Seven Things To Know About The VAR500

2009 Was A Rocky Road

Though a good number of companies made it to 2010 with healthy revenue increases, some of the top 500 VARs sustained some bumps and bruises in the form of lower growth rates and sales. Our list includes IT consultants, solution providers, traditional resellers and vendor services arms. Here are seven things VARs can learn from the 2010 VAR500.

1. Sure Revenue Decreased, But The Long View Looks Better

Reflecting the sour economy, total revenue for this year's VAR500 is $523,253,705,492, down roughly $47 billion from last year's $597,588,818,754, or a decline of 7.9 percent.

That revenue comprises various types of technology, including desktops and notebooks, backup and security. VARs tend to sell multiple vendors rather than put all their eggs in one basket. On average, for example, members of the VAR500 sell roughly four different brands of printers (see chart).

Once again, IBM Global Services topped the list. This year it appears at #1 with revenue of $55 billion, down 4 percent from 2008 sales of $57.3 billion. In fact, four of the top 10 VAR500 saw revenue declines. But six saw average growth of between 1 and 8 percent. HP Services vaulted to the number two spot -- and saw phenomenal growth of 32 percent -- based largely on the vendor's purchase of EDS in 2008.

10 Years Ago: The 2001 VAR500 generated more than $278 billion in 2000 revenue, some $30 billion more than they brought in the year before. The mean revenue for was $557 million; the 2010, the average revenue is roughly $1 billion, an 80 percent increase.

2. A Billion Isn't What It Used To Be

An impressive number of companies -- 70 -- came in at the $1 billion revenue mark. Although that's down from 89 companies with $1 billion in sales last year, this year's 70 companies contributed more to the total revenue of the 500: $450.8 billion or 82 percent of its $550 billion total. Last year’s billion-dollar VARs accounted for 77 percent of the overall revenue.

10 Years Ago: Our Billion-Dollar Club had just 52 solution providers, up from 42 companies in the 2000 ranking.

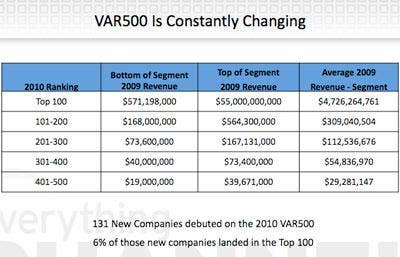

3. Smaller Companies Took A Hit

In a year that brought the big guns trouble, how did the relatively smaller players fare?

The combined total revenue of companies 401-500 is $2.9 billion. Last year, the combined total of that segment was 4.12 billion. Clearly, the recession hit smaller companies -- those ranked 401-500 have revenue between $39.7 million and $19 million -- hard. The average revenue of a VAR in the final 100 was $29.5 million in 2009, in 2008 it was $41.2 million.

Some companies are not on the list this year, largely the result of the challenging economic environment. One hundred thirty companies are new to the list this year, because of bankruptcies, mergers or acquisitions.

4. VARs Can Sell Backup

What's the top technology sold by VARs?

Backup and recovery solutions lead the way, the same as last year. Backup was sold by 67.9 percent of respondents, followed closely by virtualization software (see chart at left). Last year, the top five technologies were backup and recovery, networking equipment, basic security, enterprise storage, and servers.

The typical VAR works with roughly 27 vendors on average, but bigger VARs tend to have a few less vendor partners. On average, our survey found solution providers with more than a billion dollars in annual revenue had 23.2 vendors.

10 Years Ago: Vendor favorites haven't changed much over the years: IBM, Cisco, Microsoft, Compaq and HP were the top picks in 2001. In 2010, the list is virtually the same: Microsoft; Hewlett-Packard; Cisco Systems; IBM and VMware. In 2001, VARs said networking was their top technology.

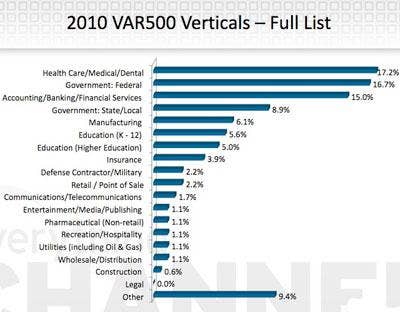

5. In Vertical Sector, Some Specializations Are Hot, Some Are Not

VARs who specialize in communications, retail point of sale and federal government serve mostly Fortune 500 customers.

Solution providers focusing on construction, recreation/hospitality and insurance, report large business (between 1,000 and 9,000 employees) make up most of their customers.

Those targeting pharmaceutical, defense and utilities say they cater generally to midsize business (500-999 employees) is expanding the fastest.

Integrators providing educational solutions for both K-12 and higher education, as well as health care solutions see lower midsize businesses (100-499 employees) making up most of their client bases.

Finally, VARs in manufacturing, insurance and K-12 education report working largely with small customers (less than 100 employees).

6. Fortune 500 Companies Still Eager For Business

Military cutbacks have forced VARs that specialize in that space to branch out. As a result, military contractors said their work with Fortune 500 companies is growing fastest. Solution providers to the federal government also reported the number of their Fortune 500 customers was also growing quickly.

Integrators in the pharmaceutical industry said the midsize segment was growing most quickly, while those in legal and those in wholesale/distribution said small businesses were their fastest growing customer segments.

7. There's a Lot To Be Said For Surviving

In 2009, both ends of the VAR500 spectrum felt the impact of a poor economy. Although the mean revenue of the average VAR on our list grew nearly six percent, billion-dollar-plus companies saw revenue fall an average of 1.25 percent. And many smaller companies from last year didn't make it to 2010.

/**/ /**/

"A lot of weaker companies that divided the market prior to last year were just done. If you borrowed a bunch to expand, or were highly leveraged, [you were in trouble]," said Denali CEO Chris Gerhardt. "We hired resources that were freed up when other companies were firing people." The company was looking for people with deep levels of expertise, and found them -- something not so easy to do when times are good.

The downturn also forced solution providers to focus on their strengths and face -- and then improve upon -- their weaknesses. As Gerhardt pointed out, no company can cut their way to growth.

"In a downturn, you have to still be looking for revenue. In upturn, you need to also look for efficiencies," he said. "Great companies are made during difficult times, not when everything is going well. That's when the team pulls together."