Affinity Index: Systems Management Software

In the market for SMB systems management software, which lets companies automate day-to-day tasks like provisioning, patch management and performance monitoring, VARs say their services attach rate is the most important factor when considering a vendor. A vendor's ability to meet project targets and end users' brand preference are also important, according to new research by the Institute for Partner Education & Development (IPED).

IPED is the research arm of Everything Channel, the parent company of ChannelWeb.

According to IPED's new Channel Affinity Index, Hewlett-Packard had the largest percentage share in terms of the dollar value of proposals VARs wrote in the first half of the year, and those expected to close in the second half, outpacing competing vendors by a wide margin. However, the HP placed third among SMB systems management software vendors in the study, trailing category leaders Oracle and Microsoft.

The following slides illustrate some results in the SMB systems management software category.

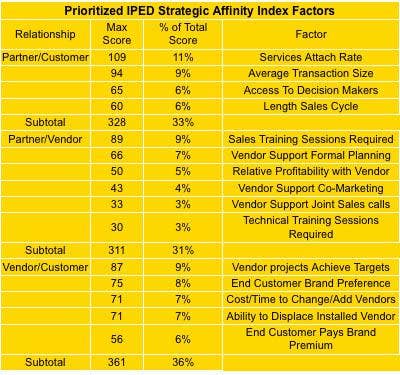

To determine the Channel Affinity Index, solution providers were asked to score vendors in 15 different factors, also weighing those factors in terms of importance. In the systems management software category, solution providers chose services attach rate as the most important factor, giving it 11 percent of the total score. That was followed by vendors' ability to achieve project targets, sales training and average transaction size, each with 9 percent of the total score.

Meanwhile, survey participants indicated that joint sales calls with vendors and technical training for systems management software were the least important factors, each with 3 percent of the total score.

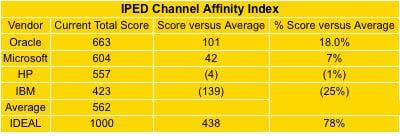

Oracle claimed the top spot in the systems management software category of the Affinity Index with an overall score of 663 points, 101 points above the average score of 562 points. Microsoft was second with 604 points.

Oracle claimed the top spot, even though HP captured the most share of revenue in terms of proposals to customers in the first half of the year, dollar value of deals closed in the first half of the year and dollar value for deals projected to close in the second half.

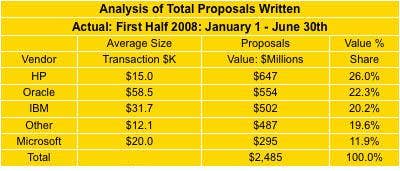

HP took the top spot in terms of dollar value share of systems management software proposals written in the first half of the year, with 26 percent, compared to 22.3 percent for Oracle and 20.2 percent for IBM. Microsoft placed a distant fourth in this category with 11.9 percent.

Oracle, with an average transaction size of $58,500 in systems management software proposals written in the first half of the year, blew away the field by a sizable margin in that regard. IBM placed second with an average transaction size of $31,700, followed by Microsoft ($20,000) and HP ($15,000).

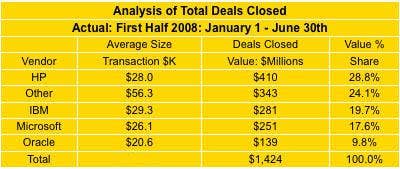

HP partners showed the ability to close systems management software deals more effectively than others in the first half of the year, with a dollar value share of 28.8 percent. Placing a distant second was IBM with a dollar value share of 19.7 percent, followed by Microsoft with 17.6 percent. Affinity Index systems management software top dog Oracle managed just 9.8 percent.

However, in systems management software deals that closed in the first half of the year, IBM had the largest average transaction size -- $29,300 -- and HP was second with a $28,000 average deal.

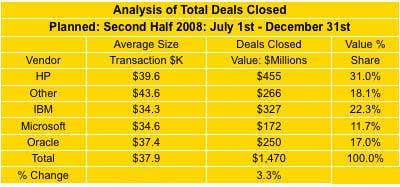

HP also dominated the field in terms of the dollar value share of deals that VARs plan to close in the second half of the year, racking up 31 percent, compared to IBM with 22.3 percent, Oracle with 17 percent and Microsoft with 11.7 percent.

HP also came out on top of its three closest competitors in average transaction size of systems management software deals projected to close in the second half, with $39,600, followed by Oracle with $37,400, Microsoft ($34,600) and IBM ($34,300).

Overall, VARs expect to close 3.3 percent more revenue in systems management software deals in the second half of the year than in the first half.