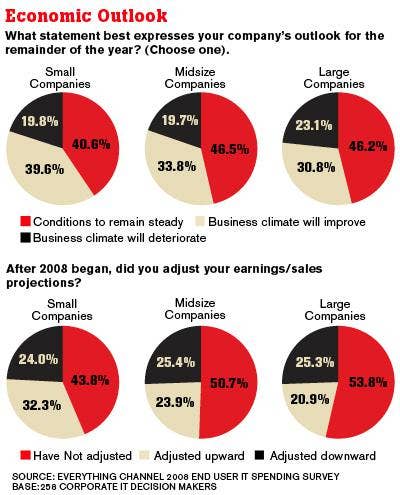

Small companies are the most optimistic for the rest of the year, as roughly 40 percent expect the business climate to improve while less than 20 percent expect conditions to deteriorate. Large businesses, while more cautious, also expect conditions to improve more than they expect things to worsen.

More companies have not adjusted their earnings/sales projections since the start of the year, but those that have are split: small companies have adjusted their forecast upward, while midsize and large companies have adjusted downward.

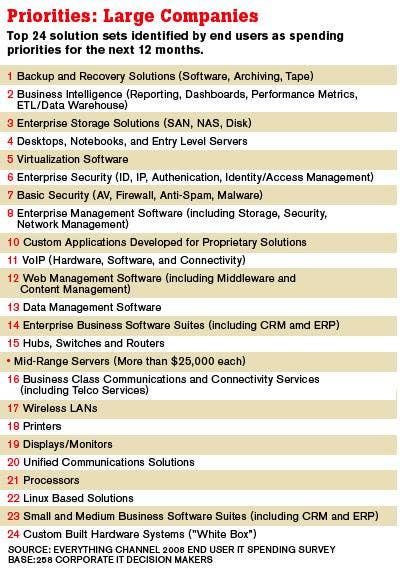

Backup and recovery solutions are the top spending priority for large companies for the next 12 months. As you might expect, other enterprise-level solutions such as business intelligence, storage, security and management software also ranked in the Top 10. Meanwhile, white box builders may be face a tough time penetrating the large customer segment.

Midsize companies appear to be poised for a refresh cycle of desktops, notebooks and entry level servers. Backup and recovery solutions were also highly-ranked in this customer segment. Midsize customers don't seem as interested in unified communications, white boxes and mid-range servers. At least not for the next 12 months.

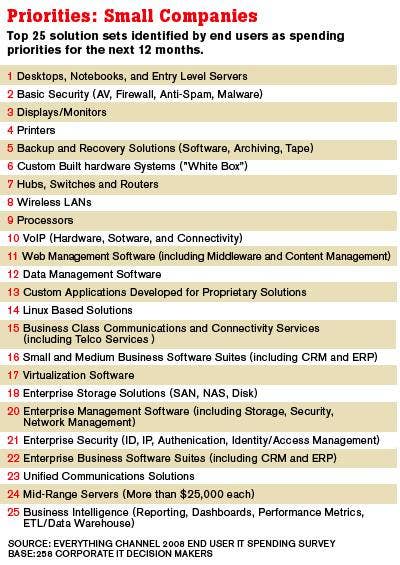

Like their midsize brethren, small businesses have also made a desktop, notebook and entry server refresh a top priority. White boxes fared much better in this customer segment, while most enterprise technologies -- such as storage, management software, security, business software suites and business intelligence -- did not.

More large companies are looking at adding mid-range servers for the first time this year. Their second choice, VoIP, was the top new technology for small and midsize businesses.

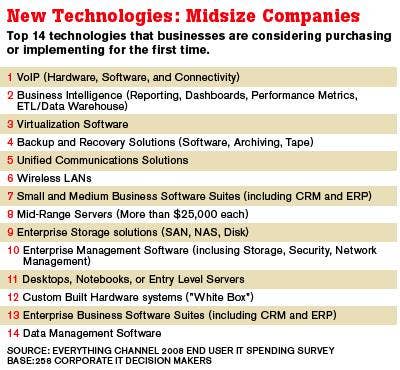

After VoIP, business intelligence applications and virtualization software were drawing interest from midsize companies.

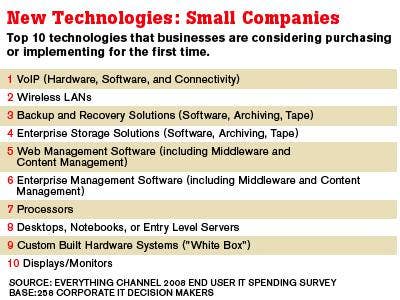

Many solution providers said VoIP has become more popular because prices have come down to make it affordable to small businesses. The same might be said for wireless LANs and backup and recovery solutions, both of which were popular with small companies.

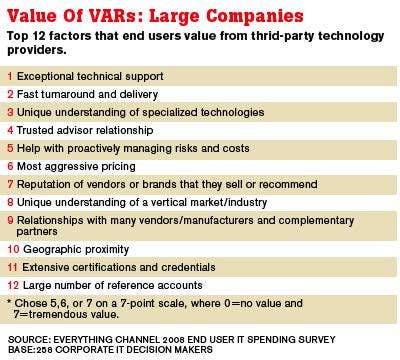

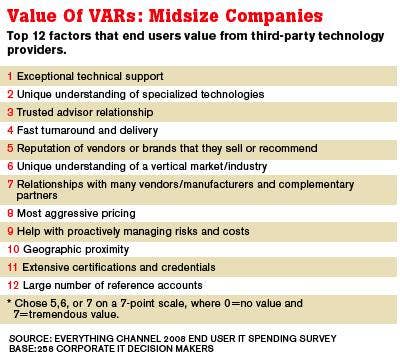

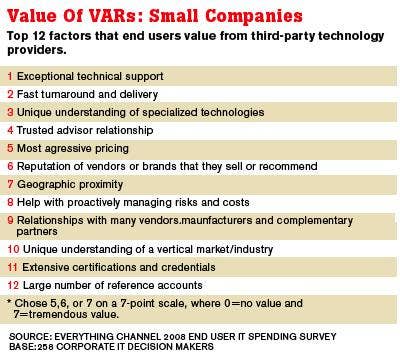

All groups of end users (small, medium and large) selected technical support as the valued factor that they want from their third-party technology providers, aka VAR partners. Large companies also want fast turnaround and delivery and understanding of specialized technologies. Certifications and lots of reference accounts were the least valuable in the survey.

Midsize customers also want their solution providers to understand specialized technologies and provide exceptional tech support. They also want more of a trusted advisor relationship from VARs than their large company peers.

Like the other two end user groups, small businesses value tech support, delivery and knowledge of specialized technology. Aggressive pricing also fared the highest with small companies, compared to midsize and large customers.

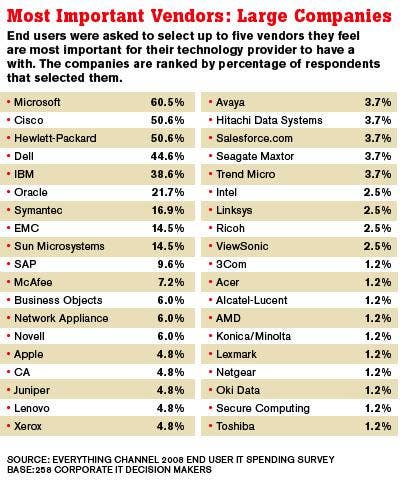

It's no surprise that Microsoft, Cisco Systems and Hewlett-Packard were chosen as the top three vendors that large end users want solution providers to have a relationship with. What might come as a shock is that Dell ranked fourth. Large companies also valued relationships with more enterprise-focused manufacturers such as Oracle, EMC, Sun Microsystems and SAP.

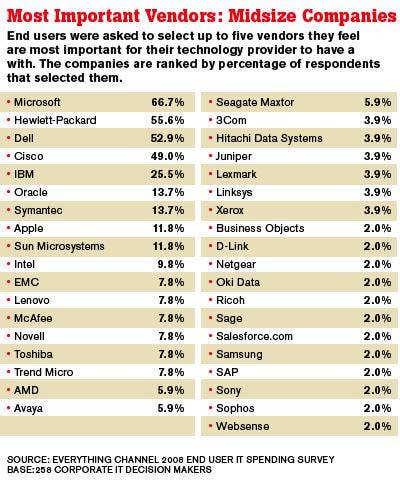

Microsoft, HP, Dell and Cisco were also the top four most important vendors for midsize customers. Apple had its best showing in this customer segment (eighth).

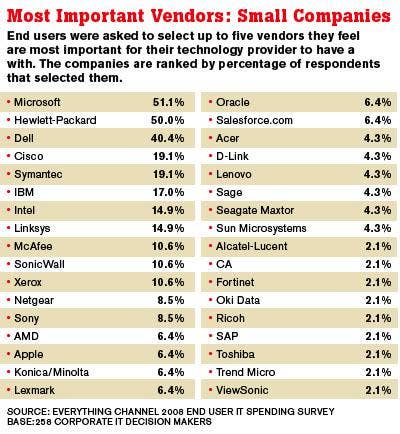

Symantec was the fifth most valuable vendor for small companies. Other vendors with their best finishes in this customer set include Intel, Linksys, McAfee and SonicWall.