HPE's Dan Belanger On Why InfoSight, GreenLake Are Game Changers For Channel Partners

The HPE ‘Safe Pair Of Hands’ Advantage

Hewlett Packard Enterprise's consistent laserlike focus on hybrid IT, intelligent edge and the services portfolio to support that strategy is paying off for partners even as competitors grapple with significant structural challenges, says HPE Managing Director, North America Dan Belanger.

"Our consistency of strategy is an advantage," said Belanger in an interview with CRN just before he formally launched a new dedicated North America storage business unit to a group of about 30 HPE partners. "As a partner recently told me, 'You have become through your transformation at this point a safe pair of hands.'

That is no small matter given the creation of the new Hewlett Packard Enterprise just three years ago and the subsequent spin-in merger of its $20 billion services business to DXC Technology and the spin-in merger of some software assets to Micro Focus.

"There were a lot of years when we were constantly in a transformational state—real structural change," said Belanger. "That is behind us. There are a lot of our competitors who are absolutely heading down that road, whether it is financial engineering or structural engineering of the company. While they are distracted with that, we have a great portfolio and laserlike focus."

Belanger said the new North America storage organization opens the door for every partner to ask: “'What company has a clear strategy and complete differentiation on both the product and solution side of the business?' That is us. That is HPE."

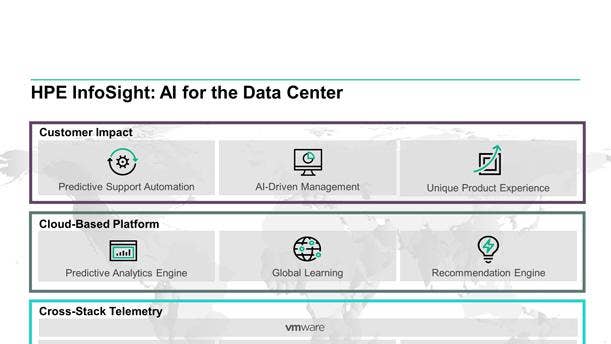

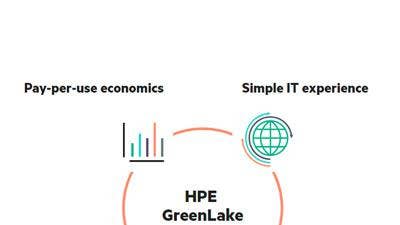

In fact, Belanger, who has won praise from partners for his channel sales commitment, said HPE's artificial intelligence-based InfoSight platform and GreenLake Flex Capacity pay-per-use model provide major competitive advantages for partners that no competitor can match.

"Those directly appeal to a partner's long-term business plan, whether it is recurring revenue through GreenLake for partners or the information they can turn into different customer experiences through InfoSight," he told CRN.

Why did you made the decision to create a new dedicated storage business unit in North America?

There are a lot of things that we ask our partners to do for us and with us. This is a way for us to clarify a solution set in an exploding market. Creating a storage business organizationally within North America with top-to-bottom responsibility allows us to be really clear in our strategy, communication and consistency with partners.

What was the genesis of the idea to create the new business unit?

When we bought Aruba a few years ago, they became a self-contained networking team within the HPE structure. So you still have the HPE umbrella, but Aruba competes as almost a separate company within the HPE structure. They know who their primary competitors are. From their planning to execution, it is all about winning in that market against their competitors first and then drafting off the HPE ecosystem. There are certainly synergies and collaboration across Aruba and the rest of the business units within HPE, but there is just clarity of charter that makes it easier for our customers and partners to understand where we are going and to engage better. I looked at the Aruba model and saw that was wildly successful within the HPE ecosystem. And I thought if we created something like that on the storage side we will get the same effect.

How fast are you are going to be able to move at as a result of the new business unit?

The market is moving at lightning speed. Our customers are being disrupted. Everything is being disrupted. It is moving too fast to be large. So the smaller, more focused and nimble you can be, and the more your organization is designed to fit your strategy, the more successful you can be. It is easier on everybody, starting with the customers. They can understand who we are and what we are all about. It is also very clear for partners.

We are blessed with a big portfolio. The storage business is over $1 billion. It is not a small business for us. But the priorities have to be set, accepted and then executed.

HPE is a very agile company right now. We are just starting to hit our stride, frankly. As we look at moving forward, we have done a lot of the heavy lifting that has positioned us well for this. Now it is about pure execution and speed.

How big an inflection point is the dedicated storage business for partners?

From a partner perspective, HPE offers them unique assets with InfoSight and GreenLake. Those directly appeal to a partner's long-term business plan, whether it is recurring revenue through GreenLake for partners or the information they can turn into different customer experiences through InfoSight.

How big an opportunity is there for partners to build a big business based on the power of the data and customer-for-life model?

InfoSight actually changes the economics for partners and HPE. It changes business models. AI and machine learning are exploding on the scene for all industries. It really holds the key to fundamentally disrupt services relationships or monetizing assets because of what you are doing with the power of data. And this doesn't stop. This is going to be an inflection point that takes over. As we put InfoSight across the portfolio, you'll see this accelerate. Think about it. For a customer to see a 20 [percent] to 30 percent improvement would be unbelievable. Imagine if you sat with your board of directors and told them you could improve efficiency by 20 percent. InfoSight pulls operating costs out of the model by 79 percent. That is a leap forward, not just a step forward. The HPE partnership allows channel partners to go into customers and provide six-nines of availability, solving 86 percent of problems, all with a Net Promoter Score of 85. We are the one that is delivering that value through our partnership.

Can you talk about the competitive position HPE has with its artificial intelligence-based InfoSight software?

We have a legacy of greatness. We have got a pretty good installed base of customers that understand us, whether it is our footprint in storage, compute or network solutions. We are bridging beyond that with our new story, especially around AI and machine learning with InfoSight as something that enables all of the storage portfolio for us.

InfoSight is a unique capability that no one else has. You can't replicate it easily. Machine learning says that volume and scale matter. When you have 60,000 arrays out there all producing information, that makes the environment more available and robust and fixes problems before they are found. And then you begin to go cross-stack with it so it is not only the storage world it is also the hypervisor, the network, the server and then you move across the HPE portfolio—you are really changing the game for customers. They have squeezed every dime in terms of efficiency out of the organization that they possibly can. They are using every arrow in their quiver to compete—on-prem, off-prem, managed cloud—to avoid being disrupted. This gives them an advantage operationally and from a cost perspective that nobody else can match.

So some of the incentives we are putting out there are not only to go after our competitors' installed base, but also net-new logos for HPE up and down the market.

How important is storage as the cornerstone of the data management strategy?

Look at the explosion of data with the Internet of Things and companies trying to monetize data—taking data and then creating revenue streams and profit pools out of data. That is unyielding. The biggest explosion that you see today is as you go from terabytes to petabytes to zetabytes—just the explosion of sheer data. It has to be stored, managed, processed, analyzed, action has to be taken upon it. That is not slowing down. That is accelerating. So if you just look at the sheer mass of opportunity that we have, storage is essential. It is the tip of the spear for much of what we do. The strategy of the company is around hybrid IT, the intelligent edge and services, but all of that is about workloads and data at the end of the day. Storage is fundamental to the success of the company moving forward.

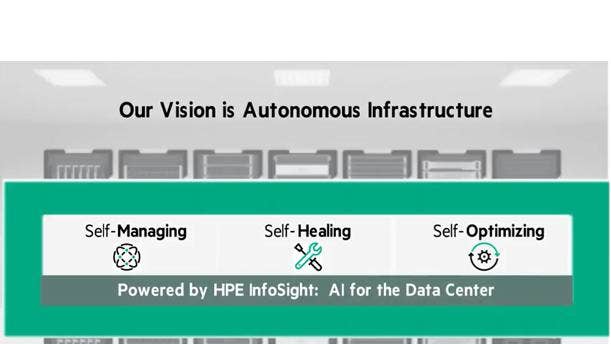

Talk about the power of InfoSight for partners.

InfoSight is an absolute differentiator. The closer you look at InfoSight in the market, the more partners and customers are going to see it is truly unique. It is about volume. When you have got 70,000 arrays with 70 million sensors each sending telemetry up and analyzing that, you get that scale. That is what it is all about. It is very difficult to replicate. The fact that it is going to gradually run across the entire portfolio will make the entire data center autonomous, software-defined, self-managing, self-healing. Those are the concepts. You have to fundamentally change the game and lower the overall economics. It is really those three vectors— people, technology and economics—none of those things can be managed in a vacuum. So we offer a unique value proposition, whether it is InfoSight across storage, server, compute and even composability. That is really unique. This is an innovation that we started a few years ago that is now taking root. Think of converged, hyper-converged and now composable. It is all about instrumenting the data center—having it be software-defined. It is doing things that humans can't do at the same pace. That is what machine learning offers.

What is the value proposition around GreenLake for HPE channel partners?

Ultimately, what customers are really looking for from us is to make it easier, pull cost out of their system and give them a path to where they want to go.

What the storage team has at their disposal is a unique offering in terms of the consumption-based GreenLake Flex Capacity. For a storage environment, GreenLake Flex Capacity provides a great solution. There is an explosion of data there which is variable. When you can match that variable with a platform that says you are paying for only what you need when you need it and you have the same experience on-premises as you do with public cloud, that is an advantage. So just how we allow customers to consume technology and infrastructure with storage is completely unique with GreenLake Flex Capacity.

Where are you seeing the biggest game-changer in terms of channel sales in North America?

We are seeing GreenLake and the consumption model grow at triple digits in North America. This is a service offering that gives customers a cloud experience with better economics than public cloud from an on-premises perspective. It allows you to control your own data and bridge that IT gap between demand and supply.

That is number one on our list. The more consumption-based solutions that we can provide into the field, the better it is for us. It's a rocket ship for us. It is totally unique, and storage is the biggest driver of the consumption model growth.

How big an impact is GreenLake having on the ability to close storage solution deals?

Our goal is to move two-thirds of our entire solution set to recurring revenue streams through consumption. Customers are pulling us in that direction. So more and more customers are looking at how to transform. Our customers are faced with transformation and yet they have to figure out how to fund that with 70 to 80 cents of every dollar being spent on the legacy environment rather than new applications. Transformation has to be funded in some way. It is one of the hardest problems for customers to solve.

GreenLake Flex Capacity gives you a real way to transform through asset buyback and then applying those funds to new capabilities and capacity. That is unique to us. GreenLake continues to evolve. It gets faster. It gets quicker. It gets easier to customize.

What are the product sets that are driving a storage solution competitive advantage for HPE?

GreenLake, InfoSight, Nimble and 3Par. We are huge in block storage, but we have great partnerships in file and object as well. So we get to compete across the full spectrum either with our own portfolio or really, really tight partnerships that we have curated through our Pathfinder program with partnerships like Scality, Cohesity, Qumulo. That is a real advantage for us.

All our innovation is landing right now. It's a perfect time for this after our transformation. The combination of storage with composable or whether it is Apollo with different object-based software companies. We bought seven companies in seven months and they are all squarely focused on storage. Nimble is one of those.

The advantage we have with Nimble is InfoSight. It is a fantastic operating system for storage, but InfoSight is a game-changer for us across the portfolio.

When you are debt-free and throwing off cash, you have the flexibility to do that. The final thing is partnership—different companies that help our customers broaden out the solution set whether it is object, file or block.

What kinds of trends are you seeing with digital transformation solutions?

Most of the customer mandates are around how do they take the environment they have and how do they modernize and transform that to be more agile. There is still the governance and security issues they face. I haven't found a customer yet who hasn't acknowledged that they are transforming. They are in the process of that journey to move from where they are to where they need to be.

Something had to change. People just can't keep procuring more, whether it is power consumption or cost of people with storage specialists and network specialists employed and up to date. You start to see these things converge at the speed they are and you can see why GreenLake and GreenLake Flex Capacity are growing so fast. There are very few levers customers can pull to fund the transformation. GreenLake offers that unique opportunity.

Can you talk about the hybrid model and what you are seeing there versus public cloud?

Hybrid IT is playing out to be the dominant way the world is going with customers leveraging on-premises and off-premises. With the economics on-prem, the governance model, security and data sovereignty, we are seeing some level of U-turn where applications that have gone to the public cloud are coming back on-prem. You have got to offer customers a window into whatever world they are looking at and help them understand the economics. The disruption is relentless. This is not going away any time soon.

Can you talk about the overall strategy and how that is resonating with partners?

When I speak to partners—especially those that have been an HPE partner for a long time—they appreciate the consistency of the strategy. Our strategy has been consistent. We are very easy to understand.

Having laserlike focus is empowering for the channel partners. I just think we have to show up more often and continue to be as consistent and clear as possible. The portfolio is fantastic, and it is evolving quickly. You have market demand and real uniqueness in GreenLake. No one else has that. Competitors are trying to replicate it. It is more than just offering consumption demand. There is metering along with cost and economic pieces. So it can't be replicated easily. And then InfoSight is a game-changer. You have demand that continues to escalate. We have a portfolio that has never been better, and we have the flexibility as a company because we are fiscally fit to either add organically, inorganically or through partnerships. That combination of things gives us an advantage.

Our consistency of strategy is an advantage. As a partner recently told me, 'You have become through your transformation at this point a safe pair of hands.' There were a lot of years when we were constantly in a transformational state—real structural change. That is behind us. There are a lot of our competitors who are absolutely heading down that road, whether it is financial engineering or structural engineering of the company. While they are distracted with that, we have a great portfolio and laserlike focus. The storage company within North America gives every partner competing for this huge market a chance to look at us and ask the question: 'What company has a clear strategy and complete differentiation on both the product and solution side of the business?' That is us. That is HPE.

What are you hearing from customers in the field?

I see 10 to 20 CIOs a month. I have not had a single customer look at the HPE strategy and where we are focusing and say, 'You are not right.' They say the strategy around hybrid IT, the intelligent edge and the services is on point. Our challenge is how do we show them the differentiation.

HPE was created in 2015. So we are kind of a relatively new company even though we have an 80-year lineage in Silicon Valley. Having partners see us through that lens is harder than you think.

The most common thing I hear from customers is, 'I just didn't know how much progress you have made.'

Our job is to get out and tell our story because it is the best in the industry. When we tell the story and go through with customers on the back of the transformation we have gone through, it is pretty compelling.

How much faster and more focused is HPE today than when the company was created in 2015?

We looked at our portfolio for what we wanted to do over the next three to 10 years. We said, ‘Here is the core.’ We had to fundamentally change the view of HPE and HPE became a smaller, more agile, very fiscally fit organization that can compete in the new world. That has been huge for us. If you think of it, it is [HPE CEO] Antonio [Neri] to [HPE Global Sales Officer and Hybrid IT President] Phil [Davis] to me. There are no layers. You can feel the walls of the machine. What we do in North America matters. We are a huge portion of the overall global revenue of the company. Our voice gets heard. It is customer to me to Antonio. Antonio is so visible to the customer base. You can really feel the speed of the company. That is different for someone that has been in the organization for a long time.

How do you feel about the storage opportunity going forward?

The creation of the organization we have now is a result of what we heard from partners. In a lot of ways, the partners helped us design the new organization. Their feedback was taken seriously.

I have been at the company a long time and I have never been more excited about the acceleration of what we have done. I look at this almost as a launching point even though we have done a lot of work. It's like being on the launching pad of an aircraft carrier. We are not perfect by any stretch, but we try to be every day.

We have got deep relationships with a legacy of greatness, whether it is channel partnerships or our solution set. This is that year to get to the summit. This is the year. I'm looking forward to it.

What is the call to action for partners?

First, to see the positive changes. With any relationship or partnership, as you traverse those waters sometimes it is hard to see what has changed because of everything that is going on.

I say that as well to internal employees: 'Stop. Take a deep breath and look at what we have put in place and where we are—not where we have been.’

The call to action for partners is embrace this change, understand how they can leverage HPE and the storage focus we have as well as the other businesses with the creation of the new HPE. Leverage that. There is a big opportunity for upside working with HPE and where we are going.