Affinity Index: Operating Systems

Microsoft Windows market share may be slowly eroding due to the growing popularity of competitors' offerings, but the software giant still dominates the operating systems space, where end users' brand preference plays the biggest factor in choosing an OS vendor, according to new research by the Institute for Partner Education & Development.

According to IPED's new Channel Affinity Index, Microsoft had by far the largest percentage share in terms of the dollar value of proposals VARs wrote in the first half of the year, and those expected to close in the second half, easily outpacing the competition. Microsoft also blew away the field in terms of overall Channel Affinity Index score in the category.

But despite Windows' status as the industry's "alpha" operating system, the average transaction size of Microsoft-related deals was generally smaller than those of Red Hat, Sun and Novell, according to new research by IPED.

The following slides illustrate some results in the SMB operating systems category. ChannelWeb will provide further findings in other product categories throughout December.

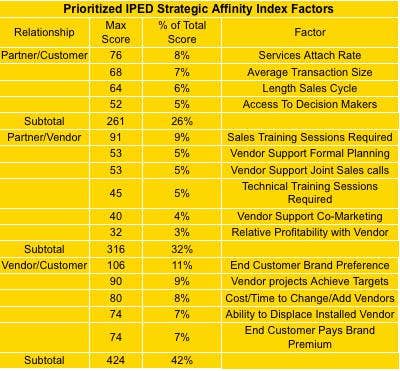

In the Affinity Index study, solution providers were asked to score vendors in 15 different factors, also weighing those factors in terms of importance. In the operating systems category, solution providers chose the end customer brand preference as the most important factor, giving it 11 percent of the total score. That was followed by vendors' ability to achieve project targets, with 9 percent of the total score.

Meanwhile, solution providers gave short shrift to the relative profitability with an OS vendor, giving it just 3 percent of the total score.

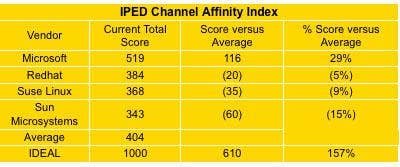

Microsoft attained the highest Channel Affinity Index score in the category, with a total score of 519 -- 29 percent higher than the average score of 404 points. Red Hat was second with 384 points, followed by SuSe Linux (368) and Sun Microsystems (343).

The large margin of victory came as no surprise to Microsoft channel partners. "For a company Microsoft's size and with its level of market dominance, they're really friendly to partners of all shapes and sizes," said Todd Swank, vice president of marketing at Nor-Tech, a Burnsville, Minn.-based system builder and Microsoft partner.

Microsoft's channel reps are constantly reaching out to partners to get feedback and figure out how to create programs to sell products, which is going to be key to surviving in challenging times, Swank added.

"Microsoft has a huge array training and channel program offerings for resellers of all sizes," said Swank. "If you want to sell technology, you can find a program with Microsoft to get trained and build your business, plain and simple."

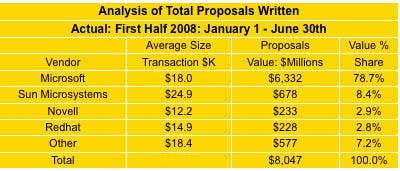

With the top Affinity Index score, it's no surprise that Microsoft generated the largest share of revenue in terms of proposals to customers in the first half of the year. Microsoft was the key OS vendor in almost 80 percent of proposals to customers during that period.

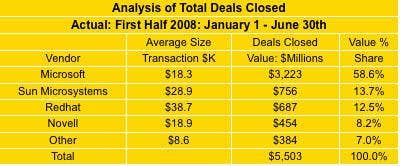

When it comes to sealing the deal, no other vendor even came close to Microsoft. The software giant recorded a dominating 58.6 percent dollar value share derived from deals closed in the first half of 2008, with Sun Microsoft coming a distant second with 13.7 percent, followed by Red Hat (12.5 percent) and Novell (8.2 percent).

However, Microsoft had the lowest transaction size of the top four vendors for deals that closed in the first half, with $18,300, compared to $38,700 for Red Hat, $28,900 for Sun Microsystems and $18,900 for Novell.

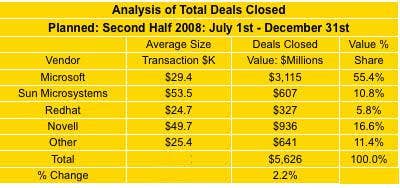

Microsoft also dominated the field in terms of the dollar value share of deals planned to close in the second half of the year, racking up 55.4 percent, compared to Novell with 16.6 percent, Sun Microsystems with 10.8 percent, and Red Hat with 5.8 percent. Overall, it appears Microsoft's competitors are making some market share progress, at least compared to the first half of the year.

However, in terms of average size of transactions projected for the second half, it was Sun Microsystems that came out on top, with an average of $53,500, followed closely by Novell with $49,700. Microsoft actually moved up a notch from the first half of the year in this category, with an average deal size of $29,400, while Red Hat came last with $24,700. All told, solution providers expected to generate 2.2 percent more revenue through OS business in the second half of the year, compared to the first half.