Affinity Index: SMB Storage Virtualization

Of the top three SMB storage virtualization vendors, IBM looks to be on track to gain the most share of the storage virtualization market compared to its top competitors, Hewlett-Packard and EMC, according to a survey by Everything Channel's Institute for Partner Education & Development (IPED).

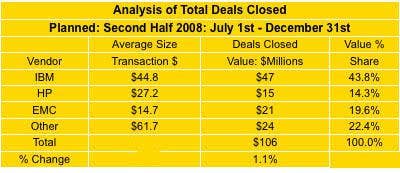

That's good news for IBM solution providers in a market that VARs only expect to grow 1.1 percent in the second half of the year, compared to the first half. IPED's new Channel Affinity Index also found that solution providers said services, sales training and customer lock-in potential offer the vendor and its partners the best opportunities.

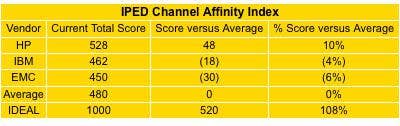

Yet despite its dominance in terms of the value of storage virtualization deals that have either been closed or are pending, IBM takes second place to HP in terms of overall channel affinity thanks to its longer history of offering storage virtualization to small and midsize businesses and its varied solutions focusing on this part of the market.

The following slides illustrate some results in the SMB storage virtualization category. ChannelWeb is providing further findings in other product categories throughout December.

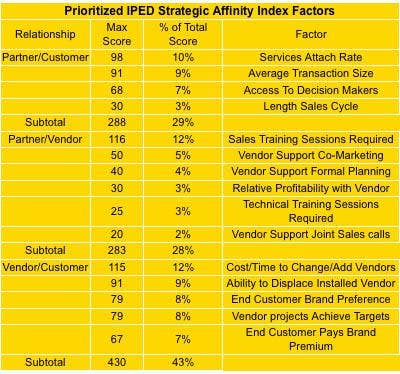

To determine the Channel Affinity Index rankings, solution providers scored vendors in 15 different categories, and also weighed those categories in terms of importance. The study found that storage virtualization VARs scored sales training as the most important factor determining affinity in the server virtualization market. VARs gave 12 percent of the final score to sales training, along with the cost and time it takes to change or add a vendor. Services attach rate also scored well, accounting for 10 percent of the total score.

The three factors indicate that storage virtualization offers solution providers not only strong services opportunities, but also strong value-add possibilities. That most likely results from small and midsize customers understanding the importance of storage virtualization while requiring hand-holding from their solution providers as they move into this relatively new technology.

However, it appears that some solution providers are willing to sell storage virtualization solutions on their own, as vendor support for joint sales calls accounted for only two percent of the total score, the lowest of the 15 factors.

HP, perhaps thanks to its much longer history compared to IBM and EMC of working with small and midsize businesses in the storage market, was rated the vendor in the storage virtualization part of that market with the highest Channel Affinity Index score (528), which adds up the vendors' scores for all 15 factors in the index.

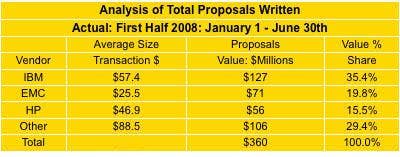

While IBM is the No. 2 SMB storage virtualization vendor in the Channel Affinity Index, according to various analysts' reports, the vendor's solution providers proposed a higher percentage of the value of all small and midsize storage virtualization proposals in the first half of the year than did partners of its two nearest competitors.

According to the IPED survey, IBM's solution providers proposed deals that totaled 35.4 percent of the total SMB storage virtualization market in the first half of 2008, with average deals worth $57,400. EMC was second in terms of the value of deals proposed despite being third in terms of average value per deal because of its rather late entry into the small and midsize business market compared to its competitors.

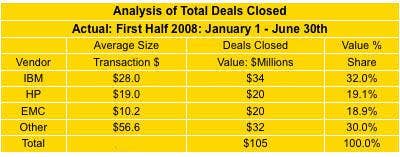

IBM's solution providers were also able to close the lion's share of the value of storage virtualization deals during the first half of the year. IBM accounted for 32 percent of the value of all closed deals in the first half, with an average transaction of $28,000.

Meanwhile, the value of deal proposals from EMC's partners was more than HP in the first half, but when it came to signing contracts, HP's partners fared slightly better than EMC.

Despite HP's top score on the IPED Affinity Index, IBM is expected to maintain its top position in terms of deals that VARs plan to close in the second half of 2008, according to IPED. VARs expect IBM to close 43.8 percent of all SMB storage virtualization sales in the second half of the year.

More and more clients are working with IBM's storage virtualization technology, including its lead product, the SAN Volume Controller, or SVC, said Leif Morin, president of Key Information Systems, a solution provider and IBM partner.

While storage virtualization has been around for some time, customers still have a sense of mystery surrounding the technology before it is implemented, Morin said.

" 'What is the value?' they ask," Morin said. "But after it's implemented, it becomes the 'fax machine' of computing. I've had clients come back and say, 'How did I ever manage storage without it?' Those exact words."

SVC's ability to move volumes of data while an application is running is very important, Morin said. It is also a high-performance solution. "It's not functional to deploy virtualization technology for flexibility if it impacts performance," he said. "IBM takes care of both."