5 Companies That Came To Win This Week

For the week ending March 18 CRN takes a look at the companies that brought their ‘A’ game to the channel.

The Week Ending March 18

Topping this week’s Came to Win list is cybersecurity tech provider SentinelOne for an acquisition that will extend the company’s identity threat detection and response capabilities.

Also making this week’s list is Equinix for its own acquisition that expands the data center colocation giant’s presence in South America. Winning applause are cloud security vendor Netskope for launching its first-ever global partner program and data analytics platform developer Alteryx for significantly upgrading its own channel program. And Cowbell Cyber makes the list for an impressive funding round, financing the company will use to drive cybersecurity insurance adoption.

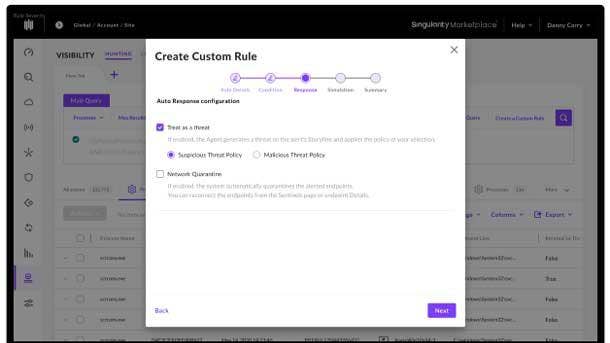

SentinelOne To Buy Identity Firm Attivo Networks For $616.5 Million

SentinelOne struck a deal this week to acquire Attivo Networks in a move that will expand SentinelOne’s capabilities in AI-powered prevention, detection and response and to protect against identity-based security threats.

SentinelOne, a developer of endpoint security technology, is paying $616.5 million for Attivo Networks and expects to complete the acquisition sometime during the quarter ending July 31.

With the acquisition SentinelOne will extend threat detection and response, identity infrastructure assessment, and identity cyber deception to its Singularity platform. SentinelOne CEO Tomer Weingarten sees identity threat detection and response as integral to his company’s XDR vision.

Equinix Acquires Four Data Centers From Entel For $705 Million

Data center services giant Equinix continued its global expansion this week with its acquisition of four data centers in South America from Entel.

Equinix is spending about $705 million to buy three data centers in Chile and one data center in Peru. The four facilities generate $53 million in annual revenue and Equinix will pick up more than 100 customers through the deal.

The 120 Entel employees at the data center sites will become Equinix employees once the acquisition concludes sometime in the second quarter of 2022.

Equinix, the $6.6 billion Redwood City, Calif.-based data center colocation behemoth, has invested $1.2 billion in its Latin American operations since it entered the region. Overall, the company has spent billions of dollars on acquisitions over the past two years and now operates more than 220 data centers worldwide.

Netskope Debuts Global Partner Program To Drive Services Revenue

Cloud security provider Netskope wins applause this week for launching its first-ever global partner program and a services delivery specialization to help partners become more involved with implementation and provide customers with a consistent experience.

The Netskope Evolve Partner Program replaces multiple reseller-focused regional programs with a unified, scalable program across all geographies that is tailored to systems integrators, service providers and MSSPs.

The new three-tiered program uses partner-generated revenue and technical and sales accreditations to determine partner status. The goal is to reward partners who are most engaged with Netskope and customers and are most capable of driving value, Dave Rogers, vice president of global alliances and channel sales, told CRN.

The service delivery specialization formalizes efforts to ensure that the company’s technology gets delivered in a consistent fashion around the world. Already about 50 of Netskope’s 1,000-plus partners have obtained the service delivery specialization.

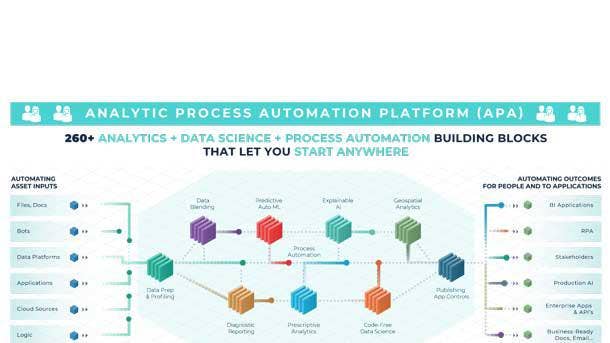

Alteryx Puts Go-To-Market Focus On Partners With Channel Program Revamp

Sticking with the topic of stepping up with channel programs, data analytics platform developer Alteryx earns kudos this week for unveiling a significant overhaul of its partner program with the goal of shifting to a more partner-centric go-to-market strategy.

The move comes as Alteryx is selling more of its software for enterprise-scale implementations, a change that puts greater emphasis on partners’ service capabilities and their domain and vertical industry expertise. That change is shifting Alteryx’s channel sales from VARs and distributors to systems integrators and strategic service providers, as well as increasing the importance of technology partners including ISVs and cloud platform providers.

The company is looking to transact a greater share of its overall sales through the channel and is putting into place incentives to encourage its own sales force to work with partners, channel chief Barb Huelskamp told CRN. The company also has released a set of global guidelines or rules of engagement to help partners optimize their benefits within the new program.

Under the partner program revamp, Alteryx is increasing its partner organization resources, including staffing in engineering, enablement and sales support, by 30 percent. The program includes additional market development funding targeted toward partners who drive innovation, develop their own intellectual property and creative solutions on the Alteryx platform.

The upgraded program also offers new role-based training curriculum and certifications. Alteryx is helping partners develop best-practice professional services, which the vendor can call on the partner to provide in customer engagements.

Cowbell Cyber Raises $100M To Drive SME Insurance Adoption

Cowbell Cyber raised an impressive $100 million in Series B funding this week, financial resources the cybersecurity insurance provider will use to strengthen its data science capabilities and risk engineering functions to bolster its business with MSPs.

Cowbell Cyber, founded three years ago, plans to use the $100 million to obtain better visibility into the entire small and midsize enterprise (SME) ecosystem and help policyholders understand where they face risks within their security operations and technology stack.

Cowbell Cyber now has 23 million businesses, all with revenue under $250 million, in its risk pool and has a goal of increasing that to 32 million SMEs. Demand is increasing from policy holders for deep CISO-type analysis of their cybersecurity risks and Cowbell Cyber is growing its risk engineering team to satisfy that demand.