Keerti Melkote On Aruba ESP Vs. Cisco Meraki, Silver Peak Plans, And How Aruba As-A-Service Isn’t Simply ‘Repackaging’

Aruba is incentivizing partners to pursue the as-a-service model and the vendors’s ESP platform is winning against Cisco Meraki and Juniper Mist. Meanwhile, Aruba has big plans for its Silver Peak purchase, Aruba Networks’ longtime leader Keerti Melkote told CRN.

All About Automation

Aruba Networks, an HPE company, spent the last year working with partners in brand-new ways as solution providers grappled with trends such as work from home, as-a-service, and more and more use cases popping up at the edge of the network at increasingly fast rates. And Aruba’s channel partners have risen to the occasion, according to Keerti Melkote, founder and president of Aruba Networks.

Despite a 2020 that was full of surprises, the networking specialist didn’t miss a beat. Aruba quickly rolled out its secure, remote networking portfolio and helping its partners keep businesses up and running. At the same time, the vendor continued to develop its one-year-old breakthrough AI-powered platform, Aruba ESP, an intelligent edge to cloud central nervous system of sorts that can analyze data across edge, wired and wireless networks. Aruba ESP is taking on the competition, including Cisco Meraki and Juniper Mist, and it’s winning, Melkote said.

Aruba has also been busy with $925 million acquisition of SD-WAN leader, Silver Peak, for the last seven months since the deal closed. The company is making sure Silver Peak’s transformational WAN technology fits perfectly into Aruba’s cloud-native, AI-driven edge services platform.

After a jam-packed year, Melkote sat down with CRN to talk about how Aruba’s approach to as-a-service “isn’t just repackaging” and how it differentiates from its rivals, Silver Peak integration plans, and when focusing on the edge won’t be enough for partners.

Here are excerpts from the conversation.

How does Aruba’s as-a-service approach differentiate from rival tech vendors’ approaches to consumption-based IT?

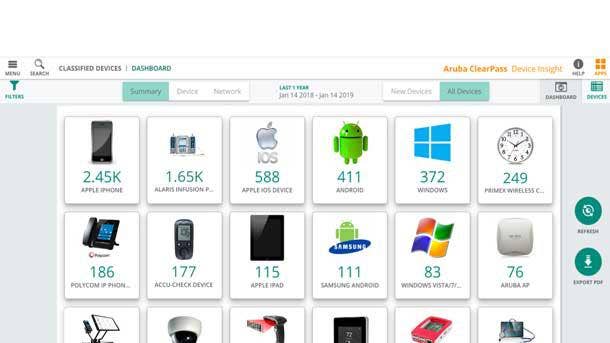

There are three areas that we offer as-a-service. The first is SaaS, so any software like ClearPass, or network management, or anything else, we’ve moved that to a subscription model with Aruba Central. So that’s sort of number one, where the hardware is still procured in the traditional CAPEX way, if you will, and the software becomes as-a-service. The second option is effectively a managed service. This is a traditional managed service that our customers are familiar with, where you package the hardware and the software, along with the operational management of the network into one -- [and] that becomes a managed service offering. Many of our partners are doing that -- they have an MSP option in Aruba Central to become an MSP and then deliver the service on top. The third option, which is relatively new, is the idea of consumption, which is network as-a-service where you can pay for what you use and it’s very similar to what GreenLake does for HPE. Those are the three lanes and options that customers have and underpinning all of this is our financial services capability.

What makes [ours] different is basically automation. What we’re doing is not just repackaging what we have into a financial offer as-a-service, but actually, using AIops in the background really automate the delivery of the service. That ultimately is going to be the way that we can economically make it work. Network as-a-service has been pretty common in the wide area network. People buy from telcos all the time, either for the home or for the enterprise. We’re used to buying and paying on a per-month basis, but we’re not used to doing that in the LAN environment, whether it’s for switching or for Wi-Fi. The nuances of delivering service in a building to a bunch of people requires typically requires typically a helpdesk [and] some skilled IT personnel on site to be able to troubleshoot and manage those large networks. In order to do it as-a-service, you need to have a pretty high degree of automation so you can do remote management [and] remote monitoring. And that’s really what we focused on with Aruba Central and AIops. idea was to really build up that automation capability, allowing either Aruba or our partners, more importantly, to be able to deliver that service without necessarily having that help desk on site for their own personnel on site. And that is, I think, the big breakthrough, which is what makes it ultimately profitable for partners. Because if you’ve got to put people on site, you’re basically billing on billable hours. People know that business model. It’s not that different. The business model is really attractive when we’re able to automate and deliver that remotely, just like cloud providers are doing from the cloud. The idea is to do the same thing for on-premises solutions.

HPE announced plans to transition its entire portfolio to as-a-service by 2022. Does that include the entire Aruba portfolio, too?

Yes. The promise was everything-as-a-service, and here we are, delivering on that promise. There are very few things not being delivered as-a-service. I think some the more complicated parts of the businesses, the high performance [the] supercomputing, and some others. I think those elements are in transition, but everything else, the storage, compute, networking, is all as-a-service. To be clear, [customers] can still buy traditionally if they want, but as-a-service is an option.

We have goals when it comes to transitioning, but we don’t want to force it. I think the one that we have learned is that we have to do it when the customers feel it’s right for them. So, we’re going to be guided more by that, rather than my own internal push towards X percent of the business needs to be as-a-service. We’re definitely going to incentivize our sales teams and our partners to transition the business, but ultimately, the customers have to dictate where they want to go with this.

How does Aruba ESP compare to competing AI-powered platforms out there right now?

Probably the two direct competitors that we have in the market are Cisco Meraki and Juniper Mist. If you look at ESP versus those platforms, with respect, Meraki is really still very much an SMB business-type of platform and they position [Cisco] DNA for the larger enterprise. We don’t -- we have one platform that goes for medium business all the way to the enterprise segment. And so, in that case, we have also a single architecture. That is the most significant differentiator versus Cisco. In Cisco’s case, you’ve got to pick a lane. You can pick the cloud lane or pick DNA on-premises lane. The hardware skills, the software subscriptions, they’re all nontransferable between the two portfolios. And with us, that is not the case. We have one system [and] one architecture for branches, campuses, [and] wired for wireless; all of that comes together in a single architecture for us. That’s probably the single most important differentiator.

The second is our AIops, which is in our fifth year of iteration. We have not seen much of AIops in the Meraki platform at all.

With respect to Mist, they talk about AI quite a bit in their marketing. The difference, I would say, is in the data that we collect. In Mist’s case, most of the data tends to be data specifically tied to key performance indicators [KPIs], like latency, or jitter, or roaming times, whereas in Aruba’s case, we are collecting a lot more data than KPIs alone. The value that it provides is not in the questions that the dashboard gives them. Everybody has a dashboard, [and] customers have questions that dashboards don’t answer. And that is really when the value of the platform comes into play. Can you answer that question? And that question depends on how much knowledge of the system [which is] directly correlated to the amount of data you’ve collected. We collect the broader surface area of the traffic going through the AI system, and we’ve been doing it for five years now, ever since the acquisition of Rasa [Networks] into the network portfolio. So, our system has learned more because of longer duration we’ve been doing it and the more data [we have]. The insights and everything we provide is to be deeper and more accurate than competitors.

Are you seeing more partners go down the MSP road today as a result of the last year?

Absolutely. In fact, I heard from a partner that has a hosted cloud service because they’re seeing a big pickup in the cloud. They’re already offering ClearPass in the cloud, and now they’re offering Silver Peak in the cloud. It’s their opportunity to differentiate; take the software, host in the cloud, and deliver it as-a-service. We’re certainly seeing a lot more uptick from our partners. And I think [regarding] the pandemic, our default motion used to be when the customer says, “Hey, I’m rolling out a big project and I need some help from you,” [the partner’s] default reaction tends to be ”Okay, you’re an important customer, let me make sure that I sent a couple of my best engineers to work side by side with you to make it happen.” And their reaction is, ”I appreciated it, but I can’t let them on the premise because of COVID protocols.” The amount of time it takes to get them permission; it’s too painful for them. Now, [the customer is asking] how people don’t have to come on site, but [still] help, so it’s forcing us to transform, and our partners to transform, because we used to take for granted that we can go on site and help our customers, [but now] it’s forcing us to think differently and do more work remotely.

When will focusing on the edge not be enough?

We’re already starting to talk about edge to cloud. The point is it has to come together. Even when we talk about the edge, we talked about it being delivered from the cloud, so I think the broad architecture -- and this is for the next decade -- I see edge to cloud becoming the de facto architecture, Where data center, cloud and edge -- those three worlds have to come together in a common architecture. The incremental opportunities I see beyond what we do right now. security’s going to be a massive, I would say additional opportunity on top of the ordinary network compute and storage infrastructure that partners can sell.

How big is the opportunity for partners around learning to help their clients make sense of their data?

This, I think, is a very, very important question. We’ve talked in the past about how network engineers in the community need to transition from becoming configuration jockeys to software engineers where they can write code. Many of them will make the transition, but not all. The second opportunity that network engineers have is, for those that don’t want to make the transition to software engineer, is becoming a data engineer. And that’s a different set of skills. You don’t have to write code for it, but you to be able to [dive into] the analysis of the data. So, I think data engineering is a very, very interesting extension of what a network engineer [can] do. I think, between those two career paths, either you go [and] become more skilled at writing software or automation, or you become more skilled at querying the data and correlating the data to give you the insight that you need. Those are the two paths I see. I see all these kids graduating with computer science degrees these days in college, but many of them are saying they want to go down the data science path or AI path, and I think the same is true for engineers at our partners as well.

It’s about seven months into the Silver Peak acquisition. What’s the integration roadmap look like?

Silver peak is going to be the fourth solution in this broad area of connecting edge to cloud. You can start very simple with a VPN client and getting people to connect into the cloud, to using remote [access points] APS at home and getting [remote workers] connected into the cloud, or using our SD-Branch portfolio for integrated offer for a retail store, and so on, where you have Wi-Fi switching and WAN integrated into one single solution. And then the pure play SD-WAN opportunity, which is what Silver Peak represents. All four of those are present as part of the ESP solution set now, so we feel like we can fulfill the domain, where it exists and where it comes from.

Obviously, customers are pushing us to ensure that it all comes together in a single connector. And that, to me, is the biggest area of focus. The first area we chose to focus on was security integration, so that is what we announced on the ClearPass policy side, [and] integration with our antivirus systems. That makes it sort of similar to what the SD-Branch solution offers. And then the third area, the integration with Aruba Central, that’s already integrated at the dashboard level, the Information Center. I think that is really the most important initial value that customers [have] is one integrated view of everything, and that’s the starting point for us. From here on out, I think we have to start to integrate the backend -- the IT systems, the sort of the non-obvious things. That’s work for the next six months with integrating the back end of the Silver Peak IT engine [with] Aruba and HPE.

What should partners focus on for the rest of this year, and hopefully soon, in a post-COVID world?

Definitely the biggest opportunities for us, firstly, it’s SD-WAN, whether it is through Silver Peak, or through SD-Branch or remote Aps, I think that is clearly a significant growth opportunity for the next two or three years, I would say [to partners], build out skills and expertise and really go aggressively in that particular domain.

The second area is Wi-Fi. Wi-Fi 6 upgrades are happening quite regularly. Everything I’m seeing is that there’s huge pent up demand in returning to the office. Once the vaccines are completed, I think people will start to open up offices. I’m already beginning to hear a bunch of large companies, like Microsoft, say they’re going to let people come back and work in the office if they want to. I’m seeing other large companies do the same, so I think there is definitely a lot of pent up demand in upgrading the infrastructures and their buildings to Wi-Fi 6. Thirdly, a huge amount of switching with Aruba CX. There I see a lot of customers migrating. In fact, we gained three points of share last quarter in switching, and, had some big wins, like with the Pentagon and other large wins across the board in public and private sector. I would say those are the three broad opportunities, and all wrapped in a cloud offering. It’s very clear that people are looking at cloud-based management as the next sort of opportunity.