Insight Rides Microsoft Cloud Prowess, Surging Notebook Demand To Massive Q1 Bounty

Strong interest in Microsoft Azure services and a robust device refresh cycle resulted in increased interest in Insight Enterprises' broad product and services portfolio for the first quarter ended March 31.

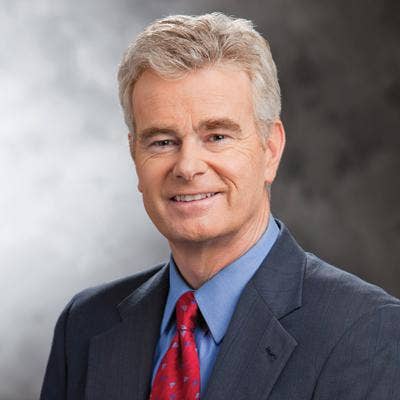

The Tempe, Ariz.-based company, No. 13 on the 2017 CRN Solution Provider 500, said that it picked up market share around notebooks, which enjoyed a particularly strong quarter, according to Ken Lamneck, Insight's president and CEO.

A big portion of Insight's hardware growth to date has been driven by a strong refresh cycle, although Lamneck said he expects the gains to slow to single digits in the second half of 2018.

[Related: Insight Steps Up Cloud Offensive, Hires Former Microsoft Senior Cloud Specialist]

On the software side of the equation, Lamneck said Insight has maintained its "No. 1" status with Microsoft and is seeing customers migrate key areas of their business to the cloud. Specifically, Lamneck said public cloud sales currently drive 14 percent of Insight's overall consolidated gross profit.

"With expected increased demand for Azure service solutions around devices and infrastructure. We believe our software DNA, strong data center capabilities, and long history of supply chain expertise will serve our clients well," Lamneck said.

Reveue shot up to $1.76 billion for the quarter ending March 31, up from $1.47 billion in the same period a year ago. That crushed Seeking Alpha's revenue projection of $1.53 billion.

’The first quarter demonstrated yet again that global demand for IT products and solutions remains healthy with opportunity for share gains and growth," Lamneck told Wall Street analysts Wednesday. "We are executing well on the sales front and are focused on controlling costs and improving the scalability of our business for the future."

Insight's stock rose $6.23, or 17.42 percent, to $42.00 in after-hours trading, which is the highest the company's stock has traded at since November. Earnings were announced after the market closed Wednesday.

Insight's hardware sales climbed 23 percent, accounting for 67 percent of overall revenue in the first quarter. Device sales led the way in the hardware sector, followed by networking and then servers and storage.

The company saw GAAP earnings skyrocket to $32.7 million, or 90 cents per diluted share, up 136 percent from $13.8 million, or 38 cents per diluted share, at the same time last year. On a non-GAAP basis, earnings jumped to $34.1 million, or 94 cents per diluted share, up 68.8 percent from $20.2 million, or 56 cents per diluted share, last year. This smashed Seeking Alpha's earnings projection of 60 cents per share.

For all of 2018, Insight expects to deliver diluted earnings per share of between $4.35 and $4.45 on mid- to high-single digit sales growth.