Marty Bauerlein On Leaving AMD, Earning Market Share, And Why D&H’s Cloud Marketplace Is An ‘Execution Machine’

‘We are determined to earn market-share gains through our strong customer enablement,’ says new D&H Chief Commercial Officer Marty Bauerlein. “I envision D&H selling to 25,000 active MSPs and VARs in North America within the next three years. … We’re taking this to another level by offering world-class intimacy with a U.S. coverage model.’

New D&H Distributing Chief Commercial Officer Marty Bauerlein says he is going to move to capitalize on the distributor’s Cloud Marketplace and Modern Solutions Business Unit advantages in a bid to “earn” market-share gains.

“We’ve got to continue to tell the market and the world about our Cloud Marketplace and our differentiators in the Modern Solutions Business Unit,” said Bauerlein, a 25-year distribution veteran who was most recently head of North America VAR sales and commercial distribution for AMD. “We are determined to earn market-share gains through our strong customer enablement. I envision D&H selling to 25,000 active MSPs and VARs in North America within the next three years. … We’re taking this to another level by offering world-class intimacy with a U.S. coverage model.

The D&H Cloud Marketplace, combined with D&H’s Modern Solutions Business Unit, have reshaped the competitive landscape in the distribution market to favor D&H, said Bauerlein.

“The D&H Cloud Marketplace is an execution machine,” he said. “We are attracting and transacting with thousands of MSPs. The D&H Cloud Marketplace allows solution providers to attach their own services. It also provides connectivity to some of the industry-leading invoicing tools.”

As for the D&H Modern Solutions Business Unit, Bauerlein said it has moved the traditional distribution model from single-threaded dedicated vendor specialists to multivendor solution specialists. “So when a solution provider or VAR calls D&H, they get a vendor-agnostic outcome that is best for the customer,” he said.

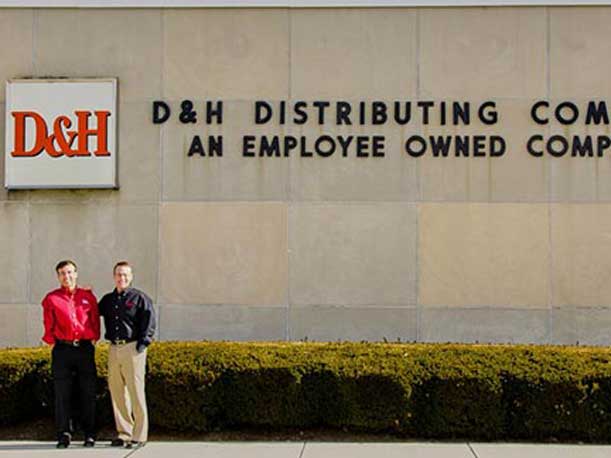

Bauerlein said D&H’s employee-owned, privately held model is paying off in big growth, attracting new partners and vendors.

“D&H is growing the cloud business by triple digits and the endpoint business massively in a down market,” he said. “We are also growing the Modern Solutions Business at a double-digit rate. D&H has momentum in the market. Vendors are getting speeding tickets lining up outside their offices to discuss business opportunities and growing their business with D&H.”

The addition of Bauerlein comes just two months after D&H reported 102 percent growth in cloud services and modern applications in 2022 fueled by the launch of the new Modern Solutions Business Unit last May.

The Modern Solutions Business Unit—the distributor’s biggest single investment in over a decade—represents a landmark shift in the D&H go-to-market model from a long-standing single-vendor practice structure with dedicated vendor sales specialists to a multivendor Everything-as-a-Service business unit focus with new technical talent.

In 2022, the D&H Modern Solutions Business Unit overall reported a 39 percent increase in sales with 66 percent growth in integration services, 46 percent growth in Cisco products and 25 percent growth in modern infrastructure.

“D&H is growing exponentially,” said Bauerlein. “That’s a fact. That’s because they have heavily invested in their Cloud Marketplace and have hired 300 people across the company. So at a time when most companies are laying off employees, D&H is investing in new talent, new tools and new leadership.”

Why did you leave AMD to go to D&H?

I learned a lot at AMD. I learned the vendor side of the business and what is it like to be a vendor. It was an amazing experience. I wanted to work at AMD because I wanted to help them build their channel program. And over the course of the last year and a half, we have been very successful with the channel. It’s been an amazing growth trajectory. AMD has experienced amazing growth in the channel. But at the end of the day, my heart and soul is with running a distribution business. I love the competition. I love building winning teams. I love the attention to detail that you need to be successful as a distributor.

I started out in IT in 1993 working for an enterprise RFID software provider that was also a reseller of a full stack of data center technologies. Then I went to Ingram Micro and learned the distribution business from the ground up, and then I was fortunate enough to be recruited by then-Tech Data President Ken Lamneck. He taught me how to be a successful leader.

Going to AMD completed the triangle. Now I understand all sides of the IT ecosystem triangle from the vendor to the distributor to the partner. That’s like getting a master’s degree in three different disciplines.

What attracted you to the D&H opportunity?

First off, when I looked under the hood of the company I saw that D&H is raising the bar when it comes to solutions aggregation and industry growth. That’s because you have genuine leadership with a vision with [D&H Co-Presidents] Dan and Michael Schwab.

They have made very big investments in cloud and modern solutions, which have been very successful. D&H has an amazing team of highly tenured employees, but they have also made some very strategic recent additions and recruited some great people. They also have a really solid enablement engine. That has put D&H in a position to continue to win in the market.

What distinguishes the D&H cloud enablement engine from distribution competitors?

The D&H Cloud Marketplace is an execution machine. We are attracting and transacting with thousands of MSPs. It allows solution providers to attach their own services. It also provides connectivity to some of the industry-leading invoicing tools.

The D&H Cloud Marketplace is head and shoulders above the competitors. I have experienced firsthand a lot of sizzle and no steak with other cloud marketplaces. D&H has done it right. They have gotten a return on their investment unlike many other cloud marketplaces.

And the D&H Modern Solutions Business Unit has moved distribution from a single-threaded vendor expertise offering to a multivendor solutions business. We have gone from dedicated vendor sales specialists to solutions specialists. So when a solution provider or VAR calls D&H, they get a vendor-agnostic outcome that is best for the customer. That’s a lot different from [what] our competitors are doing.

How big a differentiator is that vendor-agnostic outcome approach versus traditional distribution?

It’s a huge shift from traditional distribution. The distributor’s job is to make sure best-of-breed solutions are offered in the marketplace. That is why they exist. So when a solution provider calls a distributor that is single-threaded, they may not be getting the best outcome for their end user.

D&H has a team approach to meeting the solution provider customer’s business objective or problem. By the way, that doesn’t mean we give them one option. We can give them two or three options.

Why has D&H been able to make that successful paradigm shift compared with the single-threaded approach in traditional distribution?

Here is the deal: D&H is not on a 90-day shot clock. They can make investments for the long term. Look at the growth that is coming from D&H compared to some of the public and private- equity-backed distributors. D&H is industry leading in all the areas they play in versus the competitors.

D&H is growing the cloud business by triple digits and the endpoint business massively in a down market. We are also growing the Modern Solutions Business at a double-digit rate. D&H has momentum in the market. Vendors are getting speeding tickets lining up outside their offices to discuss business opportunities and growing their business with D&H.

What are some of the reasons D&H is seeing that success in the market?

Everybody at D&H is invested in doing the best job for the partner and vendor because they have ownership in the company. Everybody that touches the business has skin in the game because they are co-owners.

At the end of the day, everybody at D&H is rowing in the same direction and is in sync. They know who they are, they know where they play and they are invested in every single transaction and engagement.

Dan and Michael are the type of leaders that don’t just push spreadsheets around their desk and talk about servant leadership while they are lining their own pockets at the expense of their employees.

How important is the D&H employee-owned model to the company’s success?

It’s important because D&H can invest for the future. It’s important because they don’t have to take actions to impress Wall Street or private equity. The only people they are trying to impress is their employees.

The D&H employee-owned model is the reason they have so much loyalty and the lowest turnover in the industry. The reason they have loyalty and such low turnover is because they invest for the future. They are fiercely loyal to the co-owner employees of the business. They care about their employees. D&H has genuine leadership with vision.

Is D&H taking share away from other distributors right now?

D&H is growing exponentially. That’s a fact. That’s because they have heavily invested in their Cloud Marketplace and have hired 300 people across the company. So at a time when most companies are laying off employees, D&H is investing in new talent, new tools and new leadership.

D&H is attracting the industry’s best and brightest over the last few years because of their culture and the strategy. D&H and its co-owners have raised the bar. D&H is no longer a niche distributor. It’s a $6 billion solution aggregation engine that is competing and winning in the market.

What is your vision for how D&H will attract enterprise-focused solution providers and continue to grow over the next several years?

We’ve got to continue to tell the market and the world about our Cloud Marketplace and our differentiators in the Modern Solutions Business Unit. We are determined to earn market-share gains through our strong customer enablement. I envision D&H selling to 25,000 active MSPs and VARs in North America within the next three years. Most distributors have active relationships with 8,000 to 12,000 partners. We’re taking this to another level by offering world-class intimacy with a U.S. coverage model. We don’t outsource. That’s a point of pride with D&H. We are not going to cut corners and compromise customer experience by outsourcing partner coverage.

How important is that world-class intimacy with high local touch and deep relationships with partners which D&H prides itself on?

Everyone loves electronic transactions. Yeah, they’re great. And that’s what you strive for. But at the end of the day when a solution provider picks up the phone, they want to talk to someone that understands the business and has the appropriate training. Not outsourcing and having deep relationships and executing flawlessly is a big advantage for D&H. At the end of the day, we are the caretaker of the MSP and VAR’s image to the customer. That is the most important aspect of being a distributor. That is embedded in the actions of all the D&H co-owners each and every day.

What is your message to the solution provider community?

If you want the best experience in the industry, let’s have a conversation. I will take your call personally day or night to make sure you understand the advantages D&H brings to partners. We are open for business and we have the momentum in the market.

What is important for solution providers as you look into the future?

I think the key is being very specialized in a couple of areas. Focus your efforts on specialization and the rest will take care of itself.

D&H is helping the partners pivot. We will continue to do that. Key to that is having a deep understanding of the vendor solutions that you sell.

Who has been some of the biggest influences on your career and your view on how to be successful in distribution?

[Former Tech Data CEO] Bob Dutkowsky (pictured) is at the top of the list. He had the unique ability where you could put him in any situation whether it was a customer, vendor or an investor and he was able to fit in and be well respected in any business situation.

Bob always said, ‘Don’t believe in can’t. Can’t never did anything.’

Ken Lamneck was also a mentor to me. He used to say, ‘Your job is to put the best team on the field and to create a system for everything you do.’

I have been fortunate to work with great leaders. I’m looking forward to taking those leadership lesson and applying them to D&H.

How big is the opportunity at D&H as you look out into the future?

First off, the TAM [total addressable market] of distribution continues to grow. The future is very bright. The key is investing in the right areas, having a solid foundation and the right culture, and making sure that your vendor and channel partners are intertwined with your strategy and you’re intertwined with them. There’s not enough of that that goes on in this industry. It can’t be a buy-sell relationship. Distribution is an extension of the vendor and partner’s strategy. You need to be able to speak their language. That’s what I’m going to continue to foster in my tenure at D&H. We are an extension of the vendor and the partner. We have got to understand every single one of their value points.

At the end of the day, we have to be unique, be visible and be vulnerable. Every time I have a meeting with a partner or a vendor, I ask them to tell me where they are unique and where they are visible. But most importantly, I ask them to tell me where they are vulnerable so we can help close the gap quickly together as a team.

What is your plan for the first 100 days as you take on the new role?

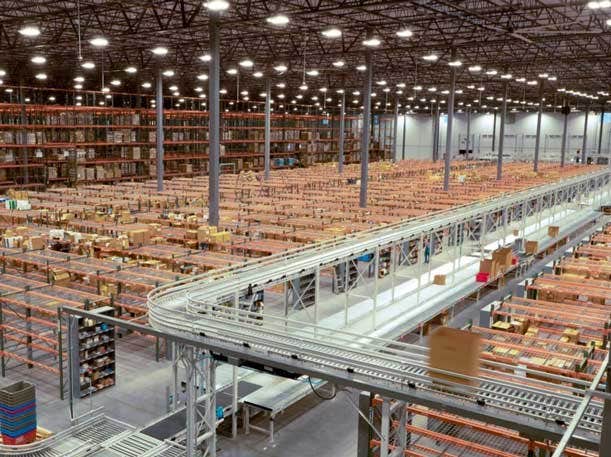

First off, my job is to listen to the co-owners of the business from president level down to the person closest to the customer and the co-owners in the logistics centers.

I really want to understand how they are outpacing the market over the last three years and why they are so successful. I need to understand that. What we are going to do is pour more gasoline on that. Then we are going to figure out long-term areas where we can innovate and further diversify the business.

Nothing is done at D&H by one singular person. It’s a group effort. That is why D&H is so successful.

D&H does not have the pressure of being a publicly owned or private-equity-owned business.

There is value that can be offered in the enterprise, and D&H has the strategy and the execution machine to get it done.

How does it feel to join the D&H team of co-owners?

Joining D&H is the most exciting moment of my career. I’m excited to contribute to the winning culture, raising the bar with customers and vendors. I have never been more excited to compete and win with the D&H team. The D&H co-owners are winners. That’s no joke. They want to win. And that’s who I want to be associated with.