6 Cloud Computing Trends: Costs, Hybrid Cloud, Economy

Here’s six interesting results from Flexera’s new cloud report on businesses top cloud challenges in 2023, overspending, cloud waste, hybrid cloud, cost optimization, and if companies plan to spend more or less during an uncertain economy.

From economic uncertainty actually spurring an increase in cloud usage this year to organizations overspending their public cloud budget by 18 percent on average, there are some major cloud computing trends that all businesses should know in 2023.

“Economic uncertainty is driving a reduction in corporate spending, but the need for innovation and increased revenues remains high—and the cloud represents an engine of innovation,” said Flexera in its new 2023 State of the Cloud Report.

CRN breaks down six of the most interesting results from Flexera’s new cloud report which includes: businesses top cloud challenges in 2023, public cloud overspending, cloud waste, hybrid cloud, policies to optimize cloud costs and if companies plan to spend more or less in cloud computing during a time of economic uncertainty.

[Related: AWS Vs. Azure Vs. GCP: Flexera 2023 Customer Cloud Results]

Cloud ‘Will Weather Economic Storms’

Before jumping into the survey results, it’s important to know that the state of the cloud market in 2023 is solid, according to Flexera’s finding, as most businesses spend millions each month on cloud computing.

Despite a global pandemic, IT layoffs and an uncertain economy ahead, cloud computing is still on the rise.

“While organizations of all sizes are prioritizing every dollar of spend, the cloud and technology will weather economic storms,” said Flexera. “Those enterprises that remain focused on digital transformation, seizing new opportunities and evolving strategic initiatives through a cost-conscious lens will be better positioned for success than their competitors.”

Flexera’s new report surveyed 750 executive leaders and IT professionals on a global basis, with the majority of respondents coming from the United States and Europe. Approximately 67 percent of respondents were in organizations with over 2,000 employees, while 11 percent of businesses surveyed had more than 100,000 employees.

With enterprises in the U.S. and Europe representing a large portion of those surveyed, the results of Flexera’s 2023 State of the Cloud Report are important to track cloud market trends.

Here are six important cloud market trend results channel partners, investors, vendors and customers should know in 2023.

Top Cloud Challenges In 2023

Flexera said this year marks the first time in a decade that managing cloud spend has overtaken security as the top challenge facing organizations across the board. As cloud spending increases, there’s no surprise that controlling this rapidly growing cost is a top priority.

The top challenges for all respondents, including both enterprises and SMBs, was managing cloud spend at 82 percent. Security followed as the second top challenge at 79 percent, then lack of resources and/or expertise in third place with 78 percent of respondents saying its a top cloud challenge.

Seeking to control high cloud costs, many organizations have or plan to create a cloud center of excellence (CCOE) and build mature FinOps practices.

One difference between enterprises and SMBs is around managing multi-cloud, with 80 percent of enterprise respondents saying its a top challenge, compared to only 47 percent of SMBs.

Cloud Spending 18 Percent Over Budget On Average

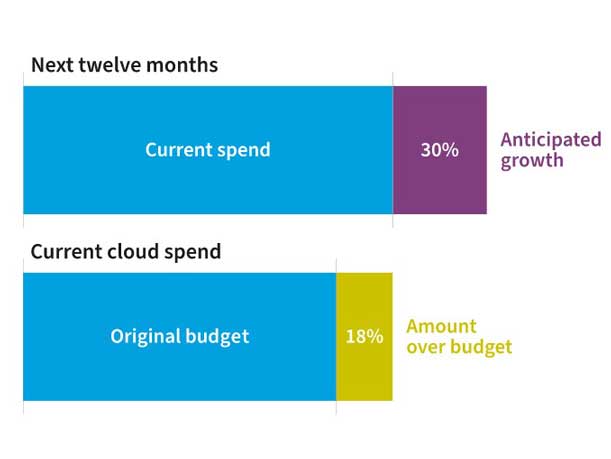

Public cloud spending was over budget by an average of 18 percent, up from 13 percent compared to the previous year.

Respondents indicated a 39-percent increase year over year in the amount of cloud spend over budget. With this in mind, it’s easy to see why FinOps continues to evolve and grow as a cultural practice and financial management discipline for many cloud customers.

Respondents remain bullish on cloud spending in 2023, as 30 percent expect spend to increase in next twelve months.

Cloud Waste

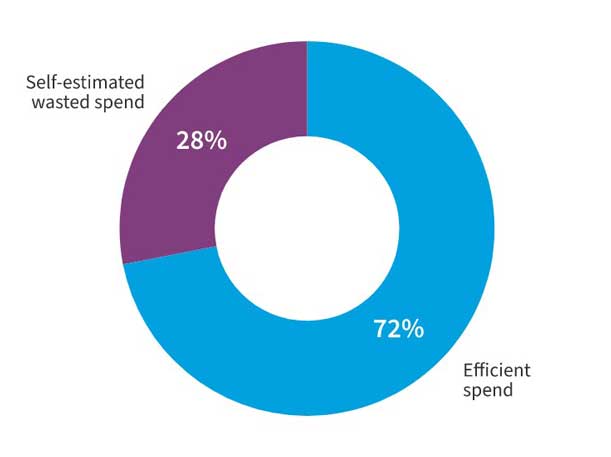

Cloud computing waste refers to when cloud services are not utilized or are underutilized by an organization. This is a concern for companies that lease offerings from cloud providers via platform-as-a-service (PaaS), software-as-a-service (SaaS) or infrastructure as-a-service (IaaS).

Respondents report that public cloud waste is 28 percent, down from 32 percent the previous year.

IT executives surveyed in Flexera’s report indicated that 72 percent of their cloud spend was spent efficiently.

Policies To Optimize Cloud Costs

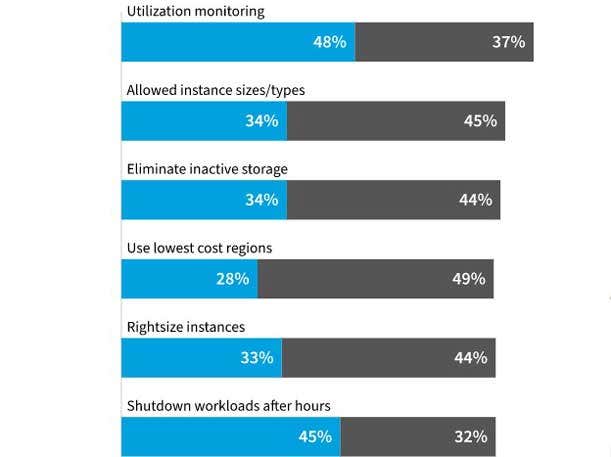

In order to optimize cloud costs, automated policies such as utilization monitoring and shutting down workloads after hours are the most common.

Using the lowest cost regions and allowing instance sizes/types are some of the most common manual policies to optimize cloud costs.

Approximately 48 percent of respondents optimize cloud cost via utilization monitoring automated policies, followed by 45 percent who shutdown workloads after hours, then 36 percent who specify expiration dates.

On the manual policies side, 49 percent use the lowest cost regions, followed by 46 percent using the lowest costing cloud.

Nearly three-quarters of respondents still don’t leverage automated or manual policies for requiring tags, a critical way to allocate and optimize costs. Despite the fact that tags help with cost allocation and optimization, only roughly one-third of respondents currently use policies that implement required tags.

Organizations Embrace Multi-Cloud

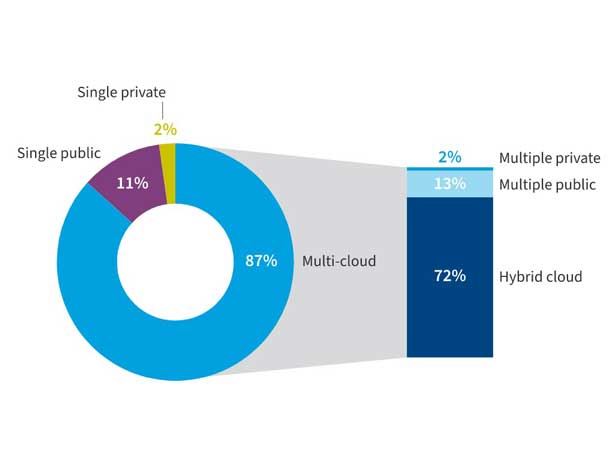

Organizations are embracing a multi-cloud strategy with 87 percent of respondents leveraging multi-cloud.

Approximately 72 percent of those businesses leveraging multi-cloud are doing it in a hybrid cloud fashion, which is a mix of public cloud and private cloud such as on-premise data centers or edge locations. Around 13 percent of multi-cloud organizations are leveraging multiple public clouds, followed by 2 percent who are using multiple private clouds.

Interestingly, respondents indicated a slight drift toward single public cloud usage. Organizations using a single cloud increased to 11 percent in 2023, up from 9 percent in 2022.

Economic Uncertainty

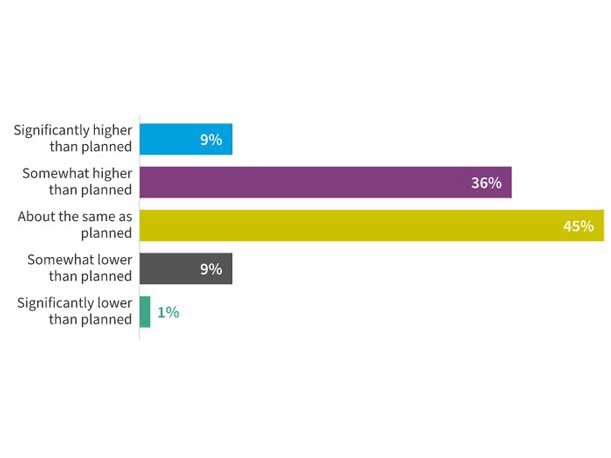

One of the most interesting findings from Flexera’s survey is that 45 percent of the 750 respondents said economic uncertainty in 2023 would not change their expected cloud spend and usage this year.

In fact, 36 percent of respondents say they are planning “somewhat higher” cloud spending and usage in 2023 due to the economic uncertainty. Approximately 9 percent of respondents say they expected cloud usage and spending to be “significantly higher” this year due to the economy.

Only 1 percent of the 750 respondents in Flexera’s report indicated that the economy would “significantly lower” their cloud usage and spend this year, while 9 percent said they planned to “somewhat lower” their cloud usage and spend.