Affinity Index: Collaboration Software

Pick most any SMB software category and odds are Microsoft will be a major player. And that's certainly true in the collaboration application space, where new research by the Institute for Partner & Education Development (IPED) illustrates Microsoft's dominant position in the SMB channel. The research also shows IBM hanging in as Microsoft's chief competitor in the Collaboration arena. IPED is the research arm of Everything Channel, which also owns ChannelWeb.

According to IPED's new Channel Affinity Index, Microsoft accounted for nearly half of the value of all collaboration software proposals to SMB customers in the first half of the year. The Redmond, Wash., software vendor also snagged more than half of the deals closed during that period and was projected to win almost half of all deals expected to close in the second half of the year.

But despite that healthy business, Microsoft finished third in the Channel Affinity Index rankings, perhaps indicating its lofty status could be at risk.

The following slides illustrate some results in the SMB collaboration software category.

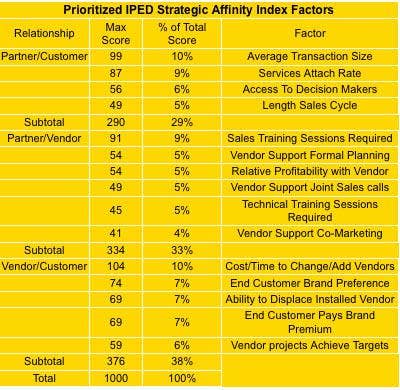

IPED's Channel Affinity Index study asked solution providers to score vendors in 15 different factors, criteria which the solution providers were also asked to weigh for their importance. The study found that collaboration software VARs consider average transaction size, and the time and expense associated with changing or adding a vendor as a supplier to be the most important factors when working with a vendor. Each of those criteria accounted for 10 percent of the total score. Those were followed closely by the services attach rate and the sales training sessions required (each 9 percent of the total score). The least important factor was vendor co-marketing support, accounting for only 4 percent of the total score.

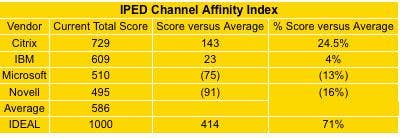

While Microsoft ranked first in the value of proposals written and deals closed, it placed only third after Citrix and IBM in the Channel Affinity Index score, which accumulated the vendors' scores in all 15 factors. Citrix's Affinity Index score of 729 far outpaced those of its competitors and was one of the highest in any category measured by IPED. The company's online division, created after Citrix's 2003 acquisition of Expertcity, offers such collaboration services as GoToMeeting, GoToWebinar and GoToAssist.

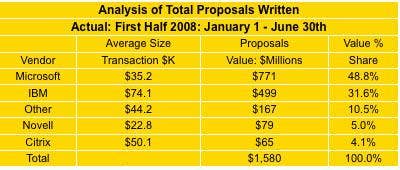

SMB VARs may show Citrix the most affinity, but they show Microsoft the most business, according to IPED's research. Microsoft's dollar-share of all channel-generated written proposals for collaboration application sales in the first half of 2008 was 48.8 percent with an average transaction size of $35,200. IBM was second with a 31.6 percent share, but its average transaction size was a hefty $74,100.

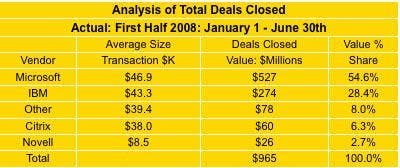

Microsoft's first-half share grew when examining the value of deals closed by the company's channel partners. The numbers tell the tale: Microsoft partners closed 54.6 percent of all SMB collaboration software dollars through the channel--nearly twice that of second-place IBM.

Microsoft also edged out IBM with its $46,900 average transaction size.

"In any [deal] that's a competitive situation, Microsoft won't lose," said Ronnie Parisella, CTO of Primary Support, a New York-based solution provider for whom Exchange accounts for as much as 15 percent to 20 percent of sales. The developer offers discounts and whatever other incentives it takes to close a sale, he said. Also helpful is Microsoft's open-value licensing plans that provide customers with upgrade protection for three years. "That's a huge benefit right there that helps us close deals," Parisella said.

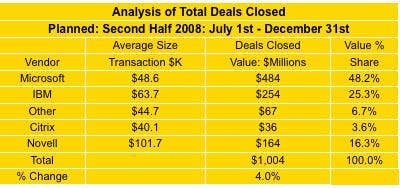

Microsoft partners seem more cautious in their outlook toward how sales in the second half of 2008 will tally. The total value of deals Microsoft resellers plan on closing before Dec. 31 is a little below the total for the first half of the year, although they expect the average deal size to inch up to $48,600. Meanwhile, VARs forecast the value of all deals expected to close in the second to increase 4 percent compared to the first half, but they expect the average transaction size to grow more than 40 percent.