Andy Jassy’s 5 Boldest Remarks On AWS, Layoffs, Chips And AI

Here are Amazon CEO Andy Jassy’s biggest statements to shareholders Thursday around AWS, his generative AI vision, the company’s 27,000 layoffs and how enterprises are focused on cloud optimization.

From AWS facing “short-term headwinds” to customers looking at “cost-optimizing” versus cutting cloud costs, Amazon CEO Andy Jassy has some very bold statements regarding his vision for Amazon Web Services.

“Many of these AWS customers tell us that they’re not cost-cutting as much as cost-optimizing so they can take their resources and apply them to emerging and inventive new customer experiences they’re planning,” said Jassy in a letter to Amazon shareholders filed Thursday with the U.S. Securities and Exchange Commission.

Jassy also discusses AWS’ Graviton CPU processors and the company’s vision for generative artificial intelligence.

[Related: AWS Confirms Layoffs Impacting ‘Single Digit Percentage’ Of Employees]

“A newer form of machine learning, called generative AI, has burst onto the scene and promises to significantly accelerate machine learning adoption,” said Amazon’s CEO. “We have been working on our own LLMs [Large Language Models] for a while now, believe it will transform and improve virtually every customer experience, and will continue to invest substantially in these models across all of our consumer, seller, brand, and creator experiences. … Let’s just say that LLMs and generative AI are going to be a big deal for customers, our shareholders, and Amazon.”

Andy Jassy, Amazon Layoffs

Before jumping into Jassy’s boldest statements to shareholders around his vision for AWS and the future, it’s key to note that Jassy was AWS’ longtime CEO. He was critical to the formation and growth of AWS for decades until he took over the reins at parent company Amazon in 2021.

“Amazon would be a different company if we’d slowed investment in AWS during that 2008-2009 period,” Jassy said in his letter to shareholders.

Some of the biggest news announcements from Amazon and AWS this year include a pair of large employee layoff rounds. In January, Amazon also said it would lay off 18,000 employees. CRN learned at the time that AWS would not be greatly affected by that round of layoffs. However, in March Amazon disclosed it will be cutting a total of 9,000 employees by the end of April. The cuts will primarily come from its AWS, PXT, advertising and Twitch organizations.

In his letter to Amazon shareholders, Jassy talks about AWS’ economic future, Amazon’s 27,000 layoffs, the company’s generative AI vision and how cloud customers are focused on optimization.

‘AWS Faces Short-Term Headwinds’

AWS is the worldwide market-share leader in cloud computing with an annual run rate of $85 billion.

“[AWS] is still early in its adoption curve but at a juncture where it’s critical to stay focused on what matters most to customers over the long haul,” said Jassy.

“Despite growing 29 percent year over year in 2022 on a $62B revenue base, AWS faces short-term headwinds right now as companies are being more cautious in spending given the challenging, current macroeconomic conditions,” Jassy said. “While some companies might obsess over how they could extract as much money from customers as possible in these tight times, it’s neither what customers want nor best for customers in the long term, so we’re taking a different tack.”

However, while these “short-term headwinds soften” AWS’ growth rate, Jassy said the cloud company’s “customer pipeline is robust, as are our active migrations.”

‘AWS Customers Not Cost-Cutting As Much As Cost-Optimizing’; Cloud Better Than On-Premises

Jassy said AWS is not trying to optimize for any quarter or year in particular, but rather build customer relationships and a business “that outlasts all of us.”

“As a result, our AWS sales and support teams are spending much of their time helping customers optimize their AWS spend so they can better weather this uncertain economy. Many of these AWS customers tell us that they’re not cost-cutting as much as cost-optimizing so they can take their resources and apply them to emerging and inventive new customer experiences they’re planning,” said Jassy.

Jassy said he’s seeing an increasing number of “enterprises opting out of managing their own infrastructure and preferring to move to AWS to enjoy the agility, innovation, cost-efficiency, and security benefits.”

AWS’ advantage in the market includes its ability to seamlessly scale up and down in terms of both capacity and costs. “This elasticity is unique to the cloud, and doesn’t exist when you’ve already made expensive capital investments in your own on-premises datacenters, servers, and networking gear,” he said.

‘Deep Look’ Into Each Business And Innovation Led To 27,000 Layoffs

Jassy said the 27,000 layoffs at Amazon, which include at least hundreds if not thousands of AWS employees, was due to the company taking a “deep look” at each business unit and its innovation.

“We took a deep look across the company, business by business, invention by invention, and asked ourselves whether we had conviction about each initiative’s long-term potential to drive enough revenue, operating income, free cash flow, and return on invested capital,” said Jassy. “In some cases, it led to us shuttering certain businesses.”

Amazon stopped pursuing physical store concepts like its Bookstores and 4 Star, closed its Amazon Fabric and Amazon Care efforts, and moved on from some newer devices where Amazon didn’t see a path to meaningful returns.

“We also reprioritized where to spend our resources, which ultimately led to the hard decision to eliminate 27,000 corporate roles,” said Jassy. “There are a number of other changes that we’ve made over the last several months to streamline our overall costs, and like most leadership teams, we’ll continue to evaluate what we’re seeing in our business and proceed adaptively.”

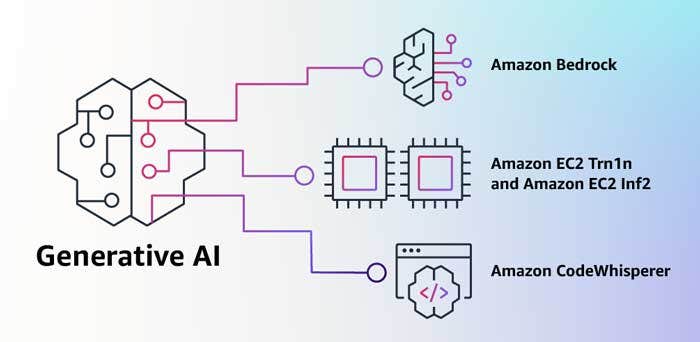

Amazon ‘Investing Heavily’ In Generative AI And Large Language Models

Jassy said Amazon is “investing heavily” in Large Language Models (LLMs) and generative AI, touting that the company has been using similar machine learning technology for decades in areas like Alexa, drones for Prime Air and in AWS.

“A newer form of machine learning, called generative AI, has burst onto the scene and promises to significantly accelerate machine learning adoption,” said Jassy. “We have been working on our own LLMs for a while now, believe it will transform and improve virtually every customer experience, and will continue to invest substantially in these models across all of our consumer, seller, brand, and creator experiences.”

Jassy said AWS is “democratizing” this technology so companies of all sizes can leverage generative AI.

“AWS is offering the most price-performant machine learning chips in Trainium and Inferentia so small and large companies can afford to train and run their LLMs in production. We enable companies to choose from various LLMs and build applications with all of the AWS security, privacy and other features that customers are accustomed to using,” said Jassy, in addition to developing applications like AWS’ CodeWhisperer.

“Let’s just say that LLMs and generative AI are going to be a big deal for customers, our shareholders, and Amazon,” he said.

‘We’re Not Close To Being Done Innovating’ AWS Processors

Jassy said AWS innovation on its general-purpose CPU Graviton processors—including the 2022 launch of its Graviton3 chips—as well as its new training chip Trainium, isn’t stopping.

“With the enormous upcoming growth in machine learning, customers will be able to get a lot more done with AWS’ training and inference chips at a significantly lower cost. We’re not close to being done innovating here, and this long-term investment should prove fruitful for both customers and AWS,” said Jassy.

Amazon’s CEO pointed at its newly launched Inferentia2 chip, which offers up to four times higher throughput and 10 times lower latency than its first Inferentia processor.

“We launched our first inference chips Inferentia in 2019, and they have saved companies like Amazon over $100 million in capital expense already,” he said. “AWS is still in the early stages of its evolution, and has a chance for unusual growth in the next decade.”