Icahn Responds To Xerox Board's Latest Letter To Investors: They're 'Delusional'

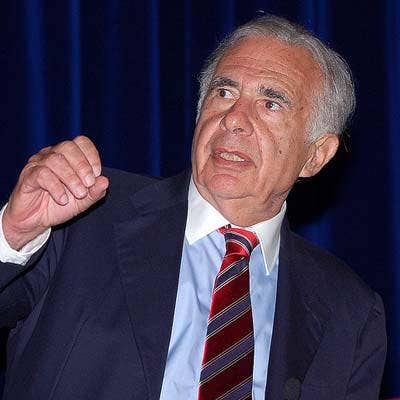

The battle for hearts and minds of Xerox investors rages on as activist Carl Icahn fired back at the company, calling a letter the board published Wednesday "misleading" in a point-by-point missive he posted Thursday morning.

"The Xerox Board of Directors issued a letter to shareholders that grossly misrepresents the facts about their conduct over the past year," Icahn wrote. "Rather than 'set the record straight' as they claim to be doing, the Board’s letter is nothing more than an unconscionable attempt to deny clear documentary evidence proving that these directors have consistently put their own interests ahead of Xerox and its shareholders." In its eight-page letter, Xerox said that since the company entered into a settlement with Icahn and Darwin Deason a week ago "our shareholders spoke clearly and expressed their views about Xerox's prospects under an Icahn/Deason regime."

"Xerox's share price fell over 12 percent and in our conversations with our long-term investors, it became obvious that a number of them were strongly averse to the settlement terms that we entered," Xerox wrote.

Xerox said it is now doing what is best for the company and all of its investors, including driving its operational and financial performance. The company said it will continue to explore options to maximize shareholder value, including securing an increase in consideration from Fujifilm. The company also said it will reopen the nomination process for director candidates.

"Your Board remains fully committed to doing everything we can to maximize shareholder value and acting in the best interests of all Xerox shareholders," the letter stated.

The Xerox decision to kill the settlement with Icahn and Deason is the latest turn in a fight that stems from the Jan.31 unveiling of an agreement between Fujifilm and Xerox under which Xerox would cede a 50.1 percent ownership stake to Fujifilm. Under the deal, Xerox shareholders would receive a $2.5 billion special cash dividend and 49.9 percent of the combined company, with Fujifilm owning 50.1 percent.

Icahn took issue with several points in the board's eight-page letter. He disputed the board's claim that the Fuji deal is the result of a robust strategic review, that the board was led by experienced advisers, that it is doing what is best for investors, and that it has been the target of unsubstantiated attacks.

"The primary concerns of these directors has been their own compensation, potential liability and reputations," Ichan wrote. "For instance, in exchange for agreeing to resign last week, they repeatedly demanded that [Xerox CEO] Jeff Jacobson be awarded an $18 million golden parachute and that the other directors have their outstanding equity awards vested and paid out immediately."

This is Icahn's second public letter aimed at the board.

"The Xerox Board is delusional," Ichan wrote in his letter Thursday. "If you listen to them, the court is wrong, the company’s largest shareholders are wrong, the analysts are wrong and the corporate governance experts are wrong. Only they – in their infinite, benevolent wisdom – know what’s best for us and our company."