Icahn Acquires 18 Percent Stake In Cloudera, Gains Two Seats On Board Of Directors

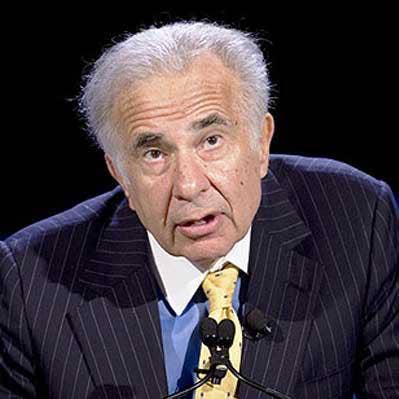

As big data platform developer Cloudera continues its search for a new CEO, activist investor Carl Icahn will now have a say in that appointment.

Activist investor Carl Icahn is gaining two seats on the board of big data platform developer Cloudera, under an agreement unveiled Monday, after he acquired a huge stake in the company.

Icahn disclosed earlier this month that he had acquired more than 50.3 million Cloudera shares for an 18.36 percent stake in the company, according to a Bloomberg story.

Icahn's involvement with Cloudera comes at a turbulent time for the company. It is in the process of integrating its operations and product line with those of Hortonworks, the direct competitor Cloudera acquired in January for $5.2 billion. In June CEO Tom Reilly announced that he would retire in July, sending the company's stock plummeting almost 30 percent.

[Related: The Big Data 100 2019]

That announcement preceded the company's fiscal 2020 first quarter financial results that included a $103.1 million loss for the quarter—nearly twice the $52.3 million loss one year earlier—and revenue that didn't meet investor expectations.

Software developers such as Cloudera and Hortonworks that base their businesses on the Hadoop data platform have been struggling because Hadoop adoption didn't take off as some pundits had predicted. Just last week MapR Technologies, another Hadoop platform developer, said that its business and intellectual property assets were being acquired by Hewlett Packard Enterprise.

The Bloomberg story said that Icahn considered Cloudera's shares to be undervalued and that he was critical of the efforts to integrate Hortonworks.

Under the agreement, Icahn Enterprises employees Nicholas Graziano and Jesse A. Lynn will join Cloudera's board of directors, which is being expanded to 10 members. In return Icahn promises to limit his ownership of the company to 20 percent and will not nominate any directors at the company's 2020 stockholder meeting.

"We are happy to have reached this agreement with Mr. Icahn and welcome Mr. Graziano and Mr. Lynn as members of our Board of Directors,” said Martin Cole, Cloudera's chairman and interim CEO, in a statement.

"Since the disclosure of his stake in Cloudera, we have been engaged in very constructive conversations with Carl and his colleagues," Cole said. "Based on the strength of our product portfolio, our impressive enterprise customer base, and the potential of our forthcoming new Cloudera Data Platform, Carl has indicated that he believes Cloudera is undervalued—and we fully agree. Together with our new directors, the board will continue to oversee the execution of Cloudera’s strategic plan and drive value for stockholders."

Cloudera is still searching for a permanent replacement for CEO Reilly. Lynn is joining the board's CEO Search Committee while Graziano will join the board's Mergers and Acquisitions Committee.

Cloudera's shares have lost more than half their value in the last year, from $13.97 a share on Aug. 13, 2018, to $6.64 a share as of this writing.