Best States: The Challenge Of Finding Tech Talent In 2021

For the annual “Best States” project, this year’s analysis is focused on presenting solution providers with information about the tech talent pool in each state, tech salaries, education levels and other criteria that figure into hiring decisions.

Tech Networks is enjoying rapid growth as the economy recovers from the COVID-19 pandemic and new clients that had hesitated during the downturn are now engaging the Boston-based MSP for its services.

“It’s 15 months of pent-up demand,” CEO Tuan Pham said in an interview with CRN. “We’re in expansion mode again. We’re really starting major growth into recurring revenue,” he said, noting that Tech Networks is now increasing its recurring revenue by about $80,000 every month – adding up to a 20 percent annual growth rate.

Pham’s challenge? “When you’re adding 20 percent to the business, you’ve got to hire. Over the past one or two months I’ve hired four people and I’m looking to hire six more to support current and future growth.”

TanChes Global Management, a Houston-based IT solutions provider and MSP, is looking to hire tech employees at all levels to staff up a new technology and network operations center the company launched in Houston last year. “And it’s been tremendously challenging,” said president Tanaz Choudhury in an interview.

Through its 23-year history, TanChes has operated with a core team of fewer than 10 people and supplemented them with contract workers as needed. With the new center the company is building up its in-house employee roster to become “a very next-generation operation,” Choudhury said.

“I want to bring on a team that can magnify what we’re doing on a larger scale. Since we are a full-service company, I’m looking for a full-service team,” she said.

Finding qualified employees, whether for management, sales and – especially – engineering and technology jobs, has always been one of the biggest challenges for solution provider owners and executives. But the task of finding and hiring tech talent appears to be especially difficult right now as the channel ramps up to meet growing demand even as the pandemic lingers and the economy remains in a state of flux.

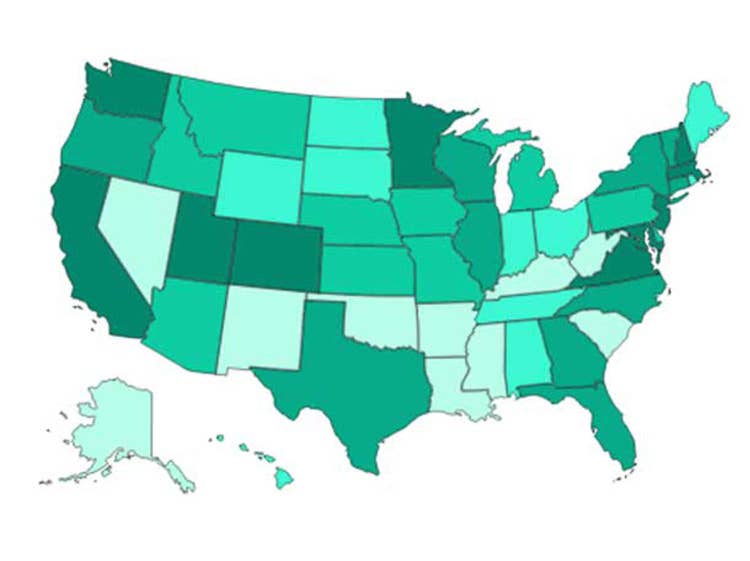

Each year, CRN researchers and editors have undertaken the “Best States” project, a detailed analysis of the business climate in all 50 states, to offer solution providers and entrepreneurs guidance on the best – and the worst – places to start and operate a solution provider business.

While finding and hiring tech talent has always been a significant part of the Best States project, this year, the ninth year of the Best States project, CRN has focused almost exclusively on the tech talent challenge. This year’s analysis is specifically geared toward presenting solution providers with information about the number of technology workers in each state, recent changes in the size of the tech talent pool, tech salaries, education levels and other criteria that figure into hiring decisions.

We also include data about economic and competitive conditions in all 50 states, such as economic growth, unemployment rates, tech industry employment, and the number of businesses – including solution provider businesses – that can make the task of finding and hiring tech talent easier or more competitive.

We present the results of the 2021 Best States research in this story; in a slide show looking at the rankings of the 50 states across all criteria, and an online database with the data used in the analysis presented in a state-by-state fashion. (A complete description of the Best States methodology and a list of the data sources can be found on the last slide in the slide show.)

As happens every year, most states have moved either up or down in their rankings – some by just a few spots and some by many. And that’s especially true in this analysis given this year’s focus on tech talent.

What hasn’t changed from last year is that the state of Washington remained No. 1, holding on to the top spot the Evergreen State claimed in the 2020 Best States analysis.

It’s no surprise that Washington is a hotbed of tech talent given that the Seattle-Bellevue-Redmond region has become one of the country’s leading tech centers and is home to two IT giants (Microsoft and Amazon) with trillion-dollar market capitalizations. Technology GDP/GRP (gross domestic product/gross regional product) in Washington accounts for 22.5 percent of the state’s total GDP/GRP – No. 1 among all states.

Tech jobs account for 28.1 percent of the total workforce in Washington, No. 2 among all states (behind only No. 1 Massachusetts). The Evergreen State is forecast by the CompTIA IT industry organization to add 11,011 jobs to its tech workforce in 2021, a 2.7 percent gain. That’s after adding 5,222 tech jobs (up 1.3 percent) in 2020, a year when tech employment declined in many states.

Washington ranked No. 1 in the Best States analysis for the overall experience and education levels of its tech workforce. While the state is only No. 14 for the percentage (39.9 percent) of residents 25 to 44 with bachelor’s degrees, Washington was ranked No. 1 for the number of science and engineering degree holders. And the state scored at or near the top among all states for workforce and general population education.

All that experience and education comes at a price, however. Washington’s average tech worker salary $122,640 – is highest among all 50 states (according to Visual Capitalist) and even more than No. 2 California’s $116,820 average tech worker salary.

With Microsoft and Amazon based in Washington, Doug Schneider, CEO of Seattle-based 2nd Watch (No. 140 of the CRN Solution Provider 500), notes that the state is a hotbed of tech and sales talent, especially with expertise in cloud computing. That’s important for 2nd Watch given its focus on providing services around the major public cloud platforms.

“We hire people every month,” Schneider said, recruiting both to meet the fast-growing company’s needs and to account for normal employee attrition. Engineers and developers make up the biggest portion of 2nd Watch’s base of about 250 employees. And while the solution provider does at times find itself competing with the cloud giants for tech workers, the CEO says that works both ways, acknowledging that he has on occasion poached tech talent from them.

Massachusetts, with its Boston/Cambridge tech hub, was No. 2 on this year’s Best States analysis, a rank boosted by the Bay State’s No. 4 showing for overall tech workforce education and experience. Massachusetts is No. 1 for the percentage of tech jobs (29.4 percent) as a percentage of the total workforce and No. 1 for the percentage (52.9 percent) of residents 25 to 44 with bachelor’s degrees

Massachusetts is forecast to add 8,657 tech jobs this year (No. 8 among all states), up 1.9 percent. That follows the 2,456 tech jobs the Bay State added in 2020.

But as with Washington, that experienced workforce has a big price tag. The average tech worker salary in Massachusetts is $105,400. Only Virginia ($107,130), California ($116,820) and Washington had higher average tech worker salaries.

At Tech Networks in Boston, CEO Pham confronted that reality head-on two months ago when the company overhauled its salary tables, upping pay scales across the board. “Because we saw that we needed to offer more to be competitive,” he said.

The day he talked to CRN, Pham was on-boarding a new engineer employee in the company’s headquarters. In a technology hub like Boston the competition for tech talent is fierce both from local companies and industry giants like Microsoft, Google and Amazon with operations in Massachusetts. “I have all these job requisitions open. Finding people is the hard part,” Pham said.

He offers his staff referral bonuses for hires, stays connected to area colleges and technical schools, hires interns and trains them for entry-level jobs and uses tools like LinkedIn. He’s even relying on professional recruiters – something he’s rarely done in the past. Several weeks ago he hired a recent immigrant from Morocco with a computer science master’s degree – Pham said larger companies hadn’t hired him because of his lack of IT experience in the U.S.

He even recently hired a managed services director from another MSP. “To get tech talent in Boston, you have to bribe people,” he joked. “Talent is just being taken fast for a lot of money.”

Behind Washington and Massachusetts, Virginia (No. 3), Colorado (No. 4) and Maryland (No. 5) rounded out the top five states for finding and hiring top technology talent.

Other states that have been in the Top 10 of the CRN annual Best States analysis in previous years were ranked likewise this year including Utah (No. 6 this year) and Minnesota (No. 9).

This year’s emphasis on tech worker education, experience and availability, in contrast to previous years when criteria such as tax rates and the cost of living were also considered, resulted in significant shifts in rankings for some states. California (No. 7), New Jersey (No. 8) and New York (No. 13) moved up this year, for example, while some states that boast more “business-friendly” economies, including North Carolina (No. 12) and Georgia (No. 14), moved down in the rankings.

Texas (No. 18 this year) is one such state that has long touted such advantages as the state’s lack of either corporate or personal income taxes. But the Lone Star State remains one of the country’s fastest growing tech hubs. In December Hewlett Packard Enterprise announced that it was moving its headquarters to Houston (while retaining its technology hub in San Jose, Calif.), followed just two weeks later by Oracle, which moved its headquarters to Austin.

CompTIA forecasts that Texas will add 29,171 tech jobs in 2021, up 2.8 percent, putting it at No. 2 among all states and behind only California, which is forecast to add 41,632 tech jobs this year. (Texas added 11,862 tech jobs in 2020 – No. 1 among all states.)

Houston-based TanChes Global Management is one Texas IT company that is looking to fill tech jobs and staff up its new tech center. That will allow it to expand as it provides SMB, enterprise and SLED customers with a range of IT consulting, design and implementation services, help desk and IT support, and managed services including disaster recovery and business continuity.

But president Choudhury said finding and hiring tech talent, from entry level to highly specialized engineers, has been difficult. She thinks the talent is out there but that some tech workers are sitting tight in their current positions – especially highly skilled workers who are reluctant to lose seniority by switching jobs.

She also believes the wave of government aid during the recent economic downturn created disincentives among some workers to apply for positions and even questions the work ethic of some workers today. “It’s not just a professional dilemma, it’s more of a social as well as a cultural dilemma at this point,” she said. “We’ve got to get back to work.”

TanChes is focused on hiring tech teams in Texas. Choudhury said that’s due to her desire to support the local community. “If they work here, they earn here, they spend here, they stay here, they play here” she said. “It’s more about creating a financially sustainable ecosystem, for our team.” TanChes also finds the work-from-home concept to be a diluting factor when it comes to a company’s business culture and the energy of the team is just not at the same level without true human interaction and connections. “We are a people-centric tech firm and we believe in ‘the human element,’” she said.

Tech Networks, which focuses on providing IT services to non-profits, is flexible about where its employees work: Outside its Boston headquarters the company has employees in California, Colorado and Texas. The company’s sales manager is in Philadelphia. “If I can get a systems administrator in Topeka, Kansas, and pay Topeka, Kansas rates – hell yeah, I’ll do it,” Pham said.

Schneider noted that due to 2nd Watch’s cloud-based operating model, the solution provider was better positioned to hire people across the U.S. – rather than for specific offices or geographies – even before the pandemic sent everyone working remotely and demonstrated that a company could operate with a dispersed workforce.