Vendor University: Is It Getting Better?

CHANGING ATTITUDES: VENDOR UNIVERSITY MAKES THE GRADE

Could peace be at hand?

The ongoing tension evident in recent years between vendors and channel partners over the proliferation of training and certification programs, rising costs and constantly changing requirements appears to be waning.

Solution providers' satisfaction with vendor training is on the rise, thanks to a number of factors, among them a solid economy, rising return on training investments, more flexible and streamlined programs, improved Web-based training and greater willingness by vendors to invest in training loyal channel partners.

"Keep it coming," said John Riddle, president of Information Networking, a Cisco and IBM networking integration partner in Irvine, Calif., echoing the view of a number of solution providers. "Keep the tests expensive and difficult [in order] to weed out the flakes."

Riddle said he's tired of hearing complaints about training and certification costs. Yes, he's paying a lot more than he was a few years ago, and his need to get people trained is growing in areas such as security and telecommunications. But he added: "I'm all for that. I truly believe in the long-term benefit."

This year's CRN Certification and Training Report—based on an analysis of three major CRN surveys assessing solution provider satisfaction, channel compensation and profitability—indicates there are key differences in the way solution providers view training and certification issues ( see charts) based on their area of focus. Software partners are not quite as happy as network infrastructure solution providers, for example. But the surveys, along with CRN's interviews with solution providers, indicate that Riddle's view reflects attitudes across the channel.

In general, solution providers are experiencing a relatively quick return on training investments. In the 2006 CRN Profitability Survey, solution providers indicated their return on investment ranged from 7.3 months in network security to 4.8 months in mobile technology. In the 2006 CRN Channel Compensation Survey, solution providers not only placed above-average importance on vendor-paid training but expressed above-average satisfaction with the vendor-paid training they receive.

Some suggest one reason for that may be because the distinction between training, education and communications is blurring as vendors use Webinars, podcasts, online training tools and other methods to deliver training in smaller, more digestible segments.

"I think the industry is building more short-chunk modules, and you hear less and less grousing because nobody is spending five days in Chicago to get trained," said Tom Kelly, vice president of NetApp University, the corporate training arm of storage vendor Network Appliance, Sunnyvale, Calif. "The destination training is kind of evaporating. The classroom training is still going on, but it's more selective."

For smaller VARs, that is certainly a big plus. "The online training tools, in terms of efficiency, have increased threefold. Whether it's Microsoft or VMware, they're all doing a pretty good job," said Ron Kramer, president of All Computer Solutions, a small-business solution provider in Portland, Maine. "The resources on the Web are just extraordinary."

NetApp University, which like most corporate training units operates on its own P&L, also increasingly is working with marketing and sales units in what Kelly called a "coalition model" to help those units create workshops, Webinars, boot camps and free online course content. "Right now, one of our metrics is success through empowerment of others," Kelly said. "Everybody is struggling with, 'I've got to do more with less because partners aren't going to pay for it.' "

Not everyone is equally happy with the state of training and certification. In infrastructure software, only 26 percent of solution providers said they received any form of free training, and satisfaction levels were low compared with those of solution providers in networking and systems areas.

"I think it's gotten better in the business applications world, but on the infrastructure side, it's still the same," said Alex Solomon, president of Net@Work, New York, which sells CRM and accounting solutions from Sage Software. Solomon praised Irvine, Calif.-based Sage for accommodating larger partners by not requiring all of his consultants to go through certification training, providing training rebates and delivering new programs in sales and consulting training.

"On the infrastructure side, it's very difficult," he added. "Everybody wants you to get authorized on their products."

Training also remains a concern among security specialists. While 37 percent of solution providers in the security area received some form of free training, they also reported the longest return on investment in training and below-average satisfaction in the amount of training subsidies they received.

"You're seeing a rising need for more and more certifications. What's also happening with the bigger ones is you think you have it down and they keep changing things and you have to do more," said Pat Grillo, president and CEO of Atrion Communications Resources, a security specialist in Somerville, N.J. "That's when you question what you're doing."

By bigger ones, think Cisco Systems. According to Grillo, Cisco alone could keep his guys in class full-time. One upshot for Atrion is that it may start focusing on fewer vendors. As Cisco's security product line matures, Atrion is liable to drop vendors with overlapping point products. "You have no choice," Grillo said. "You can't have our guys going to school everywhere."

For major vendors, that's not a problem. They are using training and certification programs as a way to cement partner loyalty and improve attach rates, solution providers said. Distributors also are getting into the act. Atrion, which buys most of his Cisco gear through Ingram Micro, was recently approached by Tech Data with an offer to receive free Cisco training credits in exchange for buying products through Tech Data. "That's fairly new," Grillo said. "I think you'll see more of that going forward."

While Cisco perhaps has sparked more angst than any other vendor recently for changing its certification requirements as it adds product lines and pushes partners into specialty areas, it also has won widespread applause for the quality of its training and the benefits it delivers.

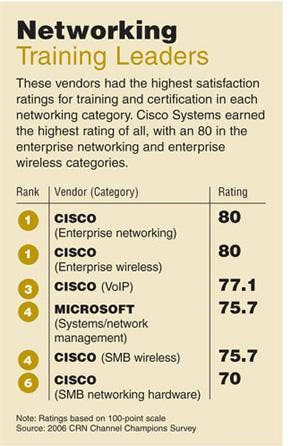

An analysis of CRN's annual Channel Champions partner satisfaction survey shows that Cisco consistently earned the highest satisfaction ratings for training in networking categories, an area where solution providers also indicated they were most likely to receive vendor-subsidized training.

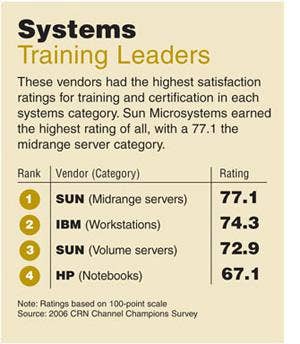

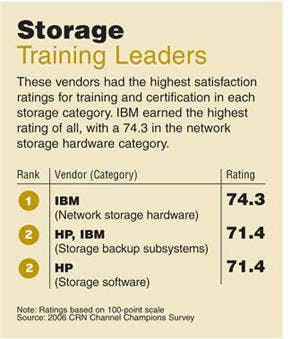

The survey results pointed to other channel training leaders as well. Microsoft's satisfaction ratings for training in business software suites was the highest in the survey. IBM took high marks in storage among the major vendors, while Sun Microsystems showed strength in the systems categories.

In the stories that follow, CRN takes a closer look at the training issues in each of these categories and at programs from the training leaders.

MICROSOFT USES TRAINING TO ITS ADVANTAGE IN BUSINESS APPS

Solution providers have to put more skin in the game with software vendors than in other technology areas—at least when it comes to training, according to CRN research.

Only 26 percent of solution providers indicated that they were receiving reimbursement for training in applications and infrastructure software, which was the lowest percentage of reimbursement of any product category, according to the 2006 CRN Channel Compensation Survey. Not surprisingly, software solution providers also were the least satisfied of any group with the vendor-paid training they receive.

But that dissatisfaction did not spill over into their bullish support for Microsoft's training and certification programs, particularly in the business applications arena.

Solution providers consistently gave Microsoft good satisfaction ratings for training and certification in this year's CRN Channel Champions survey. And its rating of 81.4 out of 100 points in business software suites, in particular, was the highest rating any vendor received in any category—software or hardware—and was higher than those of SAP, Oracle and Sage, its rivals in the category that incudes ERP, CRM and accounting software.

The fact that Microsoft Business Solutions has its roots in Great Plains Software—a small Fargo, N.D., company known for the personal care and feeding of its partners—remains a plus, some MBS partners said. Microsoft, Redmond, Wash., bought Great Plains in 2001 and subsequently bought Navision for its ERP expertise. "If you look at that lineage, you see a deep history of great training programs and a deep commitment to partners," said Alan Kahn, co-CEO of InterDyn AKA, an MBS partner in New York.

Kahn, like many MBS partners, has a dual perspective on this issue since his company both consumes training for its own staff and offers training to customers on behalf of Microsoft. Since the time of the survey, Microsoft announced that it would provide all MBS ERP customers with free online training and coursework, a decision that irked some training partners. At the Microsoft Worldwide Partner Conference in July, one Midwestern training partner said his company's revenue from e-learning and training was down 30 percent from last year. "The community of learning partners is very fragile and financially challenged," he said.

While some training partners may be dissatisfied, Terry Petrzelka, CEO of Tectura, a Redwood City, Calif.-based MBS partner, is not. Microsoft is proactive about getting its partners and customers trained on its latest wares and also is aggressive about requiring partners to get and keep certifications, he said. "You have to keep your people current, and Microsoft drives the Gold certification as a differentiator. All the major partners that are successful take that training and certification process seriously."

For Microsoft, training and education is a profit-and-loss center, although the company does not disclose much more than that. One East Coast MBS partner, who requested anonymity, said that didn't bother him. "We're happy with the training we get," he said. "We get tons of free training, tons of reduced-price training, and the fact that Microsoft training is a P&L doesn't bother us. I don't think they try to profit off of partner training."

CISCO SETS THE STANDARD IN NETWORKING TRAINING

In channel satisfaction surveys, solution providers consistently give Cisco Systems top ratings for training and certification, leaving little doubt that, in the networking world, the vendor sets the standard.

One thing that separates Cisco, San Jose, Calif., from the pack is that its expectations are high, and it doesn't waver, solution providers said. Partners who invest time and money in certification are not going to be undercut by one-off deals that give product access or benefits to non-certified partners.

"That creates value for the whole process, which requires a big investment on our part and a big investment on theirs," said Mont Phelps, president of NWN, a Cisco Gold partner in Waltham, Mass.

Cisco also is clear about requirements, giving partners an unambiguous path to follow in order to reach their goals, solution providers said. "It's probably the most well-defined program I've seen," said Ethan Simmons, partner at NetTeks Technology Consultants, a Cisco Premier partner in Boston.

While clarity and consistency are important, VARs often put the greatest emphasis on the quality of training when assessing vendor programs.

Cisco pushes the bulk of its training through the channel via a handful of partners authorized as learning centers. The quality remains high because the vendor keeps tight control over the content, constantly updating it to keep it fresh, said Mike Zanotto, COO of Skyline Advanced Technology Services, a Cisco Silver solution provider and authorized training partner in Campbell, Calif. Cisco also requires a lot of hands-on training. "About 70 [percent] to 80 percent is hands-on," he said. "Others do the bulk of their training with e-learning. Cisco has that, too, but the vast majority of the content, especially for the advanced technologies, is instructor-led."

Another factor is assessing the vendor's willingness to subsidize partner training. Among networking VARs surveyed by CRN, 40 percent reported receiving some free training. That was higher than any other area except managed services.

Cisco partners said they fund training in a variety of ways, paying for some outright while, in other cases, getting help from Cisco or its distribution partners. As a member of Ingram Micro's VentureTech Network, Information Networking gets most of its Cisco training free through the distributor. "Very seldom do we have to pony up," said John Riddle, president of the Irvine, Calif., company. "That is because of our network relationships."

As it aims to provide more differentiation for channel partners, Cisco's requirements become stiffer, creating a challenge for partners—particularly smaller players—to keep up, solution providers said. The vendor earlier this year rolled out a new, lower-end specialization that requires partners to traverse multiple technology areas, part of Cisco's effort to ensure that all of its partners have a strong foundation on which to build broad solutions.

The moves put Cisco between a rock and a hard place. On the one hand, the company is striving to cut down on the complexity of its programs. On the other, since existing partners have already invested in Cisco's training and certification, they don't want requirements to become too lax for newcomers.

"They have some work to do to make it easier to do business with them," Simmons said. "But I don't want them to make it too easy because I've already invested there."

JOHN LONGWELL contributed to this story.

AMONG SYSTEMS VENDORS, SUN IS THE TRAINING LEADER

When it comes to training on its systems, Sun Microsystems, Santa Clara, Calif., is doing something right.

While solution providers appear relatively satisfied with the vendor training they receive on systems these days, Sun's midrange server training rises to the top, according to the 2006 CRN Channel Champions partner satisfaction poll.

What's Sun's secret? System integrators say hands-on work with servers during training sessions and the quality of Sun's instructors and curricula put the vendor ahead of competitors. Solution providers also liked the quality of Sun's free online tutorials.

"If you have a day free and want to figure something out, you have the opportunity to learn it without having to spend a lot of money," said Steve McLane, principal Sun consultant at Alphanumeric Systems, a Raleigh, N.C.-based systems integrator.

McLane also likes the quality of Sun's classroom education. "They are comprehensive, and there's always the hardware that you need available. That makes all the difference," he said. "You get some hands-on training with industry experts in that field."

Sun also is actively subsidizing training for its authorized partners. While Sun's training unit, like other vendors' units, does operate as a profit center, its channel organization provides training credits to partners based on sales volume. It recently revamped its program to simplify it and help lower-volume solution providers, said Bill Cate, director of U.S. partner programs at Sun.

The new program allots credits to each tier, and each credit allows one person to take one course. Top resellers receive six credits, midtier resellers three credits and other resellers two credits per quarter. The new system not only simplifies the former accrual system, but also puts unused training credits into a "slush fund" from which other partners can borrow. "We have sized this in such a way that we think the credits are more than enough to get partners through each quarter," Cate said.

Changes in the program will not have much effect on Sigma Solutions, one of Sun's Elite resellers. "Because of our position within Sun's programs, we'll end up getting enough credits to train the people we need to train," said Eric Kronenthal, vice president of professional services at the San Antonio-based VAR.

Sun's training was superior to other system vendors because of its variety, he said. "They have top-notch training instructors and coordinators. ... We have not had to pay for any of the more advanced classes."

Amy Hargis, education operations manager at Maryville Technologies, St. Louis, said, "Students are very pleased with the courseware and the variety of offerings that Sun has. They seem very pleased with the content that is delivered and that they're able to get practical experience in the labs."

Maryville offers Sun classes for up to 14 students, but Hargis said they try to keep the numbers low to give participants more hands-on time. Each class is at least 50 percent lab time, working with the servers rather than sitting through lectures or presentations.

"I think labs are why [Sun is successful] from a feedback perspective. That's one of the biggest positives that I hear students give when they're leaving," Hargis said.

STORAGE INTEGRATORS HAPPY, IBM PARTNERS HAPPIEST OF ALL

When it comes to vendor-sponsored training programs, solution providers in the storage arena were the most satisfied of any group, and of those working with major vendors, IBM storage partners were the happiest of all, according to CRN research.

At the same time, they were less likely to get reimbursed for training expenses than solution providers in areas such as networking and security. Only 32 percent reported receiving free vendor training. One reason for that may be the bevy of smaller vendors and emerging technologies in the storage arena.

"Relative to other technologies, the total universe of storage solution providers is a little bit smaller, and the quality of education you get from vendors like FalconStor [Software] and QLogic is much higher," said Greg Knieriemen, vice president of marketing at Chi, a Cleveland-based storage integrator. "Out of our primary vendors, I've never been through a training program that I didn't think was of high value."

If Knieriemen has any beef with training and certification programs, it would be with major vendors' programs aimed at improving vendor loyalty and attach rates. "You can develop 'vendor lock' with some of those types of programs," he said.

While Knieriemen may steer away from what he described as drinking a particular vendor's punch, there are plenty of other solution providers that find aligning themselves with one of the major vendors a plus. One reason for that is the quality and breadth of training programs for increasingly complex storage solutions.

Among the major vendors, VARs gave IBM the highest satisfaction rating for training and certification in one of the CRN Channel Champions storage categories. Its rating of 74.3 out of 100 points for training in network storage hardware topped the ratings of Hewlett-Packard, Sun Microsystems, Network Appliance, EMC and Hitachi Data Systems.

Solution providers said IBM offers classes on its storage technologies, both on-site for solution providers and at IBM training locations, at a cost of between $1,000 and $3,000 each. The company also offers e-learning tutorials on CD-ROM, as well as free tutorials on storage product installation. Certification exams cost the test taker between $120 and $200 and are administered worldwide. Solution providers also said IBM gives partners credits based on sales volumes that solution providers can put toward training.

Cost is not an issue for Todd Bowling, president and CEO of Solutions-II, a solution provider in Littleton, Colo. "It's worth the investment," he said. "A lot of people's compensation in the partner community is tied to the number and levels of [employee] certifications on the product line."

IBM's ability to integrate its storage training with its other systems sets it apart, according to Ricky Kumar, director of storage technology and services for MSI Systems Integrators, Omaha, Neb. "They have a large, large offering, starting from operating systems all the way to storage. Other storage vendors are more focused on just the product they have, but they don't have a complete solution," Kumar said.

MSI also benefits from IBM sessions that describe the company's technology road map. "Especially for systems integrators like ourselves, we strive to be on top of technology, so when we compose a solution for our customers, we take future technology into consideration," Kumar said.

Storage integrators say training has become increasingly important as storage has moved from a peripheral concern to being incorporated into the fabric of network and software infrastructure.

"Storage isn't like it used to be five years ago," Bowling said. "It's probably one of the more complex solutions out on the market today. Instead of going out and selling by drive speed or tape capacity, you've got to incorporate everything from network-attached storage to SAN-attached storage to different types of software, making sure it fits into the backup-and-recovery plan. Storage touches every part of the enterprise computing environment."