Tech Stock Winners And Losers In Q1 2023: Lenovo And AMD Up, Dell And IBM Down

Here’s a look at the tech industry companies that saw the biggest share price gains and losses in the first three months of 2023 including AMD, Lenovo, Salesforce, Palo Alto Networks, Dell Technologies, IBM and Nutanix.

Stock Prices On The Rise

Tech companies had a challenging first quarter with many of the biggest players in the IT industry navigating the uncertain economy and laying off thousands of workers.

But the quarter was a good one for most IT companies when it came to their stock prices.

Of the 57 IT vendors on the CRN watch list, only 10 recorded stock price declines in the period between Jan. 3 and March 31. And only a couple of those were significant drops – many were low single-digit percentage declines. Among the 47 companies that saw their stock price rise during the quarter, a little more than half of the companies recorded double-digit price gains.

The quarter marked a significant change from all of 2022 when only seven IT vendors on the CRN watch list recorded share price gains. (And several of those, including VMware, Mandiant and Citrix Systems, were due to acquisitions that locked in price premiums offered by the acquiring companies.) The rest recorded share price declines for the year – with many companies’ shares losing more than half their value.

For the quarter the Dow Jones index was up 1.49 percent to 33,642.48 while the tech-heavy NASDAQ was up 15.72 percent to 12,221.91.

Here’s a look at the biggest stock price winners and losers in the first three months of 2023. We start with the 10 winners, counting down to the IT vendor with the biggest stock price gain during the quarter. Then we list the 10 companies whose stock price declined the most, concluding with the IT vendor with the biggest loss.

The rankings are based on the opening share prices on Jan. 3, 2023, and the closing share prices on March 31, 2023. The market capitalizations are as of March 31, 2023.

Gainers No. 10: Lenovo Group (LNVGY)

CEO: Yuanqing Yang

Jan. 3, 2023, Opening: $16.60

March 31, 2023, Close: $21.46

Change: +29.28%

Market Capitalization: $13.04 billion

For the first nine months (ended Dec. 31, 2022) of the company’s fiscal 2023 Lenovo reported revenue of $49.31 billion, down 10 percent from the first nine months of fiscal 2022. Profit for the period was $1.49 billion, down 8 percent.

Lenovo has traditionally been heavily dependent on its PC products for revenue and the PC industry has been in a slump for the last year. But in reporting its fiscal third quarter results in February Lenovo said the company’s “diversified growth engines of non-PC business” accounted for more than 40 percent of its revenue.

Gainers No. 9: Cloudflare (NET)

CEO: Matthew Prince

Jan. 3, 2023, Opening: $46.35

March 31, 2023, Close: $61.66

Change: +33.03%

Market Capitalization: $20.59 billion

Cloudflare is a provider of content delivery network, cloud cybersecurity and DDoS mitigation services. More recently the company has been expanding into the zero trust security space and online fraud detection services.

The company has continued to perform despite the uncertain economy. For its 2022 fourth quarter (ended Dec. 31, 2022) revenue climbed 47 percent year over year to $274.7 million, beating Wall Street’s expectations.

For all of 2022 Cloudflare reported revenue of $975.2 million, up nearly 49 percent from $656.4 million in 2021. The company’s net loss for the year narrowed to $193.4 million from $260.3 million one year before.

Gainers No. 8: Fortinet (FTNT)

CEO: Ken Xie

Jan. 3, 2023, Opening: $49.53

March 31, 2023, Close: $66.46

Change: +34.18%

Market Capitalization: $52.55 billion

In March cybersecurity tech provider Fortinet unveiled several enhancements to its FortiSASE secure access service edge system, including new deployment flexibility and new secure access capabilities for digital resources across private applications, SaaS and the internet.

For all of 2022 Fortinet reported revenue of $4.42 billion, up 32 percent from $3.34 billion in 2021. Net income for the year was $857.3 million, up more than 41 percent from $606.8 million one year earlier.

Fortinet will provide its first quarter 2023 results on May 4.

Gainers No. 7: UiPath (PATH)

Co-CEO: Daniel Dines

Jan. 3, 2023, Opening: $12.98

March 31, 2023, Close: $17.56

Change: +35.29%

Market Capitalization: $9.79 billion

For its fiscal 2023 (ended Jan. 31) business process automation software developer UiPath reported revenue of $1.06 billion, up 19 percent from $892.3 million in fiscal 2022. The company reported a $328.4 million net loss for fiscal 2023 compared to a $525.6 million net loss one year before.

Gainers No. 6: BlackBerry (BB)

CEO: John Chen

Jan. 3, 2023, Opening: $3.35

March 31, 2023, Close: $4.56

Change: +36.12%

Market Capitalization: $2.74 billion

BlackBerry, once known for its popular wireless communication devices, has been focused on providing security for mobile and IoT devices following its 2019 acquisition of Cylance. More recently the company has fine-tuned the Cylance portfolio into a mid-market cybersecurity offering for MSSPs.

On March 21 BlackBerry disclosed a deal “to sell substantially all of its non-core patents and patent applications” to Malikie Innovations Limited, a subsidiary of Key Patent Innovations, an intellectual monetization company, for a combination of cash at closing and potential future royalties in the aggregate of up to $900 million.

BlackBerry reported that revenue for all of fiscal 2023 (ended Feb. 28) was $656 million, down nearly 9 percent from $718 million in fiscal 2022. The company reported a net loss of $734 million for the year (due largely to charges for impairment of goodwill and long-lived assets) compared to net income of $12 million in fiscal 2022.

Gainers No. 5: Palo Alto Networks (PANW)

CEO: Nikesh Arora

Jan. 3, 2023, Opening: $141.32

March 31, 2023, Close: $199.74

Change: +41.34%

Market Capitalization: $60.90 billion

Palo Alto Networks develops a leading enterprise cybersecurity platform that provides cloud and network security and endpoint protection – including key growth areas such as AI-based SASE, zero trust and XDR (extended detection and response) tools. The company also offers AI-powered Security Operations Center automation capabilities.

In December, Palo Alto Networks completed its acquisition of Cider Security, a developer of application and software supply chain security, for approximately $195 million.

For the first six months (ended Jan. 31, 2023) of fiscal 2023 Palo Alto Networks reported revenue of $3.22 billion, up 25.5 percent from $2.56 billion in the first half of fiscal 2022. The company reported net income of $104.2 million for the six-month period compared to a $197.1 million net loss one year before.

Gainers No. 4: Sumo Logic (SUMO)

CEO: Ramin Sayar

Jan. 3, 2023, Opening: $8.25

March 31, 2023, Close: $11.98

Change: +45.21%

Market Capitalization (March 31, 2023): $1.47 billion

On Feb. 9, Sumo Logic, a SaaS analytics platform developer, said it had reached a deal to be acquired and taken private by global investment firm Francisco Partners for $12.05 per share in an all-cash transaction valued at approximately $1.7 billion.

The per-share acquisition price represented a 57 percent premium over the stock’s closing price on Jan. 20, 2023, prior to media reports about a transaction. The companies expect to complete the acquisition by the end of the second calendar quarter.

Sumo Logic reported that revenue in its fiscal 2023 (ended Jan. 31) was $300.7 million, up 24 percent from $242.1 million in fiscal 2022. The company’s net loss for the fiscal year was $124.8 million compared to the $123.4 million net loss one year earlier.

Gainers No. 3: Salesforce (CRM)

CEO: Marc Benioff

Jan. 3, 2023, Opening: $135.19

March 31, 2023, Close: $199.78

Change: +47.78%

Market Capitalization (March 31, 2023): $204.29 billion

Salesforce co-CEO Bret Taylor left the company as of Jan. 31, leaving co-founder Marc Benioff as the cloud application giant’s sole CEO. Taylor had announced his plans in November. Chief Strategy Officer Gavin Patterson also left the company effective Jan. 31.

Multiple activist investors have acquired stakes in Salesforce including Third Point, Starboard Value, ValueAct Capital Partners, Elliott Investment Management and Inclusive Capital. On March 27 Salesforce and Elliott issued a joint statement saying Elliott had decided against nominating new directors for Salesforce.

For its fiscal 2023 (ended Jan. 31) Salesforce reported revenue of $31.35 billion, up 18 percent from $26.49 billion in fiscal 2022. But net income for the year was only $208 million, compared to $1.44 billion in fiscal 2022, due in part to higher sales and marketing spending during the year and $828 million in fourth-quarter restructuring expenses.

Gainers No. 2: Advanced Micro Devices (AMD)

CEO: Lisa Su

Jan. 3, 2023, Opening: $66.00

March 31, 2023, Close: $98.01

Change: +48.5%

Market Capitalization (March 31, 2023): $160.49 billion

AMD has continued to enjoy success with its Ryzen desktop processors, Epyc server CPUs and other products, reporting significant sales growth in data center systems and gaining share in the market for x86 CPUs against rival Intel.

For all of 2022, AMD reported revenue of $23.60 billion, up 44 percent from $16.43 billion in 2021. Net income for 2022, however, was down 58 percent year over year to $1.32 billion compared to $3.16 billion one year earlier.

Gainers No. 1: MicroStrategy (MSTR)

CEO: Phong Le

Jan. 3, 2023, Opening: $145.67

March 31, 2023, Close: $292.32

Change: +100.67%

Market Capitalization (March 31, 2023): $4.31 billion

MicroStrategy is a leading company in the data analytics space, offering products for both enterprise and embedded analytics. The company is also a major investor in Bitcoin and much of the first-quarter rise in the company’s stock can be attributed to the increase in Bitcoin’s value since early January.

MicroStrategy began investing in Bitcoin in the second quarter of 2020 and has since acquired 140,000 Bitcoin for nearly $4.17 billion, according to the Cointelegrah website, at an average price of $29,803 per Bitcoin. The price of Bitcoin, meanwhile, has surged this year from around $16,600 on Jan. 1 to more than $30,000.

For all of 2022, MicroStrategy reported revenue of $499.3 million, down percent from $510.8 million in 2021. The company reported a net loss of $1.47 billion in 2022 compared to a $535.5 million loss in 2021.

Losers No. 1: Dell Technologies (DELL)

CEO: Michael Dell

Jan. 3, 2023, Opening: $40.56

March 31, 2023, Close: $40.21

Change: -0.86%

Market Capitalization (March 31, 2023): $29.40 billion

Dell’s shares were essentially flat during the quarter, losing only 35 cents or less than 1 percent of their value. But with only 10 companies on the CRN watch list recording stock price declines during the quarter, it is the first company on this list of stock price losers.

Dell is in the process of spinning off its stake in virtualization technology developer VMware, which is being acquired by hardware and chip giant Broadcom in a $61 billion deal expected to be concluded this year. Dell Technologies CEO Michael Dell recently told CRN that he is confident the acquisition will survive scrutiny by U.S. and European regulators and ultimately be completed.

In January Dell acquired Cloudify, a developer of cloud automation and orchestration capabilities for DevOps and ITSM environments.

For all of fiscal 2023 (ended Feb. 3) Dell reported revenue of $102.30 billion, up 1 percent from $101.20 in fiscal 2022. The computer maker reported net income of $2.42 billion for fiscal 2023, down 51 percent from $4.94 billion one year earlier.

Losers No. 2: Hewlett Packard Enterprise (HPE)

CEO: Antonio Neri

Jan. 3, 2023, Opening: $16.09

March 31, 2023, Close: $15.93

Change: -0.99%

Market Capitalization (March 31, 2023): $20.64 billion

In March, HPE struck a deal to acquire OpsRamp and its IT digital operations monitoring and management technology, a move that will allow HPE to expand its GreenLake Platform into the IT operations realm. That followed a deal in February to buy Athonet, a private cellular network technology provider, in an acquisition that will allow HPE to expand its edge-to-cloud and telecommunications portfolios.

For its fiscal 2023 first quarter (ended Jan. 31) HPE reported revenue of $7.87 billion, up 12 percent from $6.96 billion in the first quarter of fiscal 2022. The company reported net earnings of $501 million for the quarter, down more than 2 percent from $513 million one year before.

Losers No. 3: Nutanix (NTNX)

CEO: Rajiv Ramaswami

Jan. 3, 2023, Opening: $26.44

March 31, 2023, Close: $25.99

Change: -1.70%

Market Capitalization (March 31, 2023): $6.09 billion

Nutanix share prices rose in late 2022 on reports that Hewlett Packard Enterprise had expressed interest in buying the hyperconverged cloud infrastructure provider – followed by reports in late December that acquisition talks had ended.

On March 6 Nutanix issued “selected preliminary” results for its fiscal 2023 second quarter (ended Jan. 31) including reporting revenue of $486.5 million, up 18 percent from $413.1 million in the second quarter of fiscal 2022.

The company issued preliminary results due to an ongoing internal investigation into the company’s improper use of third-party software that was intended for evaluation, but was instead used for “validation, interoperability testing and proof of concepts over a multi-year period,” CFO Rukmini Sivaraman said in a statement. Because of the investigation Nutanix has been unable to complete expense information for the quarter and file its 10-Q earnings report.

Losers No. 4: Verizon Communications (VZ)

CEO: Hans Vestberg

Jan. 3, 2023, Opening: $39.77

March 31, 2023, Close: $38.89

Change: -2.21%

Market Capitalization (March 31, 2023): $165.40 billion

Verizon is leaning on its strength in its core networking capabilities and its rising Business and SMB segments as it focuses on its wireless strategy and growing number of subscribers.

For all of 2022 (ended Dec. 31) Verizon reported in January that operating revenue was $136.84 billion, up 2.4 percent from $133.61 billion in 2021. Net income for the year was $21.75 billion, down 3.8 percent from $22.62 billion one year before.

Verizon will report its 2023 first quarter results on April 25.

Losers No. 5: Domo (DOMO)

CEO: Josh James

Jan. 3, 2023, Opening: $14.63

March 31, 2023, Close: $14.19

Change: -3.01%

Market Capitalization (March 31, 2023): $507.58 million

On March 6 Domo, a developer of cloud-based business intelligence and data application software, said that CEO John Mellor was stepping down with company founder Josh James taking over the top executive post. Mellor joined Domo as chief strategy officer in 2019 and took over as CEO in March 2022. No reason for the change was provided.

At the same time the company announced the appointment of David Jolley as CFO, succeeding Bruce Felt who had previously announced his departure. Jolley was a long-time Ernst & Young executive, most recently serving as Americas Growth Markets Leader. And Domo named Jeff Skousen, vice president of corporate sales, as chief revenue officer, succeeding Ian Tickle.

For all of fiscal 2023 (ended Jan. 31) Domo reported revenue of $308.6 million, up nearly 20 percent from $258.0 million in fiscal 2022. The company reported a net loss of $102.1 million for the year compared to a $105.6 million loss one year before.

Losers No. 6: Pure Storage (PSTG)

CEO: Charles Giancarlo

Jan. 3, 2023, Opening: $26.99

March 31, 2023, Close: $25.51

Change: -5.48%

Market Capitalization (March 31, 2023): $7.97 billion

For all of fiscal 2023 (ended Feb. 5) Pure Storage reported revenue of $2.75 billion, up 26 percent from $2.18 billion in fiscal 2022. The company reported net income of $73.1 million for fiscal 2023 compared to a $143.3 million net loss one year earlier.

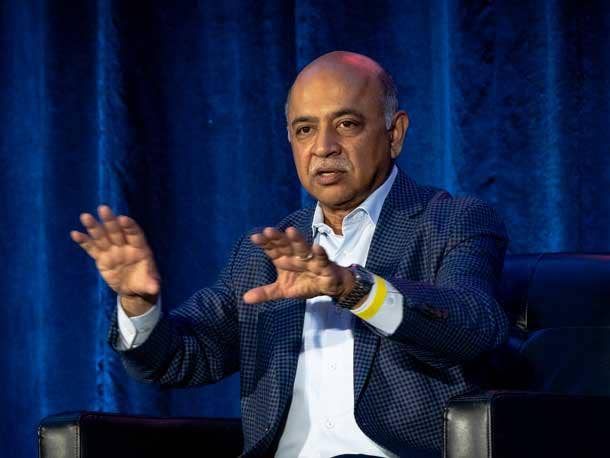

Losers No. 7: IBM (IBM)

CEO: Arvind Krishna

Jan. 3, 2023, Opening: $141.1

March 31, 2023, Close: $131.09

Change: -7.09%

Market Capitalization (March 31, 2023): $117.50 billion

In February IBM acquired StepZen, which developed a GraphSQL server that helps developers build GraphQL APIs quickly and with less code. That was followed later in February with a deal to acquire NS1, a provider of network automation SaaS systems designed to enable businesses to deliver content, services and applications.

For all of 2022 IBM reported revenue of $60.53 billion, up 5.5 percent from $57.35 billion in 2021. Net Income for 2022 was $1.64 billion, down more than 71 percent from $5.74 billion one year before.

IBM will report its 2023 first quarter results on April 19.

Losers No. 8: Commvault (CVLT)

CEO: Sanjay Mirchandani

Jan. 3, 2023, Opening: $63.31

March 31, 2023, Close: $56.74

Change: -10.38%

Market Capitalization (March 31, 2023): $2.54 billion

For the first nine months (ended Dec. 31, 2022) of Commvault’s fiscal 2023 the data management system company reported revenue of $581.1 million, up more than 3 percent from $563.6 million in the first nine months of fiscal 2022. Net income for the nine-month period was $7.72 million, down nearly 70 percent from $25.6 million in the same period one year before (due in part to a $11.4 million restructuring expense).

Commvault will announce its fiscal 2023 fourth quarter and full year results on May 2.

Losers No. 9: Rackspace Technology (RXT)

CEO: Amar Maletira

Jan. 3, 2023, Opening: $3.02

March 31, 2023, Close: $1.88

Change: -37.75%

Market Capitalization (March 31, 2023): $409.30 million

Rackspace was the target of a ransomware attack in December that cut email service to thousands of Microsoft 365 customers. In January the company confirmed that hackers had gained access to customer data in the attack.

Rackspace reported in February that for all of 2022 revenue was $3.12 billion, up 3.7 percent from $3.01 billion in 2021. But the company reported a net loss of $804.8 million for 2022 compared to a $218.3 million loss one year before.

Losers No. 10: Lumen Technologies (LUMN)

CEO: Kate Johnson

Jan. 3, 2023, Opening: $5.30

March 31, 2023, Close: $2.65

Change: -50%

Market Capitalization (March 31, 2023): $2.65 billion

Telecommunications company Lumen Technologies, formerly CenturyLink, has struggled against financial headwinds in recent years and had the biggest stock price decline during the first quarter – 50 percent – among all companies on the CRN watch list.

In February the company announced a number of changes to its executive ranks, including bringing on tech veterans Sham Chotai as executive vice president of product and technology and Jay Barrows as executive vice president of enterprise sales and public sector. The company said the moves would better position it for growth and to place more of an emphasis on customer experience.

Kate Johnson, who was appointed Lumen president and CEO in September, has declared 2023 to be a “reset year” as the company looks to return to growth while continuing to divest itself of non-core businesses.

In February Lumen reported that for all of 2022 revenue was $17.48 billion, down more than 11 percent from $19.69 billion in 2021. For the year the company reported a net loss of $1.55 billion, including a non-cash goodwill impairment charge of $3.27 billion, compared to net income of $2.03 billion in 2021.

Lumen will announce its 2023 first quarter results on May 2.