Bad Blood: Years Of War Between Icahn And HP’s Law Firm

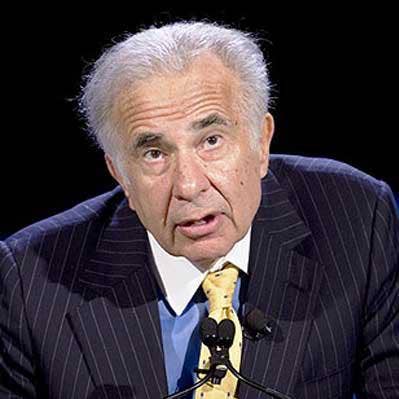

If there’s a kryptonite to Carl Icahn’s super-sized persona it may be Wachtell, Lipton, Rosen & Katz – which just happens to be the law firm HP hired for its merger talks with Xerox.

As HP rejected Xerox’s offer Sunday, it tossed a line in its press release that said it was represented by the New York law firm of Wachtell, Lipton, Rosen & Katz.

The seemingly boilerplate nod to its legal advisers is more akin to a declaration of war considering the years of bad blood between Martin Lipton, a founding partner in the firm, and Carl Icahn, who is the likely architect of Xerox takeover bid.

Wachtell, Lipton, Rosen & Katz has helped clients such as Clorox and Dell pushback against Icahn, and it has been embroiled in lawsuits with the man it called a “bullying corporate raider” since 2013. When the firm sued Icahn in New York State court, it included this description of the storied activist investor:

“Icahn became famous in the 1980s by buying up stakes in companies and threatening expensive proxy fights unless the companies paid him off with ‘greenmail,’” the firm wrote in its complaint. “His reputation as a corporate raider was solidified after a series of corporate raids that proved lucrative for him but disastrous for stockholders and employees.”

In and out of court Icahn and Lipton, both in their 80’s have sparred for years, with their most recent fight – rooted in Icahn’s 2012 purchase of CVR, a refinery and fertilizer business -- still unfolding in New York state court as well as federal court.

In the state court lawsuit, Wachtell, Lipton, Rosen & Katz pointed out the times it has successfully blocked Icahn.

“In a number of high-profile situations, Wachtell Lipton has helped clients fend off Icahn, including assisting Clorox in defeating an Icahn takeover assault in 2012 and assisting Dell when Icahn unsuccessfully sought to break up a premium transaction in order to buy the company for himself in 2013,” the firm wrote in its initial complaint.

A call by CRN to Icahn Capital LP, which publishes his press releases, was not returned. A call and email for comment from Lipton’s office was also not returned.

Dell’s highly publicized fight against Icahn left CEO Michael Dell with a negative impression of the activist investor.

“He lies, he has no ethical boundaries, he'll say anything, do anything, I have no time for him," the Dell CEO told CRN in 2014.

In the law firm’s still ongoing suit against Icahn, the firm said it hasn’t always worked against Icahn. If his offers have made sense for its clients “including high-profile examples like Motorola Mobility, Genzyme, and BEA Systems” they have reached an accord, but the firm said Icahn “resents any resistance.”

“(A)nd thus has for years attacked Wachtell Lipton in the press for its fierce commitment to its clients,” the firm wrote in its 2013 complaint. “With his new litigation campaign, Icahn takes his bullying campaign to a new level, seeking to intimidate lawyers who help clients resist his demands by making wild allegations and threatening liability.”

Icahn has a history of being direct about his feelings towards Lipton as well, telling CNBC the legal guru is “dead wrong” and a “witch doctor” who gets paid “millions and millions” by his clients to tell people activist investors are bad.

“Lipton continues to say 'they're short termist, they're no good.' It's like a witch doctor almost," Icahn told CNBC during at televised appearance in April 2014 that was later used as an exhibit in a court case. "Well why? What are your facts? 'Anecdotal.' Who's giving him the anecdote? What's his evidence? You know who? Some of his clients that are paying him millions and millions of dollars. So you don't think they're a little biased?"