2008 CRN Fast Growth 100: Speed Demons

In years of economic slowdowns -- such as 2007/2008 -- companies typically look to streamline operations, reduce costs and increase efficiencies. They also look to solution providers to help them achieve those goals. That's why, despite the stress of high-energy costs, continuing financial market turmoil and a still-declining housing sector, companies' most trusted IT partners are growing at extraordinary rates. Almost 70 percent of this year's respondents said that while the general economy may be in slowdown mode, there also was an opportunity to do work for customers that meets the challenges of the current environment, such as helping them cut operating costs.

The average 2007 revenue for CRN Fast Growth companies is $106.4 millionand#8212;that's 64 percent higher than last year's group of elite companies. How much is the Fast Growth 100 worth? All told, $10.635 billion. That's the same as the GDP of Jamaica, or of Nicaragua and Haiti combined. On the flip side, it's the same as the budget deficit in California. Gov. Arnold Schwarzenegger would do well to court even more of these companies to locate in the Golden State; currently, 13 are located in California.

From Last Year To This Year, A Nice Showing

The Fast Growth list saw a bit of movement from 2007 to 2008, with last year's third-ranked company assuming the top spot: $160-million NWN Corp. took the honor from $64.9-million Groupware Technology, which fell to #35. A total of 57 companies are new to the list this year. However, companies returning from last year are stronger overall than the debuting solution providers: They are more profitable, faster-growing and showed larger gains. For example, the alumni averaged 19 percent profit, while newcomers averaged 5 percent. In addition, newcomers averaged $79 million in 2007 sales, which is 25 percent lower than the list average. Repeat VARs on the list averaged $142.6 million in 2007 sales, 34 percent higher than the FG100 average. And, newbies have less staffand#8212;on average, they have 31 percent fewer employees, while alumni have 40 percent more employees.

Overall, the two-year revenue increase for our 2008 elite 100 was $59.4 million, $22.1 million (or 59 percent) more than that of the Fast Growth 2007. Further, the lowest rate of growthand#8212;52 percentand#8212;reported by Atrilogy Solutions Group Inc., rank #100, was higher than the 2007 CRN Fast Growth company that ranked #100. That solution provider, Webistix Inc., reported 27 percent growth between 2004 and 2006, but is on this year's list at No. 82 with 66.76 percent growth.

Smaller companies such as $3.36 million Webistix do have a growth advantage, because it's clearly easier to double $1 million in revenue than to multiply $1 billion in sales. However, the base revenue of the top 50 Fast Growth 2008 companies was only slightly lessand#8212;0.32 percentand#8212;than the base revenue of the overall 100. On average, the top 50 increased their revenue by $87 million from 2005 to 2007, while the average for all 100 companies was $59.4 million. In addition, one company, Cognizant Technology Solutions Corp. (FG 2008 #30), again this year was the solo billion-dollar club member with revenue of more than $2 billion, up 141.08 percent from 2005.

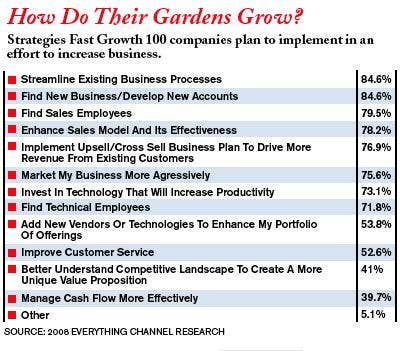

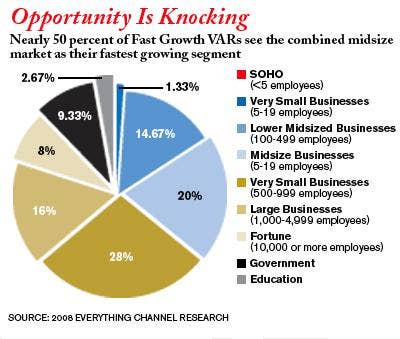

Just as their customers are working toward increasing efficiencies, so, too, are FG100 companies. In fact, the two most popular action items for these 100 solution providers are streamlining operations and adding to their customer base (see chart, "How Do Their Gardens Grow?" this page). In an effort to attract more clients, solution providers know they must broaden the spectrum of technologies they offer. To do that, a whopping 85 percent of these VARs partner with other VARs and consultants. Overall, most of them (48 percent) see the midsize market as their fastest-growing opportunity this year .

"There are no 'secrets' to growing a great business," said Mont Phelps, NWN's CEO, "but unfortunately, no shortcuts either. It takes great people, a commitment to excellence and hard work. I am very pleased with our accomplishments, but we are not satisfied and that leads to a positive culture of relentless pursuit of improvement in everything we do." (See "Grow Fast Or Flounder".)

For NWN and other top VARs, the key to success is in taking a long-term perspective in everything they do. Their focus is on developing and sustaining excellent relationships with customers, in part, by cultivating strong partnerships with the leading vendors built on mutual benefit and trust. Staffing is also a top priority. Said Phelps: "We offer a positive culture and a career path to the best people in the industry, not just jobs."

Next: Tech Talk

Tech Talk

What are the technologies that these top-tier players are looking at to fuel expansion? The technologies that will most drive growth in the coming year or so, according to the FG100, are virtualization software (according to 35 percent of respondents), managed services (28 percent) and unified communications (also 28 percent). In addition, our top 100 are ahead of the curve in terms of implementing various technologies. For example, VoIP is offered by nearly 70 percent of the FG100, but by less than 30 percent of the general solution provider population. FG100 companies are 141 percent more likely to offer VoIP than the average SP. Nearly 69 percent of these solution providers said at least 1 percent of revenue is derived from VoIP, and 45 percent said at least 6 percent.

Furthermore, enterprise security is offered by 47 percent of FG100 companies, but by only 26 percent of the general SP population. FG100 companies are 83 percent more likely than the average SP to offer enterprise security. Almost 47 percent of respondents said that enterprise security accounted for at least 1 percent of revenue; 18.2 percent said it accounted for at least 6 percent.

Another top technology, unified communications, is offered by 42 percent of the FG100, while only 23 percent of the overall SP population is involved in that segment. Overall, FG100 companies are 81 percent likelier to offer UC. About 42 percent of respondents said that UC accounted for at least 1 percent of revenue; 26 percent said it accounted for at least 6 percent.

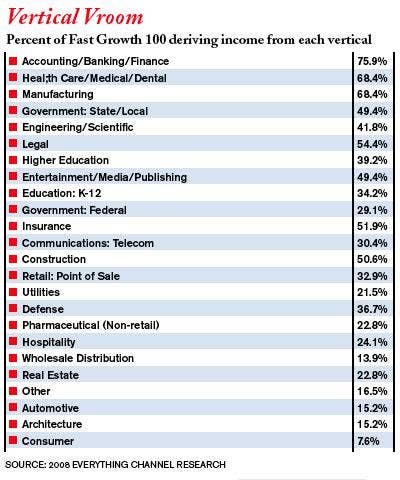

The FG100 takes those technologies and targets specific verticals. Most popular is the accounting/banking/financial sector, with 75.9 percent deriving revenue from there, followed by health care and manufacturing, at 68.4 percent each

Among all technology partners, Cisco Systems Inc. is a landslide winner; Fast Growth VARs consider the networking powerhouse their most strategically important vendor. Solution providers also said that Microsoft Corp. and Dell Inc. were among their top five vendors; interestingly, 17 percent considered Dell as one of their top five strategic vendors.

Next: New Faces Stoke The List

New Faces Stoke The List

Newcomers made up more than half of the 100 companies (see "Adaptand#8212;And Grow Like Gangbusters"). However, as was mentioned earlier, 2007 alumni outshine the newcomers in profitability, averaging 19 percent profit compared with newcomers' 5 percent.

Newcomers also generally tended to grow at a slower pace than alumni. The average growth rate of newcomers was 131 percent, which is 15 percent below the list's average. However, among those that were also on the list in 2007, the average growth rate was 184 percent, which is 20 percent higher than the 2008 list's average.

Where They're From

Does geography play a role in success? Fast Growth companies come from all over the United States. Using the U.S. Census' definitions of geographic regions, CRN found that the most companies, 29 of them, come from the Northeast (Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont), and accounted for $3.78 billion in revenue, or 35.5 percent of the entire FG100's revenue.

The South (Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia) has the second-highest number of FG solution providersand#8212;26. They account for $3.84 billion in revenue; that's 36 percent of the entire FG100's revenue.

Twenty-one companies hail from the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin). Those 21 account for $949.82 million in total revenue, or 8.9 percent of the FG100 list.

The West (Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming) is home to 23 companies. They came in with total revenue of $1.24 billion, equal to 11.7 percent of the list's total revenue.

In addition, another company, Genpact Global (FG 2008 #81), which hails from Puerto Rico, reported revenue of $821 million, or 7.8 percent of the total list. Fast-growing companies are spread throughout the United States and its territories.

The companies that have made our list have shown perseverance and a commitment to growth despite a stormy economic climate. They have found a niche to thrive in, whether that's a vertical or a particular family of technologies. They are focused and driven to succeed, and that is what propels their growth. Growth for the sake of growth is unhealthy; the key is to grow wisely, within a business plan, to outline and achieve concrete, measurable goals. In its totality, the growth of the exclusive club of IT solution providers can't be slowed by economic forces, but, instead, is adaptable, innovative and indomitable.

New Faces Stoke The List

Newcomers made up more than half of the 100 companies (see "Adaptand#8212;And Grow Like Gangbusters"). However, as was mentioned earlier, 2007 alumni outshine the newcomers in profitability, averaging 19 percent profit compared with newcomers' 5 percent.

Newcomers also generally tended to grow at a slower pace than alumni. The average growth rate of newcomers was 131 percent, which is 15 percent below the list's average. However, among those that were also on the list in 2007, the average growth rate was 184 percent, which is 20 percent higher than the 2008 list's average.

Where They're From

Does geography play a role in success? Fast Growth companies come from all over the United States. Using the U.S. Census' definitions of geographic regions, CRN found that the most companies, 29 of them, come from the Northeast (Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont), and accounted for $3.78 billion in revenue, or 35.5 percent of the entire FG100's revenue.

The South (Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia) has the second-highest number of FG solution providersand#8212;26. They account for $3.84 billion in revenue; that's 36 percent of the entire FG100's revenue.

Twenty-one companies hail from the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin). Those 21 account for $949.82 million in total revenue, or 8.9 percent of the FG100 list.

The West (Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming) is home to 23 companies. They came in with total revenue of $1.24 billion, equal to 11.7 percent of the list's total revenue.

In addition, another company, Genpact Global (FG 2008 #81), which hails from Puerto Rico, reported revenue of $821 million, or 7.8 percent of the total list. Fast-growing companies are spread throughout the United States and its territories.

The companies that have made our list have shown perseverance and a commitment to growth despite a stormy economic climate. They have found a niche to thrive in, whether that's a vertical or a particular family of technologies. They are focused and driven to succeed, and that is what propels their growth. Growth for the sake of growth is unhealthy; the key is to grow wisely, within a business plan, to outline and achieve concrete, measurable goals. In its totality, the growth of the exclusive club of IT solution providers can't be slowed by economic forces, but, instead, is adaptable, innovative and indomitable.

Research editor Jeanette Boyne contributed to this story.