Observe CEO On $115M Funding, Snowflake Investment And The Cisco-Splunk Deal

‘I think Snowflake has a huge presence in the market. They've got a huge presence in front of global customers. We're a relatively small company. And so we would look to leverage the Snowflake sales team to help us get to the observability buyer in their accounts. So Snowflake as an investor just sends a great message, not just out to the market, but out to their sales team,’ says Observe CEO Jeremy Burton.

Raising The Visibility Of Observability

Observability, which is technology for understanding the internal states of a complex system by understanding that external outputs of that system, has lately been getting some increased visibility by the market and channel.

Cisco, for instance, just acquired Splunk for $28 billion. Last year saw observability vendor New Relic go private in a $6.5-billion deal. And this week just saw San Mateo, Calif.-based observability startup Observe close its series B funding round worth $115 million.

Observe CEO Jeremy Burton told CRN in an exclusive meeting that the new funding round, which included the participation of Sutter Hill Ventures, Capital One Ventures, and Madrona, was also important because analytics giant Snowflake also took part.

For Observe, the co-founders of which came from Snowflake and from other observability technology developers, and which is developing its observability technology on top of the Snowflake platform, getting Snowflake on-board as an investor is about more than the money, Burton said.

“[Snowflake] started off as a data warehouse,” he said. “Now they're a data platform. I think Observe is arguably the best example of a company that is entirely built on top of that data platform. The great thing about it is, all of our engineering team is working on adding value above Snowflake. We don't have to spend a lot of time building a database. There’s already a pretty good one there.”

Burton also said the acquisition of Splunk by Cisco is a huge deal for the observability business in general and for Observe in particular.

“I think the price tag highlighted in people's minds the size of the opportunity,” he said. “Like, wow, someone would pay $28 billion for what is essentially at this point an old company. But they're in a space where everybody believes that there's a lot of opportunity within Cisco. I think any kind of a merger or acquisition also creates uncertainty. Longtime Splunk customers are going to ask the question, ‘What happens now?’”

Burton’s conversation with CRN also touched on the importance of AI to the observability market. He said that Observe already uses AI to help on-board new users who may not have time to read all the documentation, and also allows users to use natural language for queries rather than learn a new query language.

The following is a lightly edited transcript of CRN’s interview with Burton.

How do you describe Observe?

We're a SaaS platform that helps people reduce the time that it takes to troubleshoot incidents in their distributed applications. Typically, I think industry average is two and a half hours. We try to take a big chunk out of that and save people a little bit of money while we're doing it.

How do you do that?

Two things. The money-saving component is we're a startup. And so we had the benefit of starting later and taking advantage of new technology. The cost savings comes from our architecture. We only use cheap cloud storage, AWS S3, and we compress the data 10X. So you can basically ingest and store data for one-tenth the cost of AWS S3. And then we only charge the customer when they query the data. We think that's a good proxy for value. If you're ingesting data, it’s not that valuable. If you're querying it and you're getting answers to questions, that is valuable.

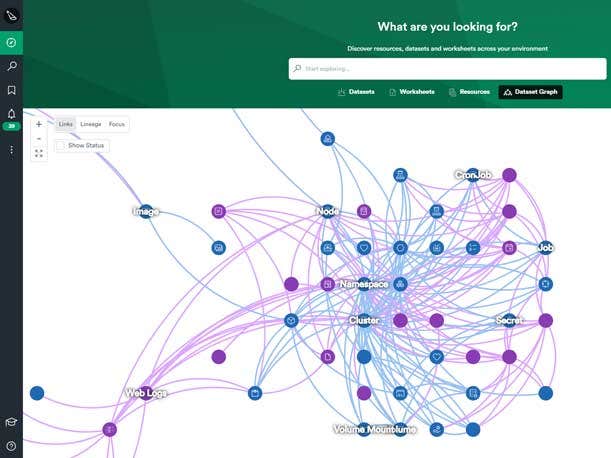

And then the real magic in the product which helps the troubleshooting speed is something called a data graph. We look at all the data that we've ingested, and we transform it into a graph of connected datasets. It makes it much easier for humans to navigate the data and then find the root cause of the problem they're investigating.

How does your technology allow Observe to do that compared to what the competition is doing?

We were probably quite unique when we started, and it's still unique today, in that we build an application on top of Snowflake. We used a commercially available database that we think operates very differently from any other database used in the observability space. And it is the Snowflake architecture that is helping us derive those cost savings. And of course, if you're navigating a graph, if you're linking from one data set to another, then a relational database is a good model for doing that. So we’re quite unusual in that, first, we were built on a commercial database, Snowflake. And second, we're also built on a relational database because we think observability is about finding related context when you're troubleshooting a problem. That's how you get to the answer more quickly. A lot of companies in our space have their own database. We thought that was a stupid idea because half of your development team is building a database and not solving observability problems for the customer. And really, what we're getting paid for is solving the observability problem.

Observe just unveiled a $115-million round of funding, bringing total funding to just north of $200 million. What are you planning on doing with those funds?

We had a great year last year. Our fiscal year 2024 ended at the end of January. We almost tripled revenue, and we’re seeing great net revenue retention, which is a measure of how sticky the product is. So we feel very good about our growth. For the coming year, I think a big chunk of that money is going to go towards expanding the sales teams. Not just sales reps, but technical people to support sales, and folks who can help with customer implementations. We're feeling pretty good about what the product is. We brought in a great head of engineering, the vice president of engineering for payments from [San Francisco-based] Stripe about 15 months ago. He has been a great add to the team. So we're feeling very good about the products, so most of the funding is going to expand our go-to-market.

You mentioned tripling revenue. That’s still from a very small base, right?

We're not up into hundreds of millions of dollars yet. But if you can keep doubling or tripling revenue, it's amazing how quickly you can get there. Obviously, when the business is small, the revenue number can be swung by a big deal or two, which is why we don't disclose it. But growth was very, very strong in the last year. If we can keep that going for another year or two, I think Observe will start to raise a few eyebrows, and perhaps we could be considered one of the longer term winners in the space.

Do you expect profitability or cash flow positive in the near future?

It's gonna be some ways down the road. The funding environment is very typical: investors are not just looking at top line growth, but looking at the efficiency of the business as well. So we're not making a profit today, nor will we be for the next couple of years. But we can see the path to cash flow positive over the next few years. It's not going to be this year or next year. But in three to four years, we can see a point where we're cashflow positive.

Do you expect to need another round or two of funding?

Yeah, we will have to go back for more funding. In enterprise software, and it's always been this way, two things have been true ever since I started doing this business. One is, in software, it always takes longer to build anything. The second thing is, you have to invest in the current year for the benefits you get the following year. So put another way, if we don't hire and expand ourselves this year, then we won’t hit a much bigger revenue number next year. And so we have to bring on board a whole lot of expense, but we won't see that benefit for a year. There’s a delayed effect. And the nice thing about the investors that we have, and this is very core to Sutter Hill Ventures, is they understand that model. We didn't build Observe just to make an interesting logging tool to compete with Splunk, or an interesting APM (application performance monitoring) tool to compete with New Relic. We think there's a huge $50-billion observability opportunity. We want the lion's share of it. We’re not playing for second place, and it takes money to do that.

Snowflake is both an investor in and a partner of Observe. Talk about the importance of having Snowflake as an investor for Observe, and why Snowflake is investing in Observe.

I think Snowflake has a huge presence in the market. They've got a huge presence in front of global customers. We're a relatively small company. And so we would look to leverage the Snowflake sales team to help us get to the observability buyer in their accounts. So Snowflake as an investor just sends a great message, not just out to the market, but out to their sales team. Our technology is 100-percent built on Snowflake, and can help solve problems inside existing Snowflake accounts that they maybe weren't aware of before. So it's a big deal. Obviously, Snowflake’s big message to the market is it is becoming a platform. They started off as a data warehouse. Now they're a data platform. I think Observe is arguably the best example of a company that is entirely built on top of that data platform. The great thing about it is, all of our engineering team is working on adding value above Snowflake. We don't have to spend a lot of time building a database. There’s already a pretty good one there.

Splunk is one of your main competitors, right? How does the acquisition of Splunk by Cisco impact the observability market?

I think the price tag highlighted in people's minds the size of the opportunity. Like, wow, someone would pay $28 billion for what is essentially at this point an old company. But they're in a space where everybody believes that there's a lot of opportunity within Cisco. I think any kind of a merger or acquisition also creates uncertainty. Longtime Splunk customers are going to ask the question, ‘What happens now? Does the Splunk identity get lost? Does the talent flow away?’ It's a very small fish in a very big pond. And that's good for startups like ourselves, because if customers are worried, we feel like now's a good time to start looking.

What part of Observe’s business goes through indirect channels?

Right now, pretty much none of it. We just did an announcement with [San Diego-based] Cybereason, and they've actually built a security offering on top of Observe. It's more like an OEM-type model than it is a reseller model, but that’s the first kind of companies that will essentially be taking Observe to their customers. They are essentially a channel for us. But we are starting to get to the point where I think it's time to engage with regional partners.

When a company is young and you haven't quite figured the product out and you're still trying to figure out how to sell it, what's the value proposition, how to implement this, how to do it repeatedly, until you've figured that out, it's hard to go to a partner. But I feel like this last year was a breakout year for us where we figured out that go to market, we figured out some of the key things on the implementation. So I think the indirect, regional integrator-type partners, we're going to get with them in the coming year.

We actually have someone working full time on this. We didn't have that last year. Right now, they're predominantly focused on folks like Snowflake and AWS. Those companies have big sales teams that we would look to leverage as we go to our customers. But you could expect our channel team to grow in the coming year. And it's not inconceivable that this time next year, we would have a number of partners able to do implementations.

Has AI started to have an impact on observability and observe?

I think it will have a positive impact. Generative AI, to me, is very different in our space. Years ago, there was AIOps, which didn't really work. It was a little bit like snake oil, in my opinion. But generative AI, we're finding a lot of usage for it. It makes it easier for people to get up to speed with Observe. And that can just be the raw GPT help, like all the documentation. Well now you can interface with it through a chatbot. If you're moving from another product, and everybody who we sell to is coming from a similar product, if you move in from Splunk, you probably use a standard language like SPL. With Observe, we have OPAL (Observe Processing and Analysis Language). And so there's a barrier to entry because people have got to learn OPAL in order to query the data in Observe. So we introduced a co-pilot that lets you interact with Observe through a natural language—‘Extract IP address from log’—and it'll write to OPAL. So we’re finding AI very, very beneficial in terms of getting new users up to speed with the platform. And we've got some big ideas around, can we also use large language models and train them on prior incident histories? And can we provide recommendations to the SRE (site reliability engineer) or the DevOps team in terms of which step to take next in the troubleshooting flow?

So we're actually quite bullish on what GenAI can do. With AI more broadly, there's gonna be some big winners like OpenAI, Microsoft, Amazon. All these guys are hosting the LLMs. There's going to be a handful of big winners there, maybe. But from what we've seen, AI is not a thing in and of itself, aside from the big players. But if you've got something like observability, AI makes it better.